Are you concentrating?

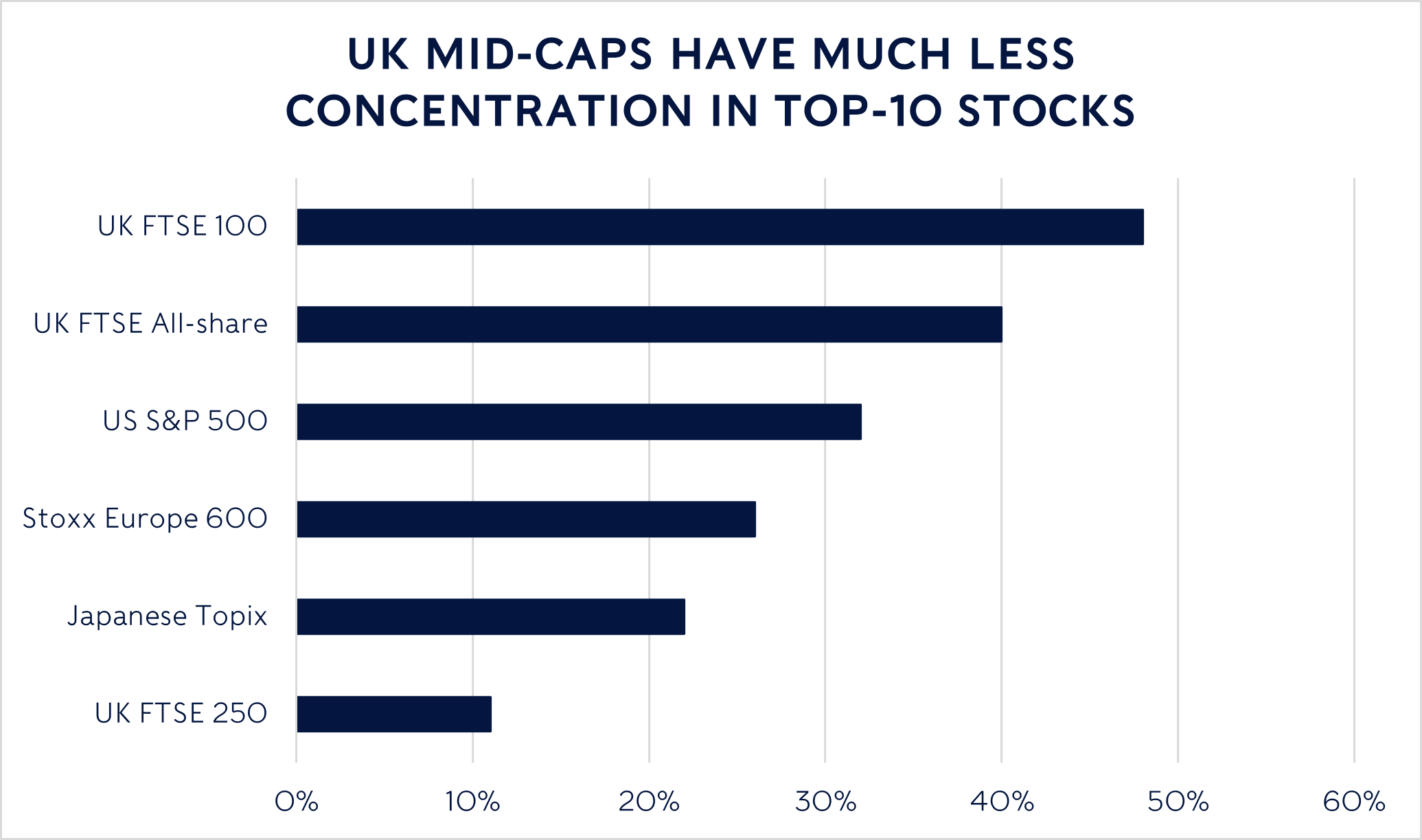

The massive concentration of the American stock market is a hot topic. If investors in US stocks had owned the seven largest companies by market cap in 2023, they’d have more than doubled their money. Without those seven, the S&P 500 large cap index made just 8%. Because of this huge imbalance in returns, the weight of the top 10 most valuable stocks in the S&P is now an eyewatering 32%.

The massive concentration of the American stock market is a hot topic. If investors in US stocks had owned the seven largest companies by market cap in 2023, they’d have more than doubled their money. Without those seven, the S&P 500 large cap index made just 8%. Because of this huge imbalance in returns, the weight of the top 10 most valuable stocks in the S&P is now an eyewatering 32%.

Yet this isn’t just an American phenomenon. In fact, the top 10 stocks’ weighting in the FTSE All-Share is even higher, at 40%. And the UK index has roughly 70 more companies than its US counterpart. The FTSE 100 is even more concentrated, with a whopping 48% of its market cap accounted for by the 10 largest companies. Strange to say, but the UK is more top-heavy. It’s no wonder that many large-cap UK funds’ top-10 holdings look so similar.

Source: FTSE, Bloomberg, S&P Dow Jones, Rathbones; data as of 29 February 2024

Looking under the rocks

These top-heavy indices make it hard for active managers to be ‘at weight’. Doing so would mean jettisoning reasonable diversification and taking on huge risks that wouldn’t benefit investors. In some cases, it would nudge close to, or even exceed, regulatory limits on position sizes.

High concentration also means that performance (for good and bad) is driven by an ever-smaller group of stocks – in the UK, for example, the top end of the market is dominated by a few, very mature, often ex-‘growth’ names (albeit ones paying big dividends). Lots of oil, mining, banking, tobacco and consumer staples – but no technology. This seems to crowd out dynamism as well – in the UK, at least – with few changes to the top-10s from year to year.

In our view, a healthy market requires a greater breadth of names driving returns. This should also make an index less susceptible to a few huge companies dictating the overall direction and momentum of the index.

One index with a top-10 that’s far from dominant is the FTSE 250. The 10 largest businesses account for just 11% of the UK mid cap equity index so it’s well-diversified. I believe this makes it easier to spot quality companies flying under the radar. Many of these businesses are little known, with strong opportunities for growth both at home and abroad. And they seem cheap relative to their counterparts in other markets and when compared with the past.

Sausage-maker Cranswick, for example, is one of the best allocators of capital I know. In recent years, it’s invested in its facilities, pivoted into chicken, purchased an olive business, and now makes pet food as it sniffs out the most profitable opportunities it has the expertise to exploit. Truly nose to tail, Cranswick generates a steady mid-teens return on capital, and it’s cheaper than US-listed behemoth Tyson Foods.

Or take fund administrator JTC, which is in something of a sweet spot just now thanks to growth in its end markets. Private equity firm Cinven took a majority stake in JTC’s Luxembourg-based peer Alter Domus last month at what I believe is a very supportive valuation, underlining the attractiveness of the industry.

With all eyes focused on the US and on the very largest companies, I think great opportunities are on offer right now in smaller and mid-cap businesses, especially here in the UK.