Rathbones names new CIOs as Julian Chillingworth announces retirement

14 July 2021

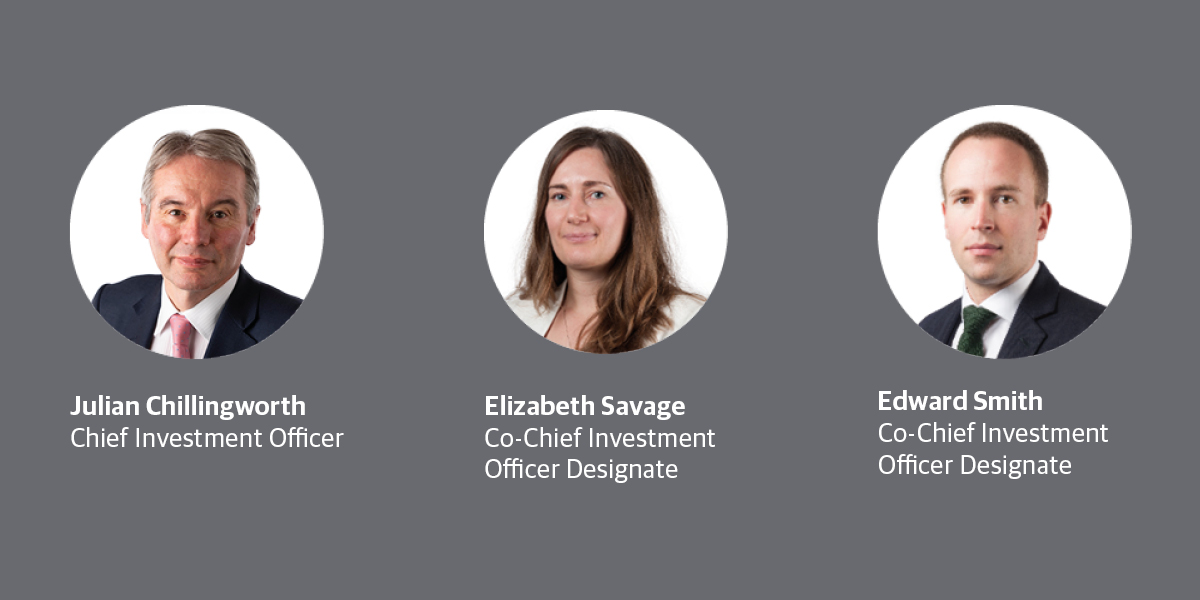

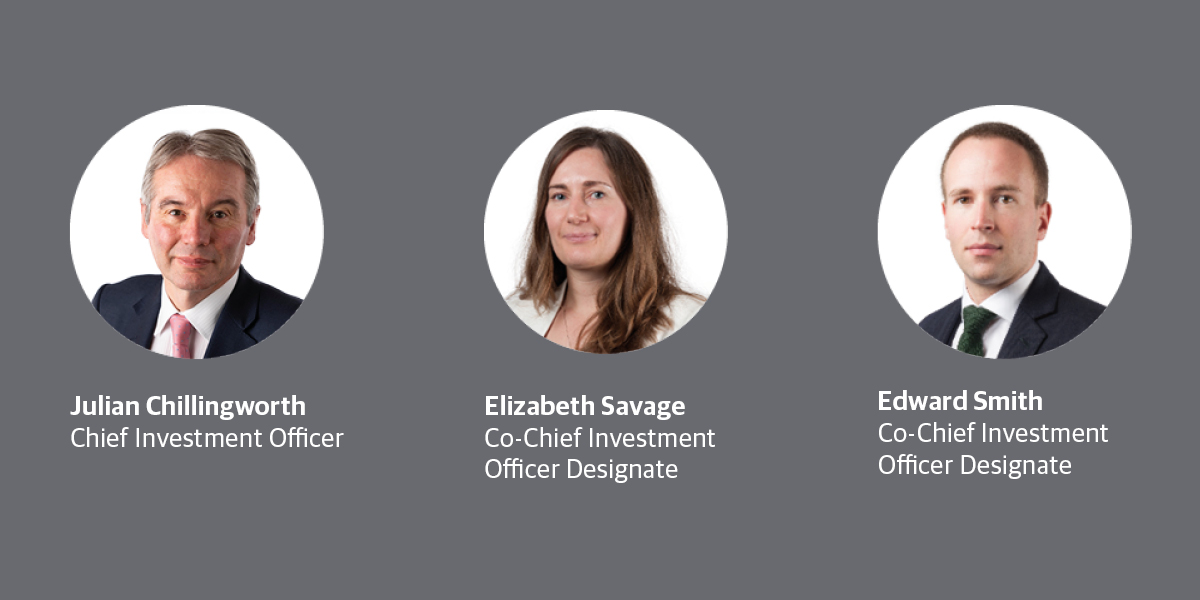

Rathbones, one of the UK’s leading providers of investment management services for individuals, charities and professional advisers, is pleased to appoint Elizabeth Savage and Edward Smith as co-chief investment officers of Rathbone Investment Management, as Julian Chillingworth announces his retirement.

Following a 20-year career at Rathbones, most recently as chief investment officer across the business, and with more than 40 years in the investment industry, Julian has decided to retire, planning to leave Rathbones in early 2022.

Article last updated 30 September 2025.

Rathbones, one of the UK’s leading providers of investment management services for individuals, charities and professional advisers, is pleased to appoint Elizabeth Savage and Edward Smith as co-chief investment officers of Rathbone Investment Management, as Julian Chillingworth announces his retirement.

Following a 20-year career at Rathbones, most recently as chief investment officer across the business, and with more than 40 years in the investment industry, Julian has decided to retire, planning to leave Rathbones in early 2022.

Under Julian’s stewardship, Rathbones has built a robust investment process with a deep research capability. With the business having grown significantly in recent years, his responsibilities have now been divided, with dedicated investment leadership roles for Rathbone Investment Management and Rathbone Unit Trust Management.

With immediate effect, Elizabeth and Edward, currently head of research and head of asset allocation research respectively, will lead the newly created ‘CIO office,’ reporting to Rathbone Investment Management managing director, Ivo Darnley. A chief investment officer for Rathbone Unit Trust Management will be announced in due course. Over the coming months, Julian will work closely with all investment teams to ensure a smooth and successful transition.

Paul Stockton, chief executive, Rathbones said: “There will be many chances to thank Julian over the coming months, but I would like to take this early opportunity to recognise his significant contribution to Rathbones over the past 20 years. During that time, global markets have changed almost beyond recognition, and Julian has played an enormous part in steering us through both calm and turbulent waters. Our warmest wishes go to him for a long and happy retirement.

“A robust and dynamic investment process is critical to Rathbones being able to deliver strong investment returns into the future, and we are very fortunate to have the individuals who have played a crucial role in the development of our in-house research and strategic asset allocation skills, with the capability to step-up and lead us into the future. Liz and Ed will assume lead responsibilities for the day-to-day management of particular areas but will be jointly responsible for the investment process and its delivery. Following a full external recruitment process, I would like to congratulate both of them, knowing they will work seamlessly to lead a CIO office that represents a modern solution for our business, and establishes a strong platform for the future investment performance for our clients.”

-Ends-

For further press information, please contact:

Sam Emery/Emma Murphy

Quill PR

020 7466 5056/5054

sam@quillpr.com

-Ends-

For further press information, please contact:

Sam Emery/Emma Murphy

Quill PR

020 7466 5056/5054

sam@quillpr.com

emma@quillpr.com Madhu Kalia PR - Rathbones 020 7399 0256 or 07825 596302 madhu.kalia@rathbones.com Notes to editors: Julian Chillingworth Julian is Rathbones’ chief investment officer, and therefore plays a key role in the ongoing development of the organisation’s investment process. Prior to this, Julian was assigned board director of Rathbone Unit Trust Management in October 2001 and joined Rathbones in July 2001 as deputy chief investment director. Julian is also a member of Rathbones’ Investment Executive Committee. He has over 40 year’s investment experience, gained within organisations such as James Capel, Global Asset Management, Bankers Trust, and Investec Asset Management. Elizabeth Savage Elizabeth is head of research and joined Rathbones in 2005. She is responsible for overseeing the research team, and the development of the investment process including recommendations made by the investment committees. She is also a member of Rathbones’ Investment Executive Committee. Elizabeth previously worked at Progressive Alternative Investments, a fund of hedge funds, where she was a hedge fund analyst. Elizabeth graduated from Newcastle University and holds the Chartered Alternative Investment Analyst designation. Edward Smith Edward is Head of Asset Allocation Research at Rathbones and supports its investment process with proprietary macro-based, multi-asset research. He is a member of the Strategic Asset Allocation Committee, Sector Selection Committee, and a founding member of the Responsible Investment Committee. Edward presents frequently to clients on the economic and financial market outlook, and comments on economic developments in the press. He is a regular guest on Bloomberg TV and Sky News. He joined Rathbones in 2014 from Canaccord Genuity Wealth Management, where he was global strategist and co-lead manager of their Risk Enhanced Multi-Asset Portfolio service. He began his career at Blackrock. Edward is a Chartered Financial Analyst and has served on the continuing education committee of CFA UK, for whom he has also helped write position papers, most recently chairing the working group on the future of corporate financial reporting. He is a published expert on risk management for high net worth individuals and is a member of the Society of Professional Economists. He has an MA from the University of Oxford and an MSc with distinction in Economic History from the London School of Economics and Political Science (LSE). About Rathbones Group Plc Rathbones provides individual investment and wealth management services for private clients, charities, trustees and professional partners. We have been trusted for generations to manage and preserve our clients’ wealth. Our tradition of investing and acting responsibly has been with us from the beginning and continues to lead us forward.

-Ends-

For further press information, please contact:

Sam Emery/Emma Murphy

Quill PR

020 7466 5056/5054

sam@quillpr.com

-Ends-

For further press information, please contact:

Sam Emery/Emma Murphy

Quill PR

020 7466 5056/5054

sam@quillpr.comemma@quillpr.com Madhu Kalia PR - Rathbones 020 7399 0256 or 07825 596302 madhu.kalia@rathbones.com Notes to editors: Julian Chillingworth Julian is Rathbones’ chief investment officer, and therefore plays a key role in the ongoing development of the organisation’s investment process. Prior to this, Julian was assigned board director of Rathbone Unit Trust Management in October 2001 and joined Rathbones in July 2001 as deputy chief investment director. Julian is also a member of Rathbones’ Investment Executive Committee. He has over 40 year’s investment experience, gained within organisations such as James Capel, Global Asset Management, Bankers Trust, and Investec Asset Management. Elizabeth Savage Elizabeth is head of research and joined Rathbones in 2005. She is responsible for overseeing the research team, and the development of the investment process including recommendations made by the investment committees. She is also a member of Rathbones’ Investment Executive Committee. Elizabeth previously worked at Progressive Alternative Investments, a fund of hedge funds, where she was a hedge fund analyst. Elizabeth graduated from Newcastle University and holds the Chartered Alternative Investment Analyst designation. Edward Smith Edward is Head of Asset Allocation Research at Rathbones and supports its investment process with proprietary macro-based, multi-asset research. He is a member of the Strategic Asset Allocation Committee, Sector Selection Committee, and a founding member of the Responsible Investment Committee. Edward presents frequently to clients on the economic and financial market outlook, and comments on economic developments in the press. He is a regular guest on Bloomberg TV and Sky News. He joined Rathbones in 2014 from Canaccord Genuity Wealth Management, where he was global strategist and co-lead manager of their Risk Enhanced Multi-Asset Portfolio service. He began his career at Blackrock. Edward is a Chartered Financial Analyst and has served on the continuing education committee of CFA UK, for whom he has also helped write position papers, most recently chairing the working group on the future of corporate financial reporting. He is a published expert on risk management for high net worth individuals and is a member of the Society of Professional Economists. He has an MA from the University of Oxford and an MSc with distinction in Economic History from the London School of Economics and Political Science (LSE). About Rathbones Group Plc Rathbones provides individual investment and wealth management services for private clients, charities, trustees and professional partners. We have been trusted for generations to manage and preserve our clients’ wealth. Our tradition of investing and acting responsibly has been with us from the beginning and continues to lead us forward.

- In business since 1742.

- A FTSE 250 listed company.

- Managing/administering more than £55.8* billion for our clients.

- 15 offices throughout the UK and Jersey.