If inheritance tax (IHT) becomes payable on part of the business value, where does the cash come from without disrupting my business or succession plan?

Secondary effect: for some owners, the new “known” IHT exposure above the allowance may also change the timing and shape of exit conversations (for example, a stronger preference for liquidity and certainty), even though the reform itself is an IHT relief change.

What's changing?

A £2.5m 100% relief allowance

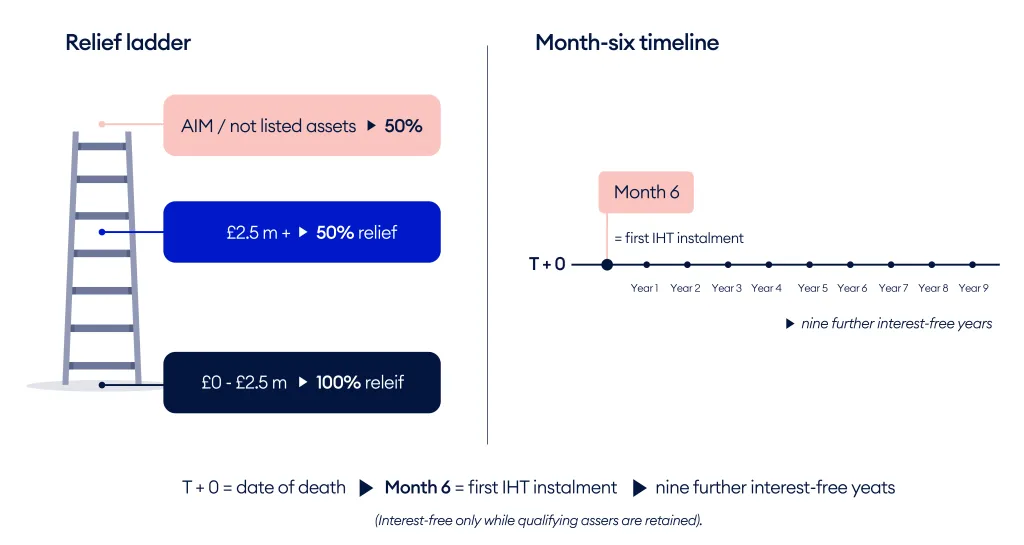

100% BPR/APR will no longer be unlimited. The first £2.5m of qualifying assets can receive 100% relief across BPR and APR combined. Any qualifying value above £2.5m will generally receive 50% relief, resulting in an effective 20% IHT charge on the excess.

The usual BPR/APR qualifying rules still apply. For example, for BPR the business must be mainly trading, you typically need to have owned the qualifying shares for at least two years and there must be no binding contract for sale in place.

Couples: unused allowance can be transferred

Any unused part of the £2.5m allowance can transfer to a surviving spouse/civil partner. So, a couple may be able to protect up to £5m of qualifying value at 100% relief (before other allowances such as the nil‑rate band). If the first death was before 6 April 2026, it’s assumed the full £2.5m allowance is available to transfer to the survivor (so widow(er)s can still potentially shelter up to £5m at 100% relief).

AIM / “not listed” shares: 50% relief

Certain quoted but “not‑listed” shares (including AIM) are set to qualify for 50% relief rather than 100%. If you hold AIM mainly for IHT reasons, it’s worth reviewing the strategy in the round (risk, liquidity and suitability - not just tax).

Instalments remain - but month six still matters

IHT attributable to qualifying business/agricultural assets (from either 100% or 50% relief) can generally be paid in up to 10 annual instalments. That can ease cashflow, but the first payment deadline is still around six months after death, and interest‑free treatment typically depends on assets retaining qualifying status.

Index‑linking later: assume a fixed cap until April 2031

The £2.5m allowance is planned to remain fixed until 5 April 2031, with CPI index-linking proposed from 6 April 2031 (subject to future confirmation).

![A graphic explaining how different assets qualify for different levels of IHT relief (using a ladder metaphor) and shows that IHT payments begin six months after death and can continue interest‑free for nine more years.]()

Why this matters

A business can be valuable but illiquid. Even if the business continues successfully after the death of an owner, the estate may still need to find cash to meet payment deadlines. So, under the new cap, a “partial” IHT bill can arise even where the business qualifies for relief - so the priority is often funding and paperwork, not changing the business itself.

What this means for business owners

1) Above £2.5m (or £5m for a couple), BPR becomes a budgeting and liquidity providing exercise

If your qualifying business interests exceed the allowance, you may have an IHT bill to plan for (even though it can be paid in instalments).

2) Liquidity planning is now central

An unfunded IHT liability (even when payable in instalments) can force dividends, borrowing, asset sales or an unplanned change in ownership. A liquidity plan reduces these risks.

3) Gifts and trusts need a quick sense-check

If you’ve transferred business interests since 30 October 2024 (including into trust), or you’re considering lifetime gifting, review how the £2.5m allowance may apply and what records trustees/executors will need.

Who should pay attention

This information is based on our current understanding of HMRC tax rules in the UK.

Do this now: a 30 minute checklist

These five items are usually enough to size the issue:

- A realistic valuation range (even if broad)

- A one-page ownership map: who owns what; what happens on first death; any buy‑sell/cross‑options.

-

Any gifts/transfers since 30 October 2024 involving business interests or trusts (relevant for forestalling/allowance calculations)

-

A “month‑six liquidity snapshot”: cash available within six months (personal cash, business reserves, borrowing capacity, insurance).

-

Any AIM / “not‑listed” holdings used for IHT planning and their current value.

Practical ways owners are responding

1) Build a one-page "BPR budget"

Split value into likely 100% relief (within £2.5m), likely 50% relief (above £2.5m and AIM/not‑listed), and likely non‑qualifying (e.g. surplus cash/investments not needed for the trade).

2) Give thought to lifetime giving of business interest

Subject to non-tax considerations, it's worth thinking about the lifetime giving of business interests that will not fully qualify for BPR.

3) Put a “month‑six” liquidity plan in place

Common levers: personal liquidity, company reserves/borrowing capacity, and insurance planning (often written in trust) to create cash at the right time and reduce pressure on the business.

4) Review wills and shareholder documents together

Ensure wills, shareholder agreements and any buy‑sell/cross‑options are consistent, so the tax outcome and business continuity outcome don’t pull in different directions.

5) If the company holds significant non‑trading value, tidy the evidence

Where cash/investments are genuinely needed (working capital, planned capex, acquisitions, risk reserves), keep a clear written rationale…where it isn’t, then be conscious of the potential for partial reduction of the amount of the business value that qualifies for BPR.

6) If you’re planning a sale, plan the “after” position early

Model the post‑sale balance sheet, IHT exposure, and what you want wealth to achieve (income, flexibility, family support, gifting, governance).

Rathbones does not offer tax advice. We recommend you speak to a tax adviser if you are unsure.

Worked example

Sarah (58) owns a trading company valued at £40,000,000 and expects it to qualify for BPR.

Assumptions (illustrative): reforms apply from 6 April 2026; IHT rate 40%; no other allowances available.

-

100% relief allowance: £2,500,000 → £0 chargeable

-

Excess qualifying value: £37,500,000 at 50% relief → £18,750,000 chargeable

-

Estimated IHT: £18,750,000 × 40% = £7,500,000

Planning takeaway: the succession plan may not need to change - but a clear funding plan for (say) £7.5m (often via instalments and/or insurance planning) becomes essential, and the first payment deadline around six months after death matters.

Tax treatment depends on your individual circumstances which could change.

Now to March 2026

Valuation range; one‑page BPR budget; month‑six liquidity snapshot; check wills/shareholder agreements; identify any relevant gifts since 30 October 2024.Where this fits with your broad aspirations for the ownership of your business consider lifetime gifts. Carefully consider how appropriate life insurance in trust could tax efficiently deliver the cash needed to meet any liability.

By 6 April 2026

Implement agreed document/ownership changes and make sure family/executors have a “month‑six” plan.

Ongoing

Keep valuations/records current; review any AIM/not‑listed exposure; revisit the IHT exposure and plan for it after major business events- especially sale.