Rathbones launches Rathbone Greenbank Multi-Asset Portfolios

<p>Will McIntosh-Whyte is the fund manager for the new multi-asset funds, supported by David Coombs, head of multi-asset investments. Additional research resource is provided by the team led by Kate Elliot, head of ethical, sustainable and impact (ESI) research at Rathbone Greenbank Investments (Greenbank) - Rathbones’ specialist ESI research and investment arm - as well as Rathbones’ fixed income and equity analysts.</p>

Article last updated 30 September 2025.

Will McIntosh-Whyte is the fund manager for the new multi-asset funds, supported by David Coombs, head of multi-asset investments. Additional research resource is provided by the team led by Kate Elliot, head of ethical, sustainable and impact (ESI) research at Rathbone Greenbank Investments (Greenbank) - Rathbones’ specialist ESI research and investment arm - as well as Rathbones’ fixed income and equity analysts.

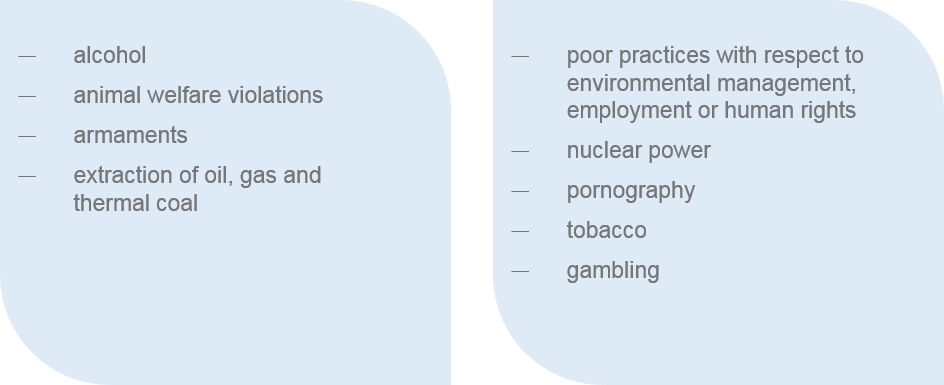

The multi-asset funds will employ the same negative and positive criteria as the Rathbone Global Sustainability Fund for their exposure across equities and corporate bonds*. Additional sustainability criteria apply to other asset classes such as government bonds and structured products. Greenbank can veto investments which do not meet the funds’ responsible investment policy, ensuring it is applied without bias or influence from the fund managers.

The Rathbone Greenbank Multi-Asset Portfolios will invest directly around the globe, using a combination of government bonds, supra-national bonds, corporate bonds, listed company shares, structured products and derivatives. The funds have a strong emphasis on managing financial, and environmental, social and governance (ESG) risk, and focus on investments with robust links to Greenbank’s proprietary sustainability framework, which includes energy and climate, innovation and infrastructure, and health and wellbeing.

Using the same approach as the Rathbone Global Sustainability Fund, the multi-asset team, while supported by the wider Rathbones’ stewardship resource, will continue to actively undertake stewardship activities such as enhanced voting, engagement and monitoring, on behalf of investors.

The minimum holding across all funds is £1000, with subsequent investments of a minimum of £500.

Will McIntosh-Whyte, fund manager on the Rathbone Greenbank Multi-Asset Portfolios, said: “These new investment-led sustainable multi-asset portfolios use the LED framework employed by the Rathbone Multi-Asset Portfolios. Combined with Rathbone Greenbank Investments’ heritage in ethical, sustainable and impact research and investment, clients can map to similar outcomes as Rathbones’ established multi-asset offering but now with an independently screened, sustainable journey.”

Kate Elliot, head of ESI research at Rathbone Greenbank Investments, added: “This new suite of funds offers several sustainable strategies, backed by a team with over two decades of experience in this space. We’ve worked with the team at Rathbone Unit Trust Management successfully for many years on several mandates. By maintaining a consistency of approach and ESG definitions across asset classes, we believe this range offers clarity and ease to investors.”

Mike Webb, chief executive, Rathbone Unit Trust Management, said: “The launch of the Rathbone Greenbank Multi-Asset Portfolios marks an important point in advisers’ increasing adoption of ESG strategies. Recent research from The Wisdom Council suggests that older, wealthier investors are looking to invest in sustainable strategies, not just the millennial and Gen Z demographics**. We believe the ability to offer a complete suite of directly-invested, sustainable funds, catering to most client risk appetites, is unique in the market. With growing regulatory pressure on adviser businesses to include ESG considerations, we believe that this new range will provide a cost-effective and efficient solution.”

For more information about the Rathbone Greenbank multi-asset portfolios please visit sustainableinvesting.rathbonefunds.com

-Ends-

|

Sam Emery/Emma Murphy Quill PR 020 7466 5056/5054 |

Madhu Kalia PR - Rathbones 020 7399 0256 or 07825 596302 |

Notes to editors

The Rathbone Greenbank Multi-Asset Portfolios now offer investors the option of the following risk strategies:

| Fund Name | Share classes | Unit types | Currency | Launch price | AMC | Estimated OCF | Estimated transaction costs |

| Rathbone Greenbank Total Return Portfolio | S-class | Income and accumulation | GBP | £1.00 | 0.50% | 0.65% | 0.07% |

| Rathbone Greenbank Defensive Growth Portfolio | S-class | Income and accumulation | GBP | £1.00 | 0.50% | 0.65% | 0.08% |

| Rathbone Greenbank Strategic Growth Portfolio | S-class | Income and accumulation | GBP | £1.00 | 0.50% | 0.65% | 0.11% |

| Rathbone Greenbank Dynamic Growth Portfolio | S-class | Income and accumulation | GBP | £1.00 | 0.50% | 0.65% | 0.10% |

|

RMAP* strategy |

RGMAP strategy |

Target return / Vol. target (% of FTSE Developed Index) | Risk level | Recommended holding period |

| RMAP Total Return | Rathbone Greenbank Total Return Portfolio |

Bank of England base rate + 2% Vol. target <33% |

Lower | 3 years |

| RMAP Defensive Growth | Rathbone Greenbank Defensive Growth Portfolio |

CPI + 2% Vol. target <50% |

Lower-to- medium | 5 years |

| RMAP Strategic Growth | Rathbone Greenbank Strategic Growth Portfolio |

CPI + 3 Vol. target <66% |

Medium | 5 years |

| RMAP Dynamic Growth | Rathbone Greenbank Dynamic Growth Portfolio |

CPI + 4 Vol. target <83% |

Medium-to-higher | 5 years |

* *The Wisdom Council research, conducted with collaborative partners including Federated Hermes, Rathbones and St. James’s Place. Survey sample size: 2067.

https://www.thewisdomcouncil.com/consumers-are-acting-more-sustainably-just-not-with-their-savings/

Rathbones Multi-Asset Team

Will McIntosh-Whyte - Fund Manager

Will McIntosh-Whyte is a fund manager on the Rathbone Multi-Asset Portfolio Funds, the offshore Luxembourg-based SICAVs, as well as the Rathbones Managed Portfolio Service (MPS), working alongside David Coombs. Will joined Rathbones in 2007, having worked previously as a specialist researcher for Theisen Securities. At Rathbones, he joined the charities team, and was appointed as an investment manager in 2011, running institutional multi-asset mandates. He has been on the Multi-Asset team since 2015 and is member of Rathbones’ Fixed Income Funds Committee. Will graduated from the University of Manchester Institute of Science of Technology with a BSc Hons in Management and is a CFA charter-holder.

David Coombs - Head of Multi-Asset Investments, Fund Manager

David is head of the team that is responsible for managing the Rathbone Multi-Asset Portfolio funds. He joined Rathbones in 2007 after spending 19 years with Baring Asset Management where he managed multi asset funds and segregated mandates. He began his career with Hambros Bank in 1984.

Craig Brown - Investment Specialist

Craig Brown is the Investment Specialist for the Rathbone Multi-Asset Portfolios and Managed Portfolio Service (MPS). Craig joined Rathbones in November 2018 and brings with him 15 years of Financial Services experience, including time with Barclays Wealth & Investment Management, and Citibank. Directly prior to joining Rathbones, Craig was a multi-asset portfolio manager at Beckett Asset Management, constructing a range of portfolios for discretionary clients. He is a Chartered Member of the Chartered Institute for Securities and Investment.

Rathbone Greenbank Investments

Kate Elliot – Head of ethical, sustainable and impact research

Kate is responsible for assessing the social and environmental performance of companies in addition to monitoring emerging ethical themes. She also helps co-ordinate Rathbone Greenbank Investment’s stewardship and engagement activities.

Since 2014, Kate has served on the Admissions Panel for the Social Stock Exchange, helping to assess and identify companies delivering social or environmental impact. She joined Rathbones in 2007 after graduating from the University of Bristol with a masters degree in Philosophy and Mathematics.

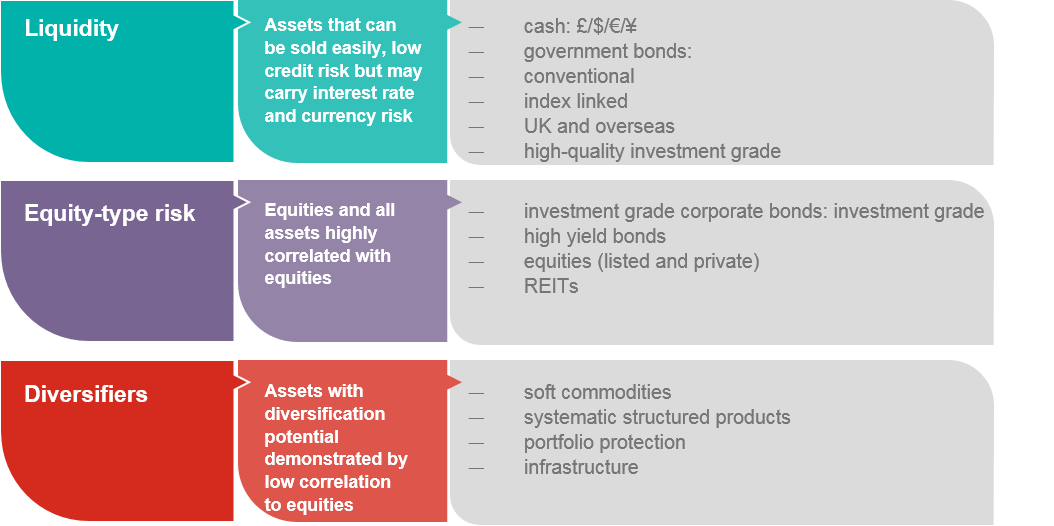

Rathbones’ LED Framework

The LED categorisation framework can be accessed through Rathbones’ bespoke, unitised or execution-only solutions.

*The Rathbone Greenbank Multi-Asset Portfolios will not invest in companies materially involved in:

Companies must also align with one or more of the following sustainable development themes via their core products and services or the way in which they operate:

| Habitats and ecosystems | Includes organisations that are helping to preserve land, water and marine habitats and biodiversity. |

| Resource efficiency | Includes organisations that are supporting the sustainable use of Earth’s resources through the products and services they provide. It also includes organisations that are operationally aligned with the theme and support positive impacts via their policies, business strategies and management of their own resource use. |

| Decent work |

Includes organisations that are supporting the quantity and quality of jobs through the products and services they provide. Also includes organisations that are operationally aligned with the theme and support positive impacts via their policies, business strategies and management of their own employment practices. |

| Inclusive economies | Includes organisations that are promoting access to basic services and supporting a more inclusive society through the products and services they provide. |

| Energy and climate |

Includes organisations that are supporting positive climate action and energy security through the products and services they provide. Also includes organisations that are operationally aligned with the theme and support positive impacts via their policies, business strategies and management of their own environmental impacts |

| Health and wellbeing | Includes organisations that are supporting physical and mental wellbeing, or helping to prevent injuries and deaths, through the products and services they provide. |

| Resilient institutions | Includes organisations that promote peace, justice and the rule of law through the products and services they provide. It also includes organisations that are operationally aligned with the theme and support positive impacts via their policies, business strategies and management of their own human rights impacts. |

| Innovation and infrastructure | Includes organisations that are supporting environmental sustainability or human wellbeing through the products and services they provide. Organisations in this theme can often play a facilitating role in creating the environment or infrastructure needed for other organisations to deliver positive impact. |

For further information, please visit here.

About Rathbones Group Plc

Rathbones provides individual investment and wealth management services for private clients, charities, trustees and professional partners. We have been trusted for generations to manage and preserve our clients’ wealth. Our tradition of investing and acting responsibly has been with us from the beginning and continues to lead us forward.

-In business since 1742.

-A FTSE 250 listed company.

-Managing more than £54.7* billion for our clients.

-15 offices throughout the UK and Jersey.

For more information about Rathbones Group Plc, please visit rathbones.com

Our purpose at Rathbones Group Plc

We see it as our responsibility to invest for everyone’s tomorrow. That means doing the right thing for our clients and for others too. Keeping the future in mind when we make decisions today. Looking beyond the short term for the most sustainable outcome. This is how we build enduring value for our clients, make a wider contribution to society and create a lasting legacy. Thinking, acting and investing responsibly. Find out more.

*as 31 December 2020. Includes funds managed by Rathbone Unit Trust Management.

About Rathbone Unit Trust Management

Rathbone Unit Trust Management Limited is a wholly-owned, London-based subsidiary of Rathbones Group plc. In 1995 and 1996 respectively, Rathbones Group acquired stockbrokers Laurence Keen and Neilson Cobbold, securing many private wealth managers, and their clients. The company also acquired unit trusts from Laurence Keen Unit Trust Management including the Rathbone Income Fund - the success of which led to a rebranding of the operation in 1999 to Rathbone Unit Trust Management Limited. Through its subsidiaries, the parent company manages £54.7billion of client funds, of which £9.8 billion is managed by Rathbone Unit Trust Management Limited. (As at 31 December 2020).

About Rathbone Greenbank Investments

Rathbone Greenbank Investments specialises in creating bespoke ethical, sustainable and impact portfolios on behalf of its individual, charity and professional adviser clients. Greenbank manages over £1.9 billion of funds (as at 31 December 2020) and is part of Rathbone Investment Management Limited.

|

This is a financial promotion relating to a particular fund range. Any views and opinions are those of the investment manager, and coverage of any assets held must be taken in context of the constitution of the funds and in no way reflect an investment recommendation. Past performance should not be seen as an indication of future performance. The value of investments may go down as well as up and you may not get back your original investment. |