Filters

Rathbone Multi-Asset Portfolio Funds: A year of Snakes and Ladders

Last Updated: September 30, 2025

Investors have done a lot of clambering up ladders only to slide down more than a few snakes this year. Assistant fund manager Will McIntosh-Whyte discusses how the US Federal Reserve and G-20 leaders have been playing the game recently and how the dice may land in 2019.

Rathbone Multi-Asset Portfolios: A close shave with Occam’s razor

Last Updated: September 30, 2025

The simplest solution tends to be the most likely answer. Following early October’s tumble, many different theories for the equity market fall have been thrown around. Join assistant fund manager Will McIntosh-Whyte as he argues you can follow a logical path back to a hefty jump in US Treasury yields stemming from the Federal Reserve’s declaration that interest rates are “a long way from neutral”, and discusses how the multi-asset portfolios have behaved through the recent market volatility

Rathbone Multi-Asset Portfolios update: An A for effort? Trump at the mid-terms

Last Updated: September 30, 2025

The US President has spent most of the year sending ill-advised tweets from the back of the classroom, but his boisterous optimism and background deregulation has pushed the US market to new highs. His politics may be questionable, but it’s businesses we focus on. Join assistant fund manager Will McIntosh-Whyte as he assesses the economic prospects as the mid-term elections approach, and runs through a report card of what has worked for the funds and what hasn’t.

Rathbone Multi-Asset Portfolios: Bored of Brexit

Last Updated: September 30, 2025

Assistant fund manager Will McIntosh-Whyte discusses how the multi-asset team remain vigilant in positioning the funds in the face of the ongoing saga that is Brexit

Rathbone Multi-Asset Portfolios: Italy - a 'new wind' or a worrying whiff?

Last Updated: September 30, 2025

Will looks at the implications of recent developments in Italian politics, and discusses how the multi-asset funds are positioned.

Multi-Asset update - exploring the China OBORtunity

Last Updated: September 30, 2025

Will looks at China’s One Belt One Road initiative. Is this is Chinese solution to global economic blues? Hear how the multi-asset strategies are allocating to the region.

Are we seeing the start of a technology backlash?

Last Updated: September 30, 2025

If you believe everything you read, Amazon pays no taxes, YouTube advertises terrorism, Facebook hands out our data to the highest bidder and Apple is tracking our every move. Will considers the folly of investing in acronyms and whether this is the start of a technology backlash. Take this opportunity to hear how the strategies are positioned as developments unfold.

Rathbones International - Multi-Asset update

Last Updated: September 30, 2025

This is the second in a series of monthly updates we will bring to you during 2018 with Assistant Fund Manager Will McIntosh-Whyte. Will shares his views on the global economy and the implications for the Rathbone Multi-Asset portfolios through this year. Take this opportunity to hear how the strategies are positioned as developments unfold

Rathbones International - Multi-Asset update

Last Updated: September 30, 2025

Assistant Fund Manager Will McIntosh-Whyte shares his views on the global economy and the implications for the Rathbone Multi-Asset portfolios through this year. Take this opportunity to hear how the strategies are positioned as developments unfold

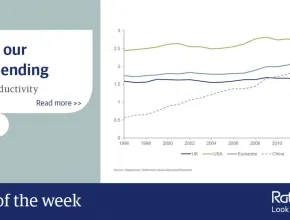

Chart of the week: A lag in our R&D spending

Last Updated: September 30, 2025

Productivity growth is falling around the world, but the slowdown is more acute in the UK. This deceleration could be lessened – and even reversed – by investment in research and development (R&D), which kick-starts new technologies and, ultimately, increases growth and productivity. However, the UK’s spending in this area is falling behind other developed economies at a time when we need to be leading the way.

Crunch time (again)

Last Updated: September 30, 2025

We don’t know about you, but over the past year or so we got into the habit of buying our travel money extremely far in advance of holidays.

How a widely used industrial metal takes the global economy’s pulse

Last Updated: September 30, 2025

Want to measure the pulse of the global economy? Ask Dr Copper, or so the adage goes. Copper is all around us. You need it to build a house, a car and a hairdryer. The red metal is even one of the most intensively used raw materials in the green energy revolution — more electrical motors, more battery packs (but fewer internal combustion engines) means more copper wiring. So demand for copper ebbs and flows with the ups and downs of the business cycle.