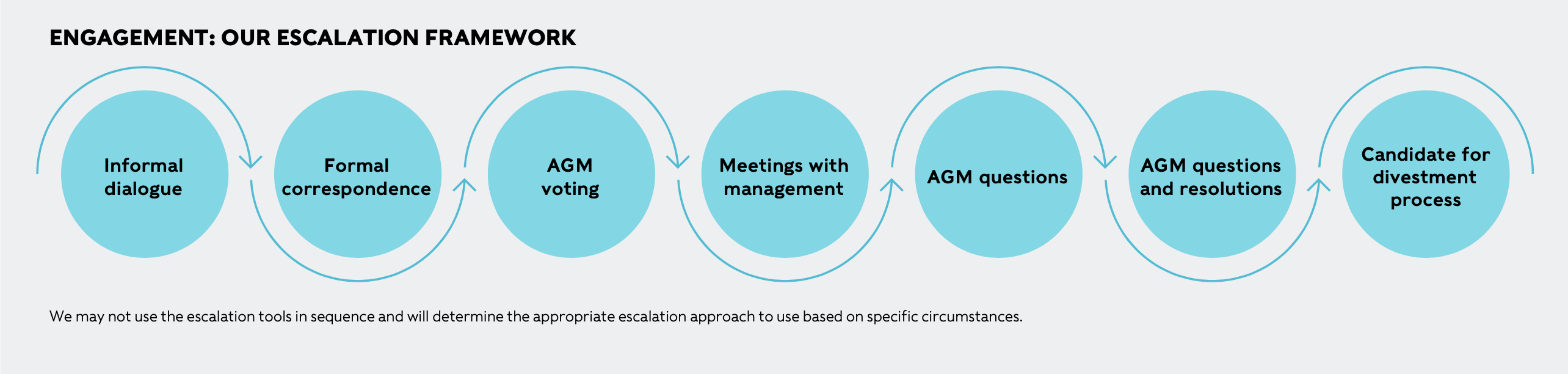

We prioritise engagement where we can help make a difference in addressing systemic ESG challenges. We are prepared to escalate our engagement activity or reduce our holdings in companies that continue to present an ongoing ESG risk.

We don’t outsource any engagement services because we see engagement as fundamental to our duty to manage our clients’ investments to their benefit. Rathbones engaged with companies around the world 752 times in 2023, on almost 50 different topics.

We were most likely of all to raise the topic of top executives’ pay with companies – more than a hundred times. But we also engaged more than 90 times on net zero and on modern slavery.

Here are some examples, from our responsible investment report, of our engagements.

WHY ENGAGE ON CLIMATE CHANGE?

We believe that engagement on ESG issues with companies in which we invest forms part of our wider responsibility, as a business, to society. One example is our engagement with companies on their plans for net zero.

Climate change threatens to affect a wide range of assets adversely, so mitigating it is in the interests of our clients as well as society as a whole.

Like other financial institutions, Rathbones has a responsibility to understand how climate change and other factors can have an impact on portfolios.

HOW WE CHOOSE WHAT TO ENGAGE ON

In deciding whether to engage, we consider:

EXPOSURE

SEVERITY

LOCATION

EXPERTISE