Things can only get better for UK equities

<p>In 1997 a reinvigorated and more centrist Labour party swept into power following a long period of Conservative rule. With the election of a new Labour government, could 2024 spark a similar resurgence in the UK stock market? </p>

In 1997 a reinvigorated and more centrist Labour party swept into power following a long period of Conservative rule. With the election of a new Labour government, could 2024 spark a similar resurgence in the UK stock market?

The 27-year-old Blairite campaign slogan, ‘things can only get better’, captured the patriotic optimism of the ‘Cool Britannia’ era. Yet it wasn’t all roses. While UK equities initially got caught up in the late-nineties’ excitement (the FTSE All-Share Index rose 32% in the 12 months after the election), accounting and regulatory changes implemented around that time actually sowed the seeds for challenges further down the track. Perhaps this government will unwind some of those impediments to investment in UK stocks and help boost a moribund market.

Much has been written about the London market’s woes, especially when compared to the meteoric rise of stocks across the pond. Are the issues down to sector composition? Not enough ‘growth’ and too much ‘value’? Too many commodities and not enough tech? For some the bedrock issue is our lacklustre domestic economy, or the dreaded ‘B’ word. Then there’s the heavy weighting to sectors perceived to be ‘ESG unfriendly’, lesser liquidity… the list goes on. While none of these factors have been helpful, I think the key challenge has been the demise of the natural buyer of UK equities.

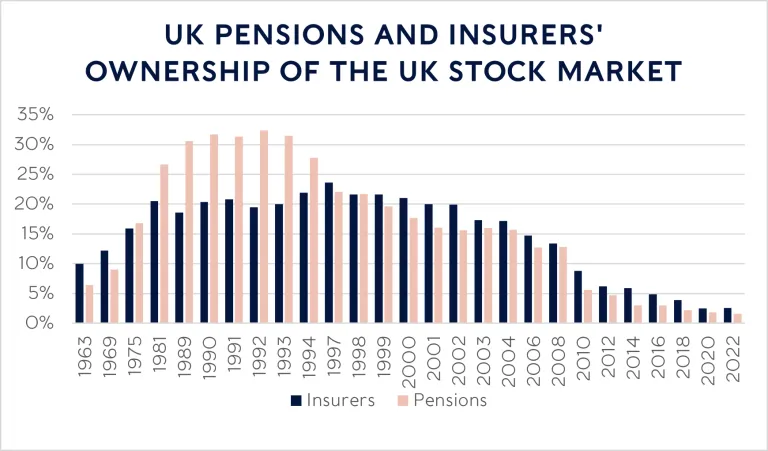

The scrapping of tax credits on dividends received by pension funds in 1997, coupled with accounting changes to bring pension liabilities onto corporate balance sheets a few years later, resulted in significant unintended consequences. For many companies, the cost of keeping their defined benefit pension funds open to new members far outweighed the benefits. With many of these schemes choosing to move into run-off, focusing on risk minimisation rather than return maximisation, ‘risky’ equities were shunned in favour of ‘safe’ bonds.

This process created a significant structural selling pressure within the UK equity market, further exacerbated by interest rates grinding lower and lower for much of the past two decades. The net result is that the UK’s £3.7 trillion pension market now has a paltry 6% invested in UK equities, down from more than 50% thirty years ago.

Bouncing off a floor?

UK asset managers have often been considered another natural buyer of UK stocks. However, a trend to reduce home bias in their portfolios, exacerbated no doubt by much better returns being posted by stocks on the other side of the Atlantic, magnified the selling pressure. As a result, overseas investors ownership of the UK market now stands at 58%. This was just 27% thirty years ago.

While this gradual process has led to many years of hurt for the UK market, it reaches a natural conclusion where domestic pension funds, insurers and asset managers have little left to sell, or at least are close to the global index weight. Though no bell will be rung or starting gun fired, I believe this moment is close and it will be important for the UK market.

That’s because the UK market trades on a very lowly valuation. Relative to its own history it is attractive. Relative to a global index it is astonishingly cheap. Though cheapness alone is not enough; it merely indicates how much pent-up outperformance could be baked into the pie. For a market to turn it needs a catalyst. Though always easier to spot with hindsight, there are a few potential sparks which collectively could fire the market back to life.

A United Kingdom for a catalyst

Firstly, despite their postcode, many UK corporates are in rude financial health and are taking matters into their own hands. Firms bought back more than £50bn of their own stock in both 2022 and 2023. With more than £27bn of buybacks already announced this year, 2024 could be another bumper year. While we disagree with the notion that firms can buy themselves back to greatness, with UK share prices in the doldrums, the potential returns from this use of capital are attractive.

M&A has hit the headlines this year. However, this isn’t the debt-fuelled, private-equity variety so prevalent in the previous decade. Instead, buyers are spotting an opportunity to acquire rivals at attractive multiples. The deal sizes are growing too; BHP’s aborted bid for Anglo-American in April/May was the largest attempted takeover of a London-listed firm for years.

Finally, although the UK only accounts for about a quarter of FTSE All-Share revenues, the health of the domestic economy matters greatly for market sentiment. The news that the UK economy has returned to growth after a very short and shallow recession is encouraging. Further, leading indicators for the housing market are positive and retail spending should pick up as real wage growth becomes embedded in the consumer psyche.

While the result of the general election has some echoes of history, when it comes to the UK stock market, we really do believe that things can only get better.