Will Markets close, and what happens if they are?

<p>Market volatility has been through the roof, with US stocks first falling rapidly and then shooting higher faster than at any time since the 1930s. Despite these jarring moves, financial markets are unlikely to close, argues our head of asset allocation research Ed Smith.</p>

<p><strong>Will the markets be closed, and what happens if they are?</strong></p>

Article last updated 30 September 2025.

Market volatility has been through the roof, with US stocks first falling rapidly and then shooting higher faster than at any time since the 1930s. Despite these jarring moves, financial markets are unlikely to close, argues our head of asset allocation research Ed Smith.

Will the markets be closed, and what happens if they are?

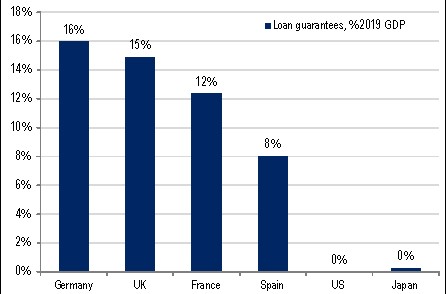

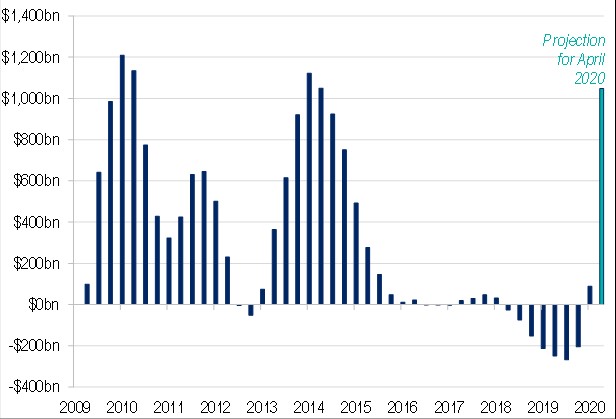

Central banks and governments across the developed markets are signalling – with words and actions – that they will do whatever it takes to keep their economies and markets functioning at this extraordinary time. We have had massive monetary stimulus packages from the Bank of England, the Bank of Japan, the European Central Bank and on Wednesday Buzz Lightyear-style QE ‘to infinity and beyond’ from the US Federal Reserve. These efforts have gone even further than during the global financial crisis and have been a lot speedier.

Annual Change in Federal Reserve Balance Sheet

Source: FRED, Rathbones Asset Allocation Research

Closing markets would heighten the fear factor and cause more angst, particularly among pensioners who are more vulnerable to Covid-19. Politicians and regulators would not want to send such a message. In the case of shuttering markets, the medicine may well be worse than the illness.

Not even during the great crash of 1929 did markets shut completely. They struck upon a strategy of “special holidays” and there were quite a few days of very short trading hours. But even those partial shutdowns were to clear a backlog of paperwork, which is not an issue today. To be sure, old-style ‘open-outcry’ trading will probably be shut down for public health reasons. It’s still quite important in futures trading, but this represents less than 10% of equity trades. It shut down in 2012 when Manhattan was pummelled by Hurricane Sandy, with little discernible impact.

The US Securities and Exchange Commission already legislates for crazy markets: under the circuit breaker rules, if the S&P 500 falls by 20% intraday, the market closes for the rest of that day. But it opens again the next day. The basic justification for circuit breakers is price discovery, and if markets were to close for more than a day, price discovery would start to be impeded. Regardless, exchange closures these days will only have limited effectiveness because so much trading happens off exchange. To illustrate the point, the New York Stock Exchange’s (NYSE’s) share of overall trade in NYSE-listed securities decreased from 87% in 1980 down to 72% in 2006, and by 2008 it had plunged to less than 50%. So trading continues even when the main exchanges are closed.

We believe the market is already pricing in a very high chance of severe and prolonged disruption to the global economy and company profits. While there is still a chance that yet more disruption will arrive, we aren’t in the business of trying to time markets. For the long-term investors we represent, we believe it makes sense to stay invested. The extraordinary measures already put in place to provide a backstop to companies and markets increase the likelihood that activity will rebound strongly when social distancing measures are removed.

Governments are backstopping companies