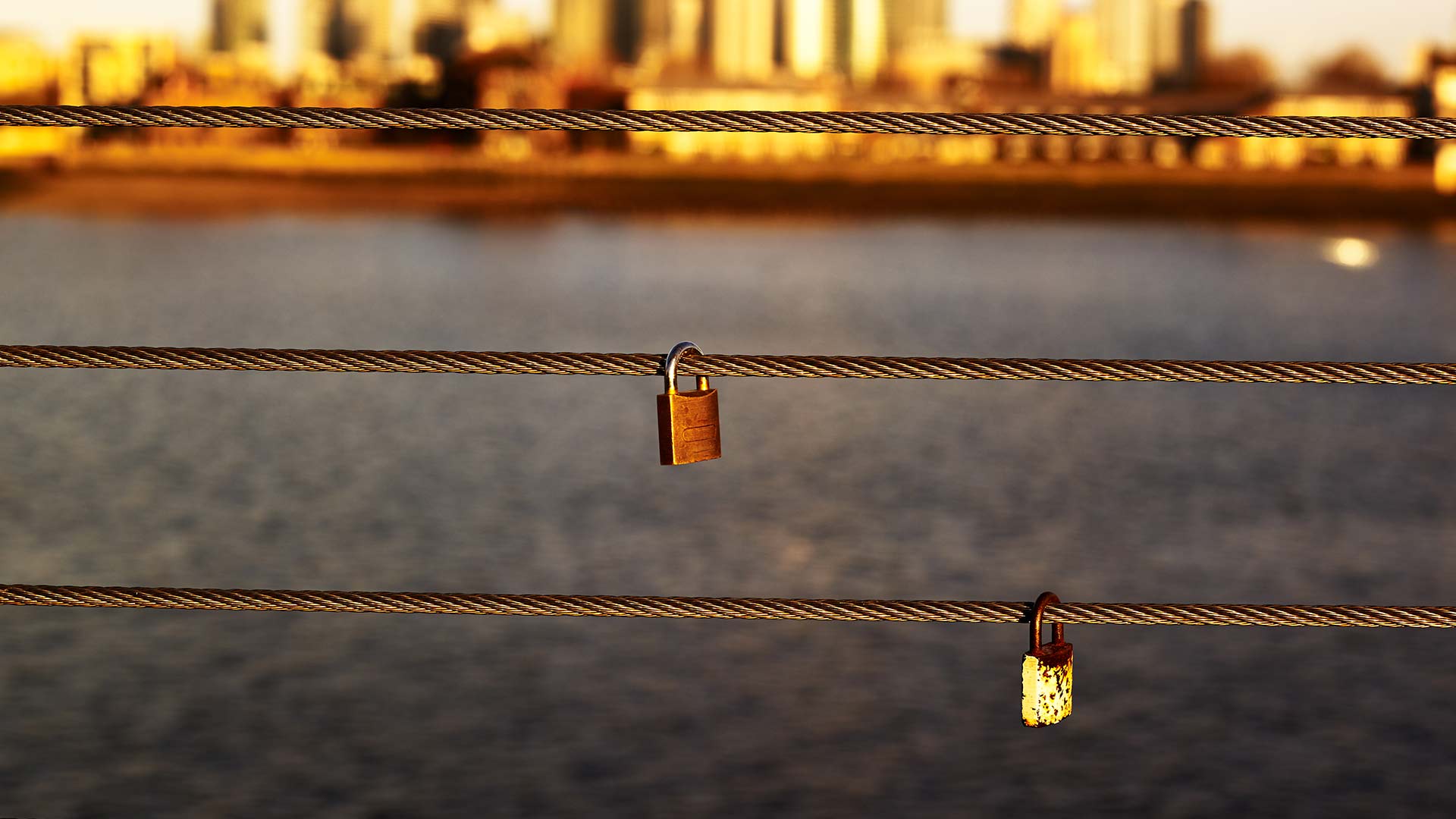

Locking in bond income for longer

Bond fund manager Stuart Chilvers explains why lower interest rates won’t sap corporate bonds’ juicy income yields straightaway.

Untameable economic data, particularly in the US, delivered a first quarter full of yet more violent moves for bondholders to contend with. And yet, corporate bonds actually eked out small gains and performed much better than government bonds.

As inflation refuses to fall back and GDP growth hums along in the US, some of the euphoric rises in worldwide government bond prices at the back-end of last year have reversed. Investors have abandoned what felt an extremely aggressive expectation of six to seven 0.25% cuts in US overnight interest rates in 2024 and now anticipate a far more reasonable (in our opinion) two.

That’s more in line with the US Federal Reserve’s own forecasts for this year which haven’t changed in many moons. This investor capitulation to reality in the US has been shadowed in most other major government bond markets – including the UK – as well (they tend to take their lead from the world’s premier economy and financial system).

However, this volatility in government bond markets hasn’t translated into weakness in corporate credit markets, as it has regularly over the past couple of years. In fact, credit spreads tightened meaningfully in the first quarter despite a really big slug of bond issuance (as had been expected).

This supply was met with very strong demand, meaning, generally, heavily oversubscribed deals, allowing issuers significantly to improve the terms of their bond issues. Part of this strength of demand has been attributed to investors looking to ‘lock in’ yields as they take comfort from central banks likely being at the end of their rate-hiking cycles. Issuers are also more willing to sell longer-dated debt now that credit spreads have tightened and government bond yields remain below the highs they hit last autumn.

Given this talk of ‘locking-in yields’, should investors expect the income they receive from corporate bonds to decline from here? That might be a premature conclusion to make.

Refinancing doesn’t happen overnight

Consider the reason behind the meaningful decline in rate cuts expected for 2024: economic data has – not for the first time this cycle – surprised most by remaining generally robust. This is also, arguably, a significant driver of last quarter’s credit spread tightening.

The ‘left-tail risk’ of a significant recession has receded, so the amount of expected rate cuts has dropped and credit spreads (the measure of default risks) have shrunk. Accompanying the drop in expected pace of rate cuts is uncertainty about the level that rates will fall to. Ongoing economic resilience suggests central banks’ ‘neutral rates’ may be significantly higher than previously.

While recession risks have receded for now, we’re keeping an eye on the future. Counterintuitively, investors spend years waiting for recessions yet they tend to arrive all of a sudden.

With companies’ borrowing rates much higher than they have been in more than a decade, lesser-quality ‘high yield’ issuers could come unstuck in a downturn.

Conversely, investment grade companies tend to withstand minor recessions without debt affordability becoming a problem. Because of this, we prefer to hold investment grade bonds.

Investment grade bond markets are slow-moving beasts in terms of income, so there’s a significant lag for those who buy units in investment grade corporate bonds funds. The reason for this is fairly simple: investment grade bond indices generally have fairly long maturities.

Even with as significant a move in bond yields as we’ve seen in the past couple of years, it takes time for older bonds with lower coupons to mature and leave the index, and new bonds to be issued with higher coupons and come into it (although price falls clearly increase the income yield in the more immediate term).

Using the ICE BofA Sterling Corporate Bond index as an example here (all as at 9 April 2024):

- Average years to maturity: 9.15 years

- Par weighted average coupon: 4.04%

- Par weighted price: 92.26

That would give you an income yield of roughly 4.38%, which represents a meaningful jump from the lows of roughly 3% that were on offer in 2021.

If rate cuts are to come in the gradual manner most expect, it’s reasonable to expect that most new issuance in the near future will come with coupons above that 4.4% income yield.

Daily speculation on when exactly central banks will start their rate cutting cycles will continue. This will clearly have a rapid impact on the income generated from cash-like instruments.

But we don’t expect it materially to hurt income yields from investment grade credit at a headline level in the near future, unless economies unexpectedly tank, forcing much swifter and deeper rate cuts than currently forecast. Erratic short-term price swings should provide us with good opportunities to buy and sell bonds at sharper prices though.