Guess who’s back?

Former President Donald Trump is the odds-on favourite to win the US election in November, despite the Democrats’ decision to bring on a last-minute substitute. Flashbacks to the bad old days of the pandemic help Multi-Asset Fund Manager David Coombs remember the playbook of dealing with him.

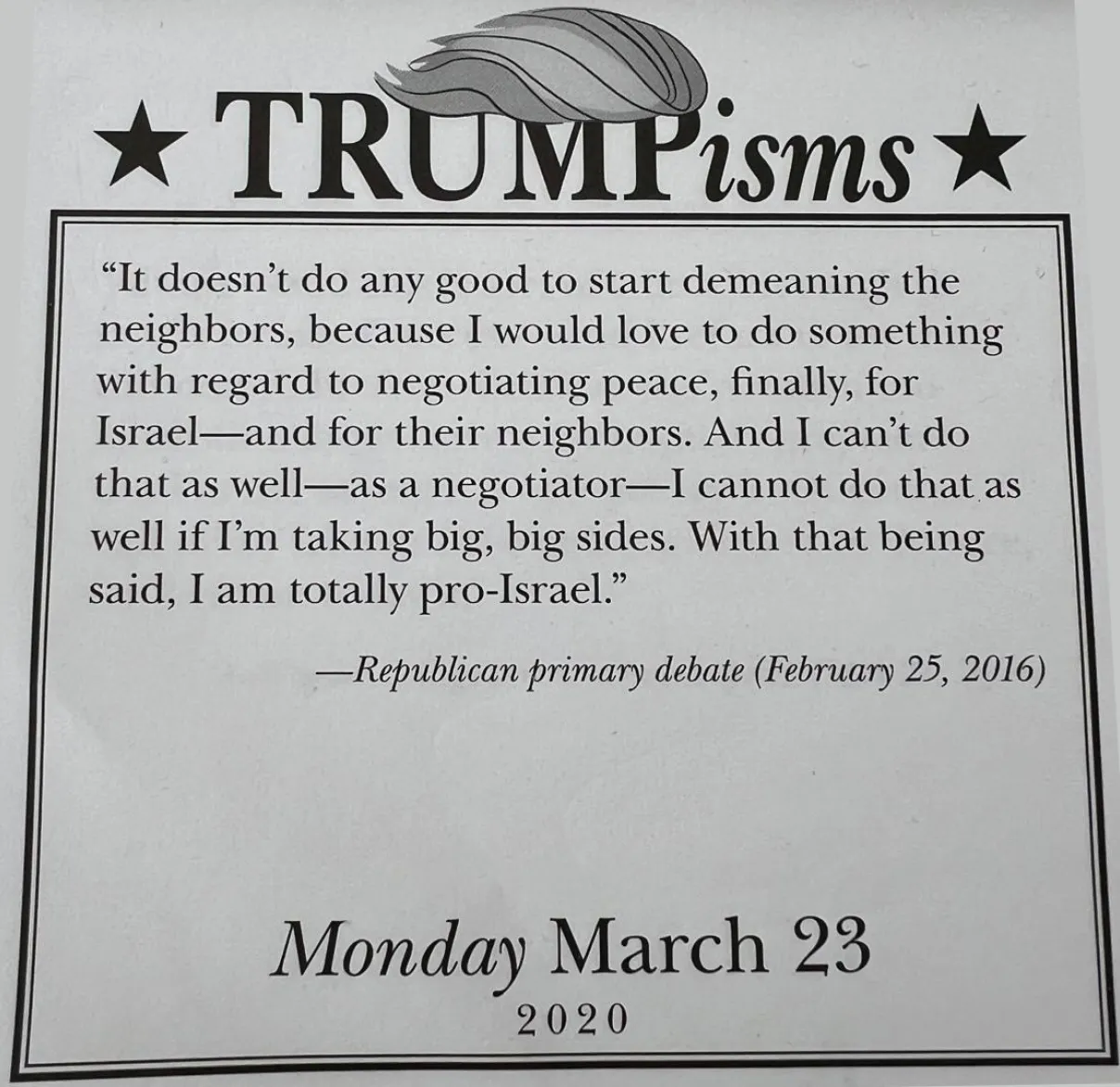

I have a Donald Trump desktop calendar with a daily ‘Trumpism’, which you can tear off each morning. This was a Christmas 2019 jokey stocking filler. The day in front of me is Monday 23 March - 2020. It was the last day I was in the office before the first COVID lockdown when Boris told us to go home.

When I finally returned to the office, I saw the calendar on my desk. It felt slightly dystopian and it somehow seemed fitting to leave it on that day for ever as a reminder of how unpredictable the world is.

The quote for that day was taken from a Trump speech at a Republican primary debate on 25 February 2016. When referring to negotiating peace in the Middle East, he said “It doesn’t do any good to start demeaning the neighbours, because I would love to do something with regard to negotiating peace, finally, for Israel – and for their neighbours. I cannot do that [be a negotiator] as well if I’m taking big, big sides. With that being said, I am totally pro-Israel.”

During his first term I used to dread his Sunday night tweets. Some random ill-thought-through rhetoric that would cause chaos in the markets for the start of the week. While I believe in free speech, I think his banning from Twitter was good for my stress levels.

Biden policies protectionist like Trump, yet with less absurdity

When Joe Biden won the last election (and I make no political point here), I was hoping for fewer chaotic headlines and a more considered approach to policy announcements. Crikey, we got that, but also a touch of the absurd in a President’s aids keeping him from view like a parody of Weekend at Bernie’s. Speaking purely selfishly, that was ok with me.

As I’ve mentioned before, most Biden economic policies had a similar impact to Trump’s, protectionist in nature and fiscally loose. So, four years of relative quiet, but now he’s back, it’s back – the Trump factor risk.

Not supporting Taiwan and telling the US Federal Reserve not to cut interest rates before the election. Here we go again. Taiwan Semiconductor Manufacturing Company (which we own) down 8% in one day, massive rotation out of the tech-heavy Nasdaq index and into the more diversified Dow Jones. Like him or not, Trump moves markets and creates volatility.

What investments would benefit from a reprise of MAGA?

What does this mean for our investment strategy? We’ve been analysing this since the start of the year and reviewing our playbook from 2016. ‘MAGA’ means you must favour US stocks over the rest of the world to hedge the Trump factor risk. Last time, tax cuts were good for American corporate profits. We think there’s little scope for the same this time given the impact that might have on Treasury yields from lost government revenue. Obviously, the environment is also very different to 2016 when we still had zero percent interest rate policy.

This time construction could benefit as reshoring of factories intensifies, as will domestically manufactured goods if tariffs are applied unilaterally on all imports. Financials would benefit if regulations are eased further. Reductions in regulations also help smaller companies compete and disrupt large incumbents across many sectors. Remember, stiffer regulations always benefit the largest and act as barriers to entry, stifling competition.

It will be interesting to see if Trump tries to be more fiscally responsible in an effort to reduce Treasury yields. Normally you might expect this from a Republican President, following a Democrat. But Trump is no normal Republican. Nevertheless, it’s likely that targets for net-zero will be reduced or eliminated altogether, which would mean lower or no subsidies and fewer sustainability regulations. There could be many losers from this in the sustainable space. On the other hand, of course, this will be a reduction in costs for other businesses.

Act on what Trump does, not what he says

Our job is to deal with the financial impacts of a change in policies, not the philosophical or political impacts. As I mentioned above, we’ve anticipated (although not necessarily predicted) a Trump win for some time, so we’ve made subtle changes to our portfolios, such as buying a European defence company, Thales, to account for that eventuality.

If Trump does return to the White House, the key will be to react to what Trump does, not what he says. And what he says can often be word salad that is too dangerous to attempt deciphering (take the Trumpism above as an example!). The volatility he creates via his news conferences and social media proclivities, often creates short-term mispricing of risk which we can take advantage of. It’s a circus, of course, which I have a sneaking suspicion he enjoys. However, most of the policies in his first term had a logic to them that we could follow. The COVID bleach incident was a notable exception.

Last month I was on a small boat off Taormina in June with a chap called Tony from Detroit (big in real estate) who was visiting Sicily with his nephew Bruno to see the ‘old country’. I asked him if his family entered the US via Ellis Island in New York. He looked at me for a moment and said, “no, we entered in unconventional ways.” Anyway, he said Trump was misunderstood and a lovely charitable man and cited a number of examples of Trump’s generosity. I thought about this, looked at Bruno, and said that I’m sure he was right and that we had nothing to worry about.

It’s worth pointing out that Trump (the philanthropist) hasn’t won yet and, at the time of writing, we cannot even be sure who he will be running against, although Vice President Kamala Harris is the bookies’ favourite as the Democrats look to throw a ‘Hail Mary’... It’s going to be quite a ride until the election, so I expect we will be very active in the coming days and weeks. Expect our asset turnover rates to pick up. The correlation between our rising turnover and Trump’s press calls is most definitely going to close in on one!

Tune in to The Sharpe End - a multi-asset investing podcast from Rathbones. You can listen here or whenever you get your podcasts. New episodes monthly.