Lessons from a tough 2022

<p>Last year was bruising for most investors, but particularly so for UK mid and small-cap specialists like me. The idiosyncrasies of businesses – the stock-in-trade of small and mid-sized company investments – were cast to the wind in favour of one great concern: monetary policy.</p>

Last year was bruising for most investors, but particularly so for UK mid and small-cap specialists like me. The idiosyncrasies of businesses – the stock-in-trade of small and mid-sized company investments – were cast to the wind in favour of one great concern: monetary policy.

It felt like no one was even looking at company results, announcements or prospects. Instead, mid and small-cap prices marched stubbornly downward. Steady outflows in the broader UK equity space compounded the issue. It was brutal and it taught me that there are situations where you can’t hold back the tide. There are inflection points where macroeconomic factors completely outweigh the micro ones of individual businesses to an extent that I haven’t seen before in more than 16 years looking at companies.

Even the highest-quality companies’ share prices struggle to perform when there’s no certainty around where interest rates will end up. These benchmark interest rates are a crucial valuation support for ‘growth’ companies – for companies that plan to take over the world tomorrow rather than deliver steady dividends today. The decade and more of ultra-low interest rates no doubt exacerbated this effect, but this sensitivity to macroeconomics is a valuable lesson.

A low bar, a healthy cushion

The year also reinforced the kind of growth we search for . We want to invest in quality companies – those that grow at a reliable clip, emphasis on reliable – with tried-and-true business models and experienced managers who have proved that they can deliver what they promise. These companies tend to be a bit more expensive, but reliable growth – with its compounding gains – is an engine room for portfolio returns.

There’s still a place for companies that are smaller, that have less-tested business models, whose managers are less experienced. These companies can make great investments when they come off. They’re the stocks that deliver strongly growing profits that drive punchy increases in price-earnings multiples that boost returns exponentially. But they are also the ones that can go pop in an almighty way – particularly when skies darken and business conditions deteriorate. Again, portfolio balance is key.

The good news is that after such a tough year, UK mid-caps started 2023 at bargain basement prices. And that was after a recovery in the tail end of the year.

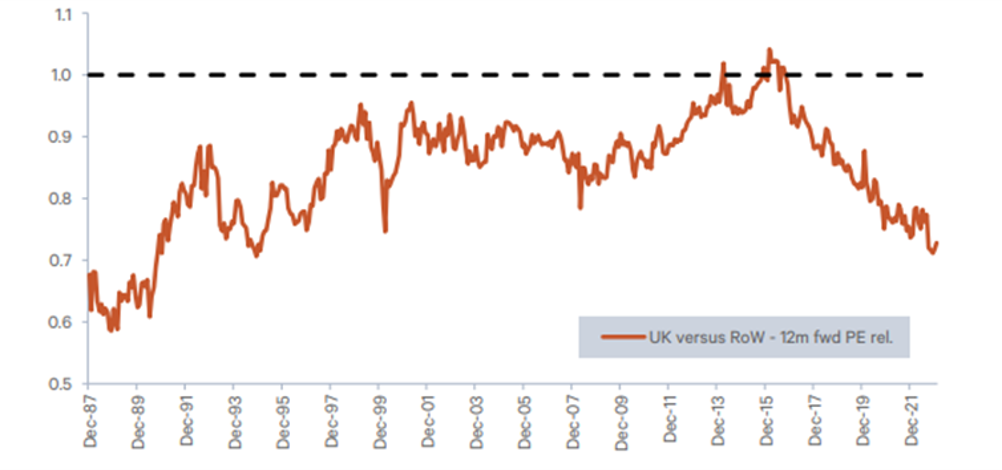

UK stocks haven’t been this cheap since early the 90s

When downgrades to future profit expectations are coming – as should be expected with recession looming – stock valuation becomes crucial. The cheaper the earnings you’re paying for, the more resilient the share price should be to short-term setbacks. The UK stock market scores well here, sitting at multi-decade lows against the rest of the world. The UK is often cheap, particularly against the US, but it’s rarely this cheap. And when investors’ expectations for earnings are pretty dark, this means there’s more chance of an upside surprise – of things turning out better than everyone hoped.

This is the cushion, the safety, that should support UK equities this year.