Filters

Notice to shareholders Letter (Rathbone SICAV Multi-Asset Enhanced Growth Portfolio Accumulation Sub-Fund)

Last Updated: September 30, 2025

Notice to the shareholders of sub-fund Rathbone Multi-Asset Enhanced Growth Portfolio Accumulation Sub-Fund (the "Sub-Fund")

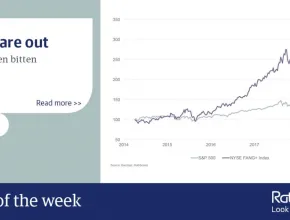

Chart of the week: FANGs are out

Last Updated: September 30, 2025

News that America’s Department of Justice and Federal Trade Commission will conduct wide-ranging probes into the market power of several tech giants sent their share prices tumbling. Investors fear growth-busting breakups. Telltale warning signs have been floating around for a year, yet they deepened in May and June. These companies have come a long way from the garages and dorm rooms where they were founded. Fresh-faced innovation has given way to mistrusted maturity. The FANGs are just too big and too powerful to be left alone.

Rathbone Multi-Asset Funds: Halfway there, living on a central bank prayer?

Last Updated: September 30, 2025

As we pass the mid-point of the year, central banks have remained front and centre as investors digest their increasingly dovish narrative. On Wednesday 8 May, at 10am (GMT).assistant fund manager Will McIntosh-Whyte discusses how the RMAPs team is positioning portfolios for the second half of the year, as well as looking back at performance in 2019 so far.

Rathbone Multi-Asset Funds: Halfway there, living on a central bank prayer?

Last Updated: September 30, 2025

As we pass the mid-point of the year, central banks have remained front and centre as investors digest their increasingly dovish narrative. On Wednesday 31 July, at 10:30am (GMT).assistant fund manager Will McIntosh-Whyte discusses how the RMAPs team is positioning portfolios for the second half of the year, as well as looking back at performance in 2019 so far.

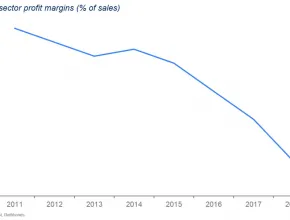

Chart of the week: Profits under pressure

Last Updated: September 30, 2025

The online shopping squeeze

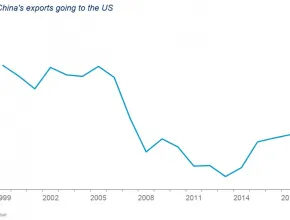

Chart of the week: China is vulnerable to trade wars

Last Updated: September 30, 2025

No end in sight.

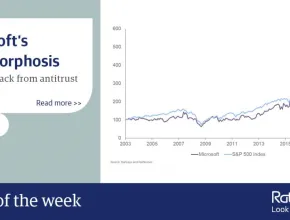

Chart of the week: Microsoft’s metamorphosis

Last Updated: September 30, 2025

Bouncing back from antitrust

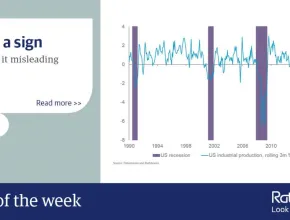

Chart of the week: Give us a sign

Last Updated: September 30, 2025

We have more reasons than at any time over the past decade to be worried about the global economic outlook over the next 12 months. Notably, US industrial production is contracting quarter- on-quarter. But we don’t think it’s time yet to cash in your chips. A mild contraction in many of these indicators is not actually unusual. Quarterly US industrial production growth has been negative five times now since the recovery began in 2009, sometimes for prolonged periods. Taken together, the indicators are not yet signalling more than a typical mid-cycle slowdown.

Rathbones Look forward podcast

Last Updated: September 30, 2025

Download the podcast of the series here. The future of happiness - Richard Layard

Rathbones’ Ed Smith comments ahead of the US Federal Reserve interest rate decision

Last Updated: September 30, 2025

Now that the latest round of China/US trade talks have come to an uninspiring end, attention will shift to this evening’s announcement from the US Federal Reserve and the expected 0.25% rate reduction in the real interest rate. Markets will also be searching for clues as to whether there will be any further rate cuts this year, or whether this is a one off insurance cut.

Rathbone Global Opportunities Fund

Last Updated: September 30, 2025

James will discuss his best (and worst) performers this year, the reason why he is fully invested and his significant exposure to the US, technology and other growth stocks.

Foxes and hedgehogs

Last Updated: September 30, 2025

They strive each day (and most nights) to completely understand their discipline, so why does their labour only make expert forecasters more inaccurate? Rathbones Income Fund manager Carl Stick looks at why specialists fail at the future.