Filters

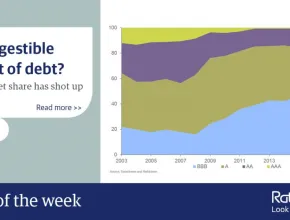

Chart of the week: An indigestible amount of debt?

Last Updated: September 30, 2025

Quality hasn’t just deteriorated in the sterling-denominated corporate bond market, but the lowest-rated BBB segment has also grown substantially as a proportion of the euro and US dollar investment-grade markets, which are both far bigger. If the rate of downgrades in the next recession is similar to the rate in the previous one, the next rung down in the bond markets – high yield debt markets – could get swamped.

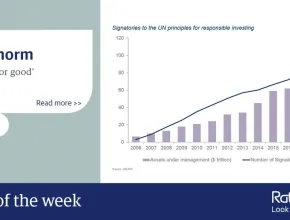

Chart of the week: A new norm

Last Updated: September 30, 2025

As society struggled to get back on its feet in the wake of the 2008 global financial crisis, one thing was clear: society needs the investment industry to be active and responsible. For many, this meant thinking about signing the Stewardship Code, and upping their game on proxy voting and engagement with underlying companies. For us, this created further incentive to refine our existing approach. Since then, responsible investing has become mainstream and over 2,000 asset managers around the world are now signatories to the UN-backed Principles for Responsible Investing (PRI).

Rathbone Global Sustainability Fund

Last Updated: September 30, 2025

David Harrison, fund manager of the Rathbone Global Sustainability Fund discusses current investment themes and how he has shaped the current portfolio to maximise returns while remaining in line with the UN Sustainable Development Goals.

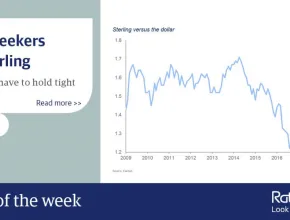

Chart of the week: Value seekers eye sterling

Last Updated: September 30, 2025

Kicking the Brexit can all the way to Halloween has done nothing but prolong the uncertainty that’s shrouded us for so long. The ‘good news’ is that we think sterling now looks so undervalued that, no matter what happens with Brexit, it should appreciate over the long term. So, those willing to hold on for a rough ride just may find themselves reaping the rewards when the Brexit puzzle is finally solved.

Property owners are adapting to the popularity of online shopping

Last Updated: September 30, 2025

We’ve always been a nation of shopkeepers and spendthrifts. But how we get our retail fix today is dramatically different to even five years ago, let alone the turn of the millennium

A change is in the air

Last Updated: September 30, 2025

Searching for investments that improve our world and deliver returns. Rathbones Global Sustainability Fund manager David Harrison takes a trip to America.

If you can make it in America, you can make it anywhere

Last Updated: September 30, 2025

What struck me is that for the first time, US investors were actually asking about ESG. That may sound silly, but the US has been very far behind Europe and the UK in this regard.

Not just a pivot: technology solving real world problems

Last Updated: September 30, 2025

Everybody wants to invest in technology companies and every company wants to be one. This is as true in 30˚C Florida as it is on the frozen shores of Lake Michigan, in Milwaukee.

In pursuit of green

Last Updated: September 30, 2025

Sustainable investing isn’t just about avoiding the risks of outdated businesses or environmental PR disasters, explains our Global Sustainability Fund manager, David Harrison. It’s also about spotting opportunities that can be captured if you keep your eyes on the future instead of the past.

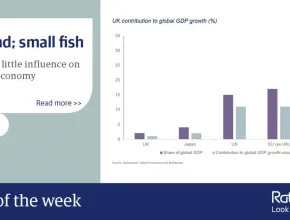

Chart of the week: Big pond; small fish

Last Updated: September 30, 2025

The UK economy is small, which may sound a little strange if you know that we have the world’s fifth-largest economy by gross domestic product. But we only contributed about 2% to global economic output last year – not enough to influence global asset prices, interest rates or the pace of global growth in any meaningful way. So the good news is that Brexit is not a globally systemic event, like the financial crisis of 2007-08 or the European debt crisis of 2011-12.

10 years ago, I dreamed a dream

Last Updated: September 30, 2025

They used to call David Coombs crazy. When he set up our multi-asset funds 10 years ago, many people didn’t get why we were setting targets for return and risk that investors could hold us to.

10 more years of evolution

Last Updated: September 30, 2025

When we set up our multi-asset funds 10 years ago, we thought people would appreciate accountability and value reliability. Turns out we were onto something. Rathbones head of multi-asset investments David Coombs looks forward to the next decade.