The devil is in the details

<p>One Budget announcement that seemed to have been almost universally welcomed was the news that the UK is going to start issuing green bonds. The National Savings & Investments (NS&I) scheme will issue green savings bonds targeted at everyday savers. And at least £15 billion of green sovereign bonds (so-called ‘green gilts’) will be issued in 2021—22. The money raised will help fund Prime Minister Boris Johnson’s 10-point public investment plan for a “green industrial revolution”.</p>

Article last updated 30 September 2025.

One Budget announcement that seemed to have been almost universally welcomed was the news that the UK is going to start issuing green bonds. The National Savings & Investments (NS&I) scheme will issue green savings bonds targeted at everyday savers. And at least £15 billion of green sovereign bonds (so-called ‘green gilts’) will be issued in 2021—22. The money raised will help fund Prime Minister Boris Johnson’s 10-point public investment plan for a “green industrial revolution”. This envisages that investing in clean energy, transport, nature and innovative technologies will kickstart the UK’s journey towards net zero greenhouse gas emissions by 2050.

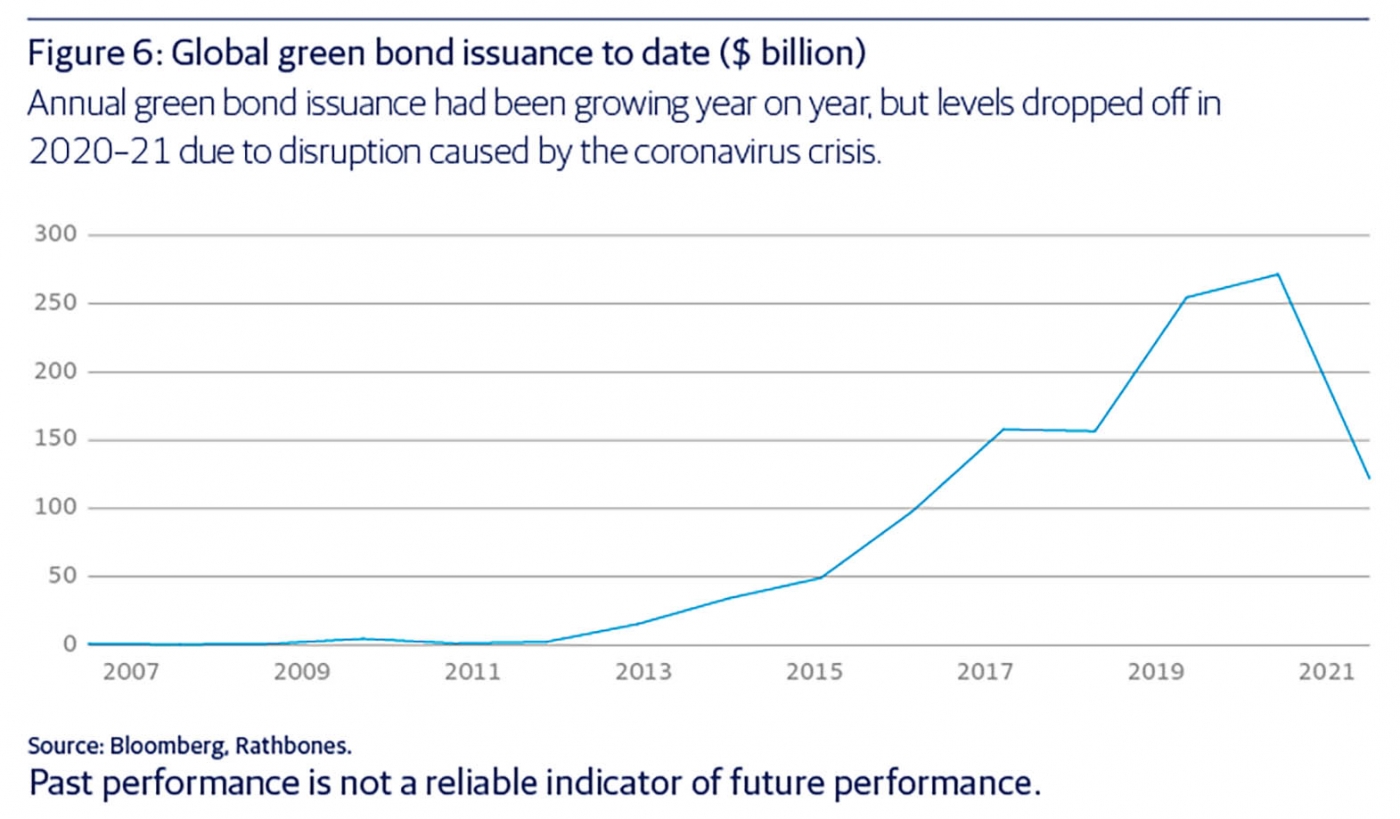

With other countries already issuing green sovereign bonds (figure 6), it seems the UK government has finally woken up to the idea that these investments could help it meet its climate change goals and objectives. The timing is opportune. The announcement should boost the government’s green credentials ahead of the next UN climate change summit (COP26) in Glasgow in November.

"With other countries already issuing green sovereign bonds, it seems the UK government has finally woken up to the idea that these investments could help it meet its climate change goals and objectives."There’s a lot still to be decided

We’ve been lobbying for green gilts for years so we’re delighted they’re on the way at last. But we eagerly await more details. The rules governing the green gilts (and also the savings products) haven’t been finalised. We don’t yet know how the money raised can be spent or how the government plans to report on that spending and its environmental impact. This framework matters. If the government’s definition of ‘green’ is cast too wide or if it isn’t transparent enough about the lasting benefits of the money raised, this could end up undermining investor confidence in the initiative. And, in turn, this could dilute its environmental impact.

How popular will the new investments prove? There’s already been some scepticism about the rate of return on offer from the NS&I green savings bond (the NS&I pays as little as 0.01% interest on some of its accounts at the moment). So the yields provided by the green gilts may prove modest compared with traditional gilts of a similar maturity.

But the rates of return may not be a deal-breaker. The Prime Minister is explicitly linking his 10-point investment plan with a “green recovery” from the economic damage inflicted by the pandemic. People may like the idea that the new green investments offer opportunities to invest in the country’s future in a green way. (This evokes memories of the sense of civic duty that encouraged people to invest in war savings during World War I and World War II.)

ESG approaches gaining traction

Big bond investors (like ourselves) are seeing huge interest in investment approaches that help meet ESG goals. This impulse has gained such traction that the Bank of England itself recently came under fire to sell out of its bonds issued by oil and gas companies that it holds as part of its quantitative easing (QE) programme. MPs recently wrote to governor Andrew Bailey, claiming that the central bank risks ‘creating a moral hazard by purchasing high-carbon bonds and providing finance to companies in high-carbon sectors’.

All this suggests that there’s likely to be lots of buying demand for the green gilts when they appear. If this happens, this should encourage more companies and organisations to start issuing green bonds as they recognise the extent of the appetite for such securities. In our view, this should help broaden and deepen our green bond opportunity set. In particular, we hope to see more sterling-denominated green bond issuance as this has been pretty rare so far. Get ready for greener bond markets!

This article has been taken from, 'Q2 2021 Investment Insights', read the full publication here.