'Trump chaos can benefit markets'

Actively managed funds are best placed to navigate challenging geopolitics and market turbulence, Rathbones Asset Management said in its 2026 Outlook, warning that geopolitical instability could otherwise result in investors missing opportunities for growth.

Leading fund managers identified key areas where they see most opportunity, noting that passive funds lack the same flexibility to cherry pick in this way.

|

Key highlights:

|

Detailed outlook

1/ Opportunity in the U.S.

David Coombs, Head of Multi-Asset Funds:

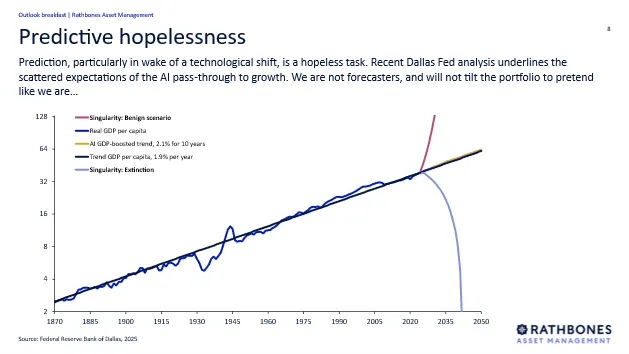

“We think the US economy could grow faster than many people think and we want to be investing in this growth. We think the S&P as a whole could be flat, but lower interest rates in the US could be good for cyclicals and we believe some equities will be up.

"We don’t pretend to know what the future holds, particularly when a social media post from the incumbent of the White House can have such an impact on markets. Our job is to take a step back and look at the facts and the data to see the longer-term impact. President Trump’s chaos is not always negative for markets.

"This year, we think the US economy could grow faster than many people think – that’s not to say the US equity market will grow, but when we invest we want to be investing in the growth of the US economy. Lower US rates should be good for US cyclicals."

2/ UK small and midcap stocks offer hedge against global uncertainty

Alexandra Jackson, Rathbone UK Opportunities Fund

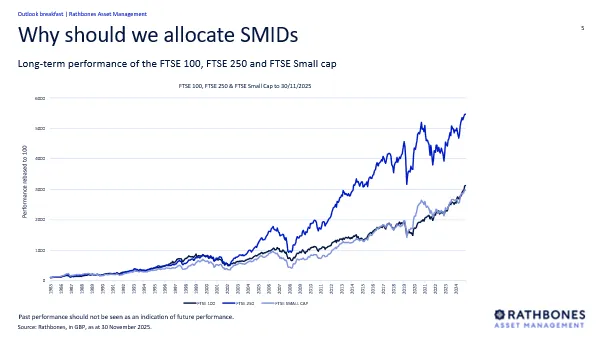

“With the FTSE 100 starting the year at an all-time high, it’s going to be tough to remain a UK perma-bear. Investors’ desire to diversify combined with a cheap and cheerful UK market is driving a reassessment of allocations.

"In a world where it seems anything can happen overnight in global politics, we think UK small and midcap stocks offer a hedge against global uncertainty.

Over past years the environment has not been kind for UK small and mid-cap stocks but the more recent inflation and interest rate regime could turn this on its head. UK small and mid-caps could be the asset class to hold for through-cycle alpha generation.

"We also think there is a very attractive valuation opportunity for this segment of the UK market with a triple discount in place (firstly for UK assets in general, then SMID caps, then for the quality part of the market).

"Generally, the broader risk-on tone of the market is supportive for these stocks."

3/ Fixed income issue season one of most aggressive yet

Bryn Jones, Head of Fixed Income

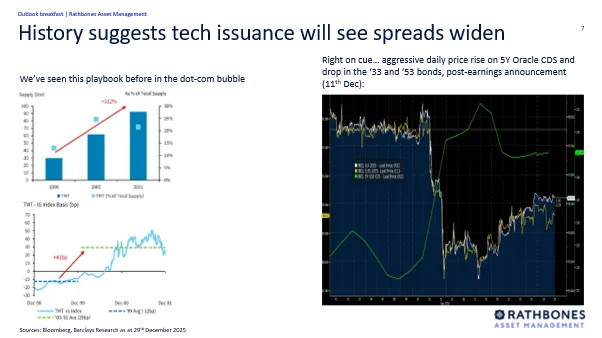

“Since the start of the year we have seen one of the most aggressive new issue seasons, with huge demand for credit almost wiping out the usual new issue premium, cutting it back to around its lowest ever level.

"It’s a big year for Europe too. It hasn’t been wildly popular over recent years but that looks set to change with the Dutch Pension Reforms, shifting from Defined Benefit to Defined Contribution, leading to some €1.5trillion of assets looking for a home over a number of years. Along with the removal of the German debt brake, allowing it to spend more on its fiscal infrastructure, Europe is becoming an interesting place for credit.

"The Bank of England cancelled QT at the long-end and there will be far less long gilt issuance from the DMO, therefore we like long-gilts and expect to see yields below 5% this year.

"Finally, we are not calling an AI bubble, but we think we will see spreads widening in the tech space with increased issuance which could lead to marginally weaker credit markets overall. However, all in yield is still attractive for asset allocators due to high Sharpe ratios in corporate bonds."

4/ Data centre boom makes infrastructure firms more attractive

David Harrison, Rathbone Greenbank Global Sustainability Fund

“Sustainability is back on the agenda following strong performance and issues around AI, power and renewable energy.

Power demand is not going away, especially with AI and datacentres, which will require a huge amount of water as well, making it a key part of both the sustainability and AI agenda. As such, we like the picks and shovels companies around grid infrastructure.

"In global equities we are seeing a broadening of mid-cap names. We are overweight UK and Europe, which has been a lonely place in recent years, but patience is paying off. In Europe we see particular opportunities in countries like Sweden and Switzerland, which offer good performance and valuations.

"As the market broadens beyond the Magnificent 7, we think the mid-cap names are particularly powerful with well managed companies and attractive valuations – sometimes at a 50% discount to the Magnificent 7.”

5/ Global opportunities in industry champions after over-concentration in tech

Joaquim Nogueira, Global Emerging Markets

“Emerging Market Equities rose 34% in 2025 and in our view are one of the most attractive investment classes over the next 2 years. It offers several opportunities which are a strong diversification from the dominant AI/Tech universe, namely:

- We believe, the radical economic reforms of Argentina have the potential to propel equities by 100% or even more over the next 2-years.

- South Africa’s social, political and economics trajectory drove equities up +78% in 2025 and should continue to do so over the next 2 years.

- Onshoring could keep driving Mexican equities up while Brazil should benefit from a “super interest rate contraction cycle”

- Poland is a highly successful “convergence play” which rose 75% in 2025 – we expect that in 2-years, Poland’s GDP/Capita gap to Germany will have narrowed to very low levels.

- We think Asia Tech and its supply chains still offer great opportunities, but it pays to rotate away from the mainstream overbought names into lagging quality (e.g. Indian Software giants).

"ESG is also a key factor for us in Emerging Markets. Arguably, the future of the planet is being decided in emerging market countries. We look at investments through a strong ESG lens and EM countries are investing hugely in the energy transition with some 240GW of renewables planned. Social and Governance transitions are also large in EM with millions coming out of poverty into the middle class."

6/ Asia ex-Japan presents opportunity based on resilience to tariffs and G7

Lisa Lim, Rathbone SICAV Asia Equity Fund

“For Asia ex-Japan we are looking at resilience, diversification and innovation.

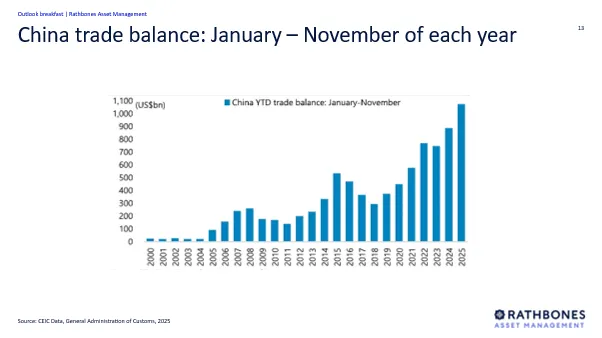

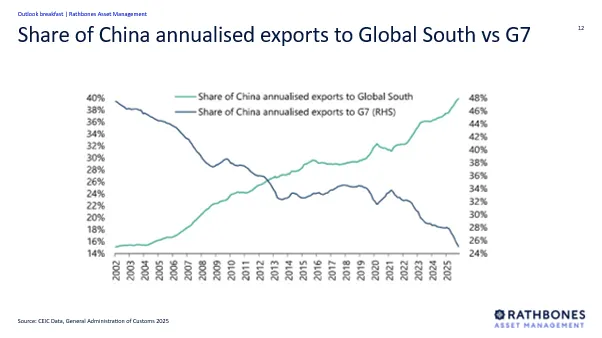

"Resilience – many questions were asked in 2025 about the impact of tariffs on Asia especially China. But businesses and economies across Asia have shown resilience, with China recording all-time high trade surplus of over USD1Trn. The region has largely become self-sufficient and resilient in the face of a trade war. We have not seen any major systemic distress and companies have reconfigured their supply chains to adapt, with the result being reduced impact. For example, Vietnam had stiff tariffs imposed but investment carries on.

"Diversification: Across the region, we see that countries have diversified from being export driven economies, and we are likely to see increasing growth from domestically driven consumption as economies reposition and middle class continues to grow.

"Innovation: We see a broad base innovation across different sectors not limited to only AI. We are measured in our approach to AI. We stress the need to always go back to valuations and not get carried away with narratives and concepts.

"The key driver for Asia last year was South Korea, up 100%, but as we go into 2026, we see opportunities emerging in other areas of the markets – for example ASEAN and India.”

7/ UK income fund focuses on the long-term, and high-quality

Alan Dobbie, Rathbone Income Fund

“2025 was very positive for UK equities and the Rathbone Income Fund, and our outlook for 2026 is broadly positive for the UK. The big question is whether this is a positive “blip” or the start of something new.

"Gains in the UK market have not been evenly spread, largely led by banks and defence, leading to a two-tier market. Indeed, the top 15 companies in the FTSE100 have returned an average of 130% over the past five years while the rest of the index returned an average of around 20%.

"But the structure of the FTSE is also very different from where it was five years ago. For example, Rolls Royce which is now a darling of the market was little more than a footnote five years ago, and banks have performed incredibly strongly in that time.

"We have trimmed our banks holdings after the period of sustained performance as we believe much of the good news is now priced in.

"In our fund we are focused on long-term, high-quality compounding stocks and we also like REITs, regulated utilities and housebuilders.

"We think the macro-outlook is aligning with the investment opportunities and that more stable UK politics points to a clearer path ahead.”

See Editor’s Note: Alan Dobbie co-leads the Rathbone Income Fund with Carl Stick, and will assume full leadership from the end of the year when Carl plans to retire.

8/ Global opportunities in industry champions after over-concentration in tech

James Thomson, Rathbone Global Opportunities Fund

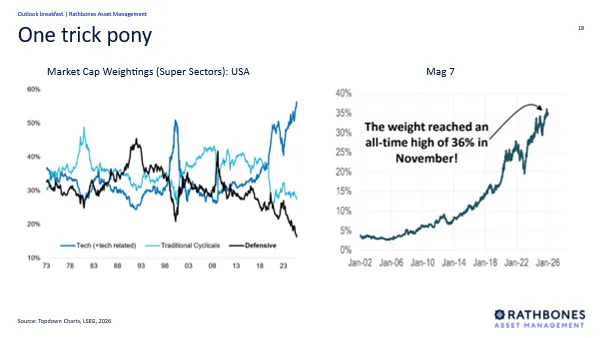

“The US market has become a one-trick pony over the past three years as tech was the only game in town. With an eye-watering 60% of the market focused on the tech super-sector and 37% in the Mag 7 stocks we have finally reached the tipping point for a new bull market.

"Investors shouldn’t sell the market, they should broaden out their portfolios as the winners change. When growth was scarce and tech focussed, we didn’t have the ingredients needed for a broadening-out of the equity market. Now we do.

"Housing activity is improving, Fed easing, money growth expanding, lower oil prices and cyclical fiscal stimulus. The spring has been coiled but we will need to look outside of the tracker fund favourites to take advantage of it.

"The Fed rate cutting cycle is particularly interesting as this time we’re not slashing to stave off a recession, we’re recharging the upside for the next phase of the bull market. In previous years when the Fed was cutting without a recession, markets moved sharply higher.

"The market seems worried about a correction leading to something deeper and more serious but we don’t think this is a re-run of the dot.com bust. Tech and comms services net income is 35.3% of the market today vs 23.1% in 2000, and tech median price to earnings is 29.6x today vs 84.6x in 2000, so there’s quite some difference. A correction and volatility in the tech leaders may be the trigger for our next run to an all time high.

"In our fund, we want to own the industry champions that will be at the vanguard of a broadening market recovery, companies like luxury brand Hermes, membership warehouse Costco, home improvement leader Home Depot, Microsoft with its pricing power, and Next, a true UK high street champion.”