The all-share combination of Investec Wealth & Investment (UK) and Rathbones Group Plc formally completed on the 21 September 2023, creating the UK's largest discretionary wealth manager. A copy of the letter sent to clients announcing the completion can be found at the link below.

Now that the combination has completed, we wanted to give you more detail on what the integration of Rathbones and Investec Wealth & Investment (UK) will mean for you and your clients. The intention is that we will use this page to update you on progress as our integration develops and host content relevant for you and your role of looking after your clients’ best interests.

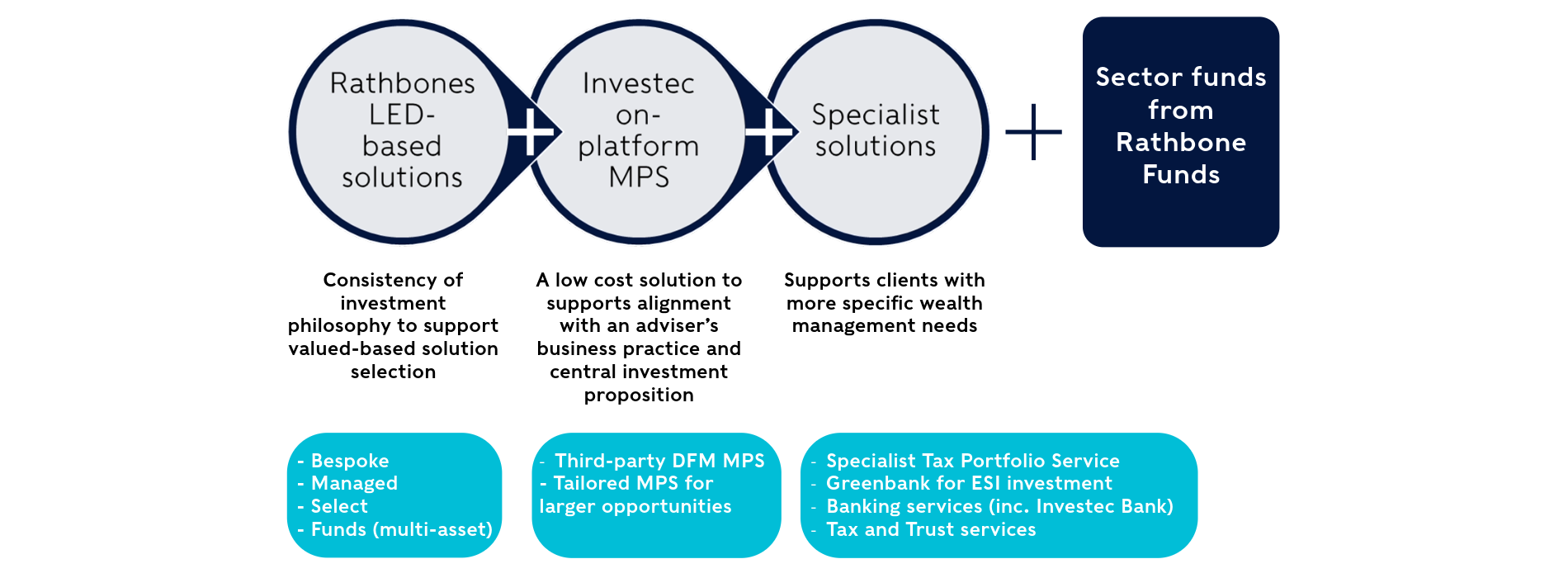

Our new, combined investment proposition will largely take its lead from Rathbones’ existing services and investment approach, whilst being enhanced by the additional award-winning services and resources that Investec Wealth & Investment (UK) offers financial advisers and their clients.

Whether you and your clients have historically been serviced by Rathbones, Investec Wealth & Investment (UK), or both, the enhancements to our combined investment proposition will be felt across all areas of our business, including:

- A deeper and richer investment process that benefits from the consistency and control of the Rathbones LED risk management framework.

- An expanded range of market-leading services for clients of financial advisers, including an on-platform MPS.

- Improved technology and systems for our investment management teams, to support optimum client outcomes.

- Enhanced systems, processes and resources for our distribution and administrative teams, to support you and your clients.

- A choice of client suitability operating models when using our discretionary services.

Our proposition for uk financial advisers

Our intention is to build the leading discretionary wealth manager in the UK and offer financial advisers a wide choice of relevant solutions to meet differing client needs and adviser business models

Further adviser support is created by the combination of the two firms

Choice of operating models for our discretionary services – Reliance on Adviser or Adviser as Introducer

Improved lead and account management supporting adviser firm onboarding

Relevant third-party ‘influencer’ relationships and accompanying events programme

Increased resource and improved management of national and network relationships

Increased RFI resources plus more efficient due diligence self-select processes including integration with DD Hub

Increased sales team resource to support closer regional engagement with advisers

Improved marketing content preference management

Future developments:

Retirement decumulation proposition

Digital client onboarding