Filters

10 more years of evolution

Last Updated: September 30, 2025

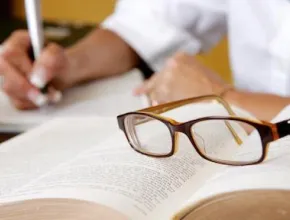

When we set up our multi-asset funds 10 years ago, we thought people would appreciate accountability and value reliability. Turns out we were onto something. Rathbones head of multi-asset investments David Coombs looks forward to the next decade.

China, emerged

Last Updated: September 30, 2025

The death of the Chinese economic miracle has been greatly exaggerated many, many times. Rathbones head of multi-asset investments David Coombs thinks you need to think differently about the Eastern giant.

Politics matters now

Last Updated: September 30, 2025

All around the world, people are angry. And when voters vent, politicians tend to react. Rathbones head of multi-asset investments David Coombs looks at how that may change the landscape for investors.

Fighting the last war

Last Updated: September 30, 2025

You spend so much time in the present that oftentimes you forget there was a past and there will be a future. Rathbones head of multi-asset investments David Coombs dredges up a sad past and ponders a hopeful future.

Changes to the funds

Last Updated: September 30, 2025

With growth comes change, and change can be good. We’ve enjoyed the benefits of greater scale and better control of risks that growth has enabled, while resisting the pressures to sacrifice quality for lower costs.

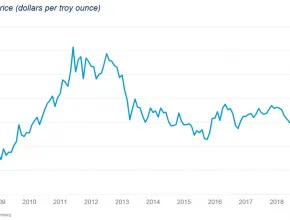

Chart of the week: Every cloud has a golden lining

Last Updated: September 30, 2025

The old investment adage of buying gold to protect your wealth from money-printing central banks inflating it away doesn’t quite sit well with us. Our research shows gold tends to be a poor way of protecting your wealth from inflation. However, gold has historically attracted many investors when things get rocky, pushing its price higher. So, holding a small amount can be a good way to reduce the volatility of your portfolio.

New EU inmates take over the asylum

Last Updated: September 30, 2025

The world seemed to unravel further last month, with British voters electing members to the EU Parliament whose goal is to leave it, and Donald Trump continuing to wield his trade cudgel. Our chief investment officer Julian Chillingworth considers the implications.

Investment Update Q3 2019

Last Updated: September 30, 2025

A time to be defensive, but also a time for calm. Amid slowing growth, trade war, tensions with Iran and never-ending Brexit, defence may be the best offence

Chart of the week: Taking up the challenge

Last Updated: September 30, 2025

Over the past decade, appetite for sustainable investment has increased across the global asset management industry and in the US, sustainably managed assets now represent 26% of the total. Commitment to the Stewardship Code has also shot up as and more managers have become involved in proxy voting and other forms of engagement with underlying companies. We’ve been doing this for a while – this year marks a decade since Rathbones signed the UN-backed Principles for Responsible Investment (PRI).

Investment Insights Q3 2019

Last Updated: September 30, 2025

While the Brexit deadline draws closer, the route to a deal between the UK and the European Union (EU) shows no signs of materialising.

Notice to shareholders Letter (merger sub-funds)

Last Updated: September 30, 2025

Rathbone Luxembourg Funds SICAV, mergers of sub-funds

It doesn’t add up

Last Updated: September 30, 2025

Stocks soared to new highs in June, but more pessimistic bond markets tolled a more ominous note amid weaker growth, falling earnings, trade tussles and other troubles. Chief investment officer Julian Chillingworth considers the mixed messages coming from stocks and bonds.