Filters

Keeping the show on the road

Last Updated: September 30, 2025

It’s one of the longest bull runs ever, but that doesn’t mean it will be cancelled any time soon.

The end of the brand?

Last Updated: September 30, 2025

If you’re paying more than double the going rate for branded batteries, what else are you overpaying for?

Millennial Matters

Last Updated: September 30, 2025

Investing in the next generation

How should brands respond?

Last Updated: September 30, 2025

Faced with this radically evolving landscape, are the major branded consumer goods companies doomed to irrelevance and terminal decline? Are there strategies they can adopt to win over younger generations of consumers and stay relevant in the 21st century?

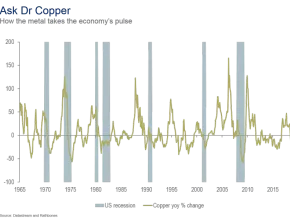

Chart of the week: Ask Dr Copper

Last Updated: September 30, 2025

Copper is all around us: in our houses, our cars, our hairdryers and it’s even one of the most intensively used raw materials in the green energy revolution. Its wide use in everyday products should make copper prices a good indicator of economic health. But there are other factors at play, and we found that the price of copper seems to respond to economic growth with a six-month delay. Perhaps we shouldn’t rely too heavily on Dr Copper’s reputation for giving us an early diagnosis.

In context

Last Updated: September 30, 2025

Investors seem to be flitting between fear and optimism in an increasingly erratic manner. Hopes for a soft-touch Federal Reserve seem to be driving most of the optimism, notes chief investment officer Julian Chillingworth.

Rathbones to make changes to its Luxembourg SICAV range

Last Updated: September 30, 2025

Rathbone Unit Trust Management prepares for post-Brexit regulatory environment. Rathbones, one of the UK’s leading providers of investment management services for individuals, charities and professional advisers, announces its intention to make changes to its Luxembourg domiciled SICAV in preparation for a post-Brexit regulatory environment.

Amusing ourselves to death

Last Updated: September 30, 2025

Quite possibly the worst bounty delivered by the 21st century is the 24-hour news cycle.

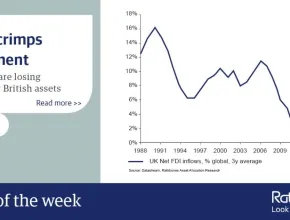

Chart of the week: Brexit crimps investment

Last Updated: September 30, 2025

Foreign companies and governments are simply not investing in British assets as they used to. This is worrying because modern economic growth relies on technological transfer, or learning from others and improving on it. The benefits of this transfer are clear from the productivity data - firms with inward investment from overseas are almost twice as productive as firms without any link to foreign investment. So, a slowdown in this area means a slowdown in productivity; a big worry.

Investment conference 2019

Last Updated: September 30, 2025

Britain’s future in the world Andrew Marr opened the evening with an insightful summary of Britain’s current political position in Europe, where we may go next, and why.

Inflation anyone?

Last Updated: September 30, 2025

US corporate earnings hit a crescendo this week, yet most people are focused on the Federal Reserve and the fluid trade policies of the American President.

Rathbone Multi-Asset Portfolio Funds: Pound of Flesh

Last Updated: September 30, 2025

Equity and credit markets exacted their pound of flesh from investors in the last quarter of 2018, as concerns over global growth mounted in the face of tariff wars and rising interest rates. Assistant fund manager Will McIntosh-Whyte discusses the outlook for 2019 and the risks that sterling might pose for investors as Brexit unfolds.