Filters

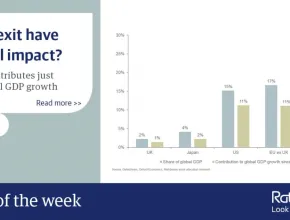

Chart of the week: Will Brexit have a global impact?

Last Updated: September 30, 2025

Britain is a small, open economy. ‘Small’ may sound a bit strange when by GDP, the UK is the fifth-largest country in the world. But, in fact, we only contribute 2% of global GDP, which means that we aren’t big enough to unilaterally influence global prices, interest rates, or the global economy at all. We are a small economy and we have some big problems, but a Brexit wobble won’t derail the whole global economy.

Rathbone Multi-Asset Portfolio Funds: Not betting on black

Last Updated: September 30, 2025

As we approach the Brexit deadline day, Will McIntosh-Whyte discusses why the Multi-Asset team are not looking to take big bets on the outcome, but rather position the portfolios in order to minimise any downside risk whatever the outcome.

Brexit edges forward amid Parliamentary chaos

Last Updated: September 30, 2025

This has been a tumultuous week for politics by anyone’s standards. Following the drama of Brexit votes and Parliament exerting its will not to leave the EU without a deal, it was a better day in the office for Prime Minister Theresa May on Thursday.

Cutting cost is good, investment is better

Last Updated: September 30, 2025

Ten years ago this month, the American stock market, stricken by the global financial crisis, bottomed out and started one of the longest upward market trends in history. Now, a decade on, Rathbone Income fund manager Carl Stick thinks it’s appropriate to talk about change.

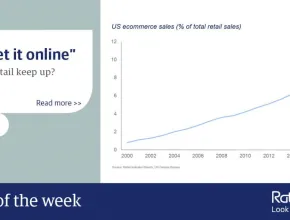

Chart of the week: “Just get it online”

Last Updated: September 30, 2025

In some ways, retail is going through a similar transformation to that of the auto industry, when greater automation and systems seeped into manufacturing decades ago. Nowadays, retail shopping is less about swamping high streets with clothes or sofas in every size and colour. Far better to save your property budget for creating a huge and efficient logistics network to deliver what consumers want, to their door, overnight. In this just-in-time environment, quality data is pivotal. But, very few companies have it, and they tend to reside in Silicon Valley.

Brexit: What on earth's going on?

Last Updated: September 30, 2025

Theresa May has asked the European Union (EU) for a delay in the UK’s departure until 30 June, with EU officials indicating they would only grant an extension on the grounds of Parliament agreeing a deal.

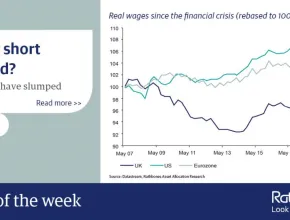

Chart of the week: Feeling short changed?

Last Updated: September 30, 2025

Unfortunately for us, this decimation in the standard of living is unique to the UK. Not only have real wages struggled since 2008, we now have the poorest rate of social mobility of any advanced major economy. Our future is uncertain, and that can’t just be blamed on Brexit. Edward Smith, Rathbones’ head of asset allocation research, discussed his concerns about our small but troubled economy and considered our future at our annual investment conference.

Rathbones clarifies changes to published AUM figures for UK-domiciled and Luxembourg-domiciled funds

Last Updated: September 30, 2025

As announced on 18 February 2019, Rathbones has made changes to its Luxembourg domiciled SICAV in preparation for a post-Brexit regulatory environment.

Beat the ISA rush for better returns

Last Updated: September 30, 2025

Given the potential of ISAs to provide tax-efficient gains that compound over time, it makes sense to invest earlier in the year. Doing so could mean greater growth in your portfolio and allow you to reach your investment goals sooner.

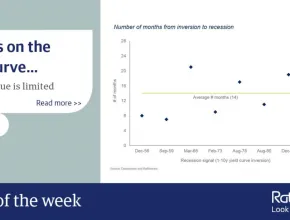

Chart of the week: All eyes on the yield curve…

Last Updated: September 30, 2025

As the joke goes, an inverted yield curve has predicted 11 of the past nine recessions. Its traditionally one of the most reliable harbingers of economic recession but a closer look at timings show that its use is limited. Over the past 50 years, the number of months from inversion (defined here as 1-year US Treasury yields surpassing 10-year yields) to recession has ranged from seven up to 24, averaging 14. So, an inverted yield curve has proved to be a reliable indication of recession, but not its timing.

Investment Update Q2 2019

Last Updated: September 30, 2025

The party goes on; just jazz, not rock and roll

FE Alpha Manager Hall of Fame

Last Updated: September 30, 2025

James Thomson, is named as one of 61 fund managers entering the FE Alpha Manager Hall of Fame for 2019.