Filters

A better place to be

Last Updated: September 30, 2025

As we move into the new financial year we begin to access the outlook for global markets as we look out to 2020 and beyond. How can investor’s best position themselves amid changing central bank policies and geopolitical risks? David Coombs, Head of multi-asset investments at Rathbones discusses.

Either you’re good or you’re dead

Last Updated: September 30, 2025

More than anything else, one thing has been at the top of our mind lately: in business, if you’re not the cheapest or the best, you’re toast.

Investment Insights Q2 2019

Last Updated: September 30, 2025

As the UK works through a significant moment in history, policies that boost trade and investment could relieve the country’s economic malaise.

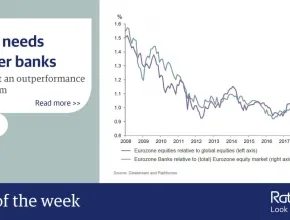

Chart of the week: Europe needs healthier banks

Last Updated: September 30, 2025

Large loan-loss provisions hamper Europe’s banks. These provisions cover things like bad loans and customer defaults and cost the sector a lot. The problem is particularly acute in Portugal and Italy but still prevalent in all the major European economies. The region needs recovery in its banking sector before the long-awaited upswing in its indices can begin. Until Europe’s banks free themselves from bad debt, the region will remain stuck in economic mud.

Delay, delay: Groundhog Day

Last Updated: September 30, 2025

The fog of uncertainty won’t disperse anytime soon. But the FTSE is an international market, defensive and quite possibly one of the better places to be as global growth slows.

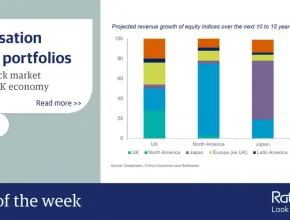

Chart of the week: Globalisation buffers portfolios

Last Updated: September 30, 2025

A quick look at the geographic exposure of the UK stock market reveals that the vast majority of UK stock market earnings are sourced from overseas. This is great news, as it means that our stock market is exposed to faster-growing economies which should boost revenue growth for UK equities. The benefits of globalisation should buffer any heavily UK-exposed portfolios. Read more about the future of our economy in our latest Investment Insights.

Mixed signals

Last Updated: September 30, 2025

Equity markets are in a happy mood, climbing through a fog of uncertainty with omens of recession tolling from the bond market. Julian Chillingworth, Rathbones chief investment officer, explains why we think it still makes sense to stay invested, but with vigilance.

Eurosif transparency accreditation

Last Updated: September 30, 2025

We are delighted to announce that the Rathbone Ethical Bond Fund has once again been awarded the rights to display the European SRI Transparency logo.

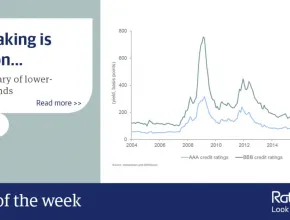

Chart of the week: Risk-taking is back on...

Last Updated: September 30, 2025

…but be wary of lower-quality bonds

Rathbones multi-asset funds: the blessed trinity

Last Updated: September 30, 2025

With the Fed putting the brakes on rate hikes, Chinese growth rebounding and positive noises coming out of US-China trade discussions, assistant fund manager Will McIntosh-Whyte discusses how the RMAPs team is positioning portfolios following the strong bounce back in equity markets so far this year.

Rathbones Multi-Asset update - The Blessed Trinity

Last Updated: September 30, 2025

With the Fed putting the brakes on rate hikes, Chinese growth rebounding and positive noises coming out of US-China trade discussions, assistant fund manager Will McIntosh-Whyte discusses how the RMAPs team is positioning portfolios following the strong bounce back in equity markets so far this year.

It’s important to be patient as the business cycle matures

Last Updated: September 30, 2025

Owing to its size and influence around the world, what happens in the US economy has important implications for financial markets everywhere.