HIGHER FOR LONGER: IMPLICATIONS FOR INVESTORS

.hero-banner__author-name {display: none !important; }<p>The inflationary shocks caused by the pandemic and war in Ukraine are finally unwinding. But that doesn’t mean we’re returning to an environment just like the one before they hit. The world has changed profoundly since the late 2010s, as have the investment opportunities available along with it.</p>

Article last updated 22 July 2025.

The inflationary shocks caused by the pandemic and war in Ukraine are finally unwinding. But that doesn’t mean we’re returning to an environment just like the one before they hit. The world has changed profoundly since the late 2010s, as have the investment opportunities available along with it. The strategies that serve investors well today will look different to those that worked best in the unusually low-rate, low-volatility environment of the last decade.

Inflationary shocks unwinding

The chaos in global supply chains following the coronavirus pandemic has now largely abated. Last year’s lengthy delays at shipping hubs have disappeared, bottlenecks of critical components have dissipated, and firms have had time to rebuild their inventories. The outcome has been falling goods inflation, with further declines likely. Manufacturers around the world report that growth in their selling prices has slowed sharply.

Although the war in Ukraine continues, its global impact is now less pronounced. The prices of key commodities, like natural gas and wheat, jolted higher after the invasion. But they’ve since dropped to even lower levels than just before Russia attacked (figure 1). The world has adapted to the conflict in remarkable ways, reconfiguring trade routes or learning to live without Russian supply.

This is already feeding through to lower inflation, helping to bring it down from more than 11% last year to under 7% in the UK. There’s probably a lot more disinflation to come as the fading of this shock continues to filter through to consumer prices. UK food producers now report that the prior surge in their input prices is over.

We’re starting to see the first signs of that on supermarket shelves, and inflation there is likely to slow much further in the next few months. In the meantime, the statutory price cap on energy bills, which rocketed in 2022, is now declining. This alone should help to pull inflation down markedly later this year. Price pressures in the UK have not been tamed yet, but the outlook has improved considerably.

Figure 1: Wheat prices (US cents per bushel)

After spiking during the first few months of the Ukraine War, wheat prices have fallen back to below the costs before Russia’ invasion. Source: Refinitiv, Rathbones.

A new-look economic environment

However, while inflation may be abating — in the Eurozone it is already back below 3% — other changes induced by the pandemic and war will be with us for much longer. Both the challenges policymakers face and the tools they’re willing to deploy appear to have changed since the 2010s, suggesting that the economic backdrop in the coming decade will also look quite different.

Geopolitical rivalries have intensified, while awareness of the dangers that human interaction with the natural world can cause has increased. Governments are placing more emphasis on building resilience in supply chains, rather than maintaining efficiency (and minimising cost) as previously. And they’re increasingly willing to use long-neglected industrial policy to support this goal. Both the US and EU have passed major acts supporting domestic chip production and the green transition.

Through their experience in the pandemic, Western governments have also rediscovered their lost appetite for activist fiscal policy, in contrast to the budgetary consolidation of the 2010s. Consumers’ balance sheets have been strengthened by the huge fiscal interventions of the pandemic too. That’s another contrast to the years immediately after the global financial crisis, when households were trying to repair their damaged finances. In the round, the economic conditions which underpinned the demand-deficient regime of the last decade — when the monetary policy tools of central banks were compelled to do much of the heavy lifting — have fundamentally altered.

The new old normal

The full implications of these changes will take years to become clear. But we are confident about a couple of points:

1. Interest rates will stay higher on average than their rock-bottom rates in the 2010s, even as the recent burst of inflation continues to fade. The conditions that kept monetary policy ultra-loose for a decade have changed. Rates should fall from current levels at some stage, but not get mired near zero again.

2. Volatility – in inflation, interest rates and economic performance generally – will be greater than it was during the 2010s. That reflects a combination of things, including the new policy environment plus the risk of greater geopolitical and climate-related shocks.

In some ways, these changes shouldn’t be at all surprising. The 2010s were unusual, with the lowest interest rates in centuries of recorded history (from the 1600s in the UK), and the second- lowest volatility in inflation (going back to the 1200s). Indeed, the ‘new normal’ after the pandemic and war in Ukraine might look more like the ‘old normal’ which preceded the financial crisis, with historians instead remembering the 2010s as the anomaly.

So, what could this mean for your clients' investment portfolios?

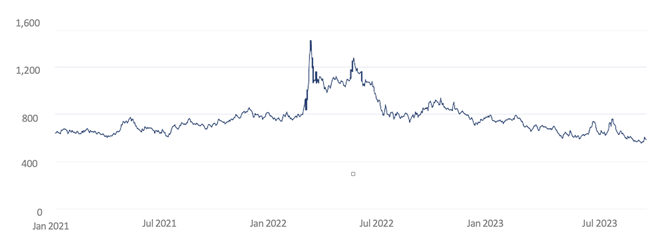

From an investor’s perspective, this regime change creates a need to adapt, but also presents opportunities. This is particularly evident in fixed income investments, where markets have moved in anticipation of this new environment. Higher rates mean higher yields available from fixed income assets with little or no risk of default (since those yields tend to be highly sensitive to expectations for interest rates). For example, UK government bonds (gilts) with a maturity of two years offered a yield well below 0.5% just two years ago, and 0.6% on average through the 2010s. Today, the yield is about 4.7%, having recently reached as high as 5.5% (figure 2). When we work out our long-term projections for returns from various asset classes, fixed income shows up more favourably than just a couple of years ago. It’s likely to comprise a larger part of our portfolios over the next few years, given the more attractive entry point.

Figure 2: UK 2-year gilt yields (%)

Government bond yields soared higher over the past year as interest rates have risen. Source: Refinitiv, Rathbones.

Higher volatility arguably also creates opportunities for careful active management in fixed income over the ups and downs of the economic cycle. From that point of view, gilts have recently become more attractive than they have been for a long time.

The Bank of England appears to be at the end of its cycle of raising rates. While a return to near-zero isn’t on the cards, we think it will cut rates in 2024. The previous surge in rates is starting to affect the economy, with inflation falling and the latest business surveys pointing to activity contracting. Although wages have been growing strongly recently, the broader evidence of loosening in the labour market suggests that will not last. Meanwhile, house prices are already falling, and consumers tend to turn cautious when that happens. In the past, interest rates have nearly always fallen in the year after house prices began to decline. This all adds to the tactical appeal of gilts, which in past cycles have performed strongly ahead of the start of rate cuts.