What’s happening

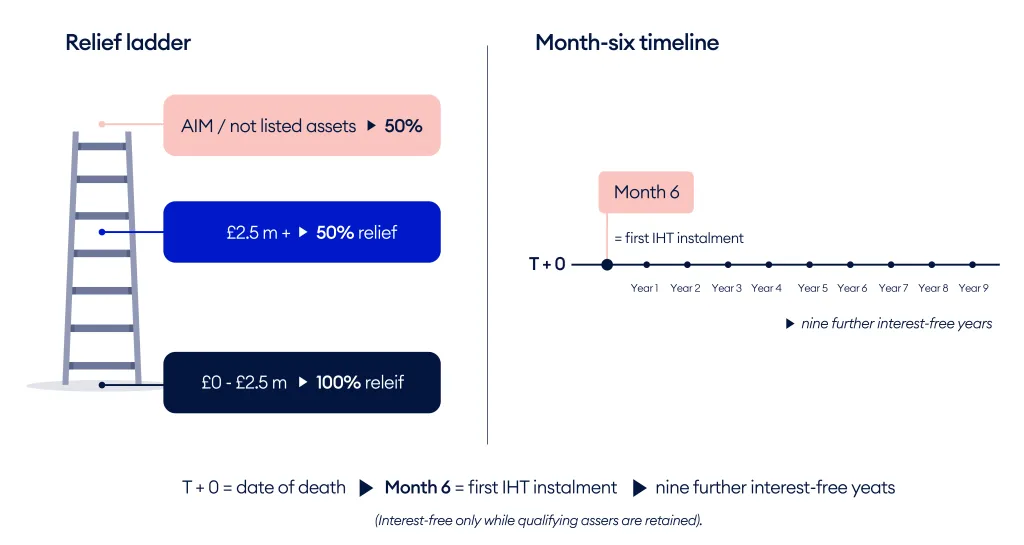

Business property relief (BPR) and agricultural property relief (APR) are being reshaped from 6 April 2026 by a new combined £2.5m 100% relief allowance.

- One combined allowance: each individual has a single £2.5 million allowance (for property qualifying for 100% APR/BPR) across APR and BPR combined. Any unused amount can be transferred to a surviving spouse or civil partner.

- Above the allowance: qualifying value above £2.5m attracts 50% relief with no upper limit, an effective 20% IHT rate on that slice, assuming 40% IHT.

- Unquoted trading shares: continue to attract 100% relief within the £2.5m allowance (subject to usual qualifying conditions, including the two-year ownership test in many cases).

- AIM / “traded but not listed” shares: from April 2026 these qualify for 50% relief. Because they do not qualify for 100% relief, they do not use up the £2.5m 100% allowance – but they can still leave an IHT funding requirement.

- Spouse or civil partner transfer: any unused part of the £2.5m 100% allowance on death is transferable to a surviving spouse or civil partner (subject to the usual IHT spouse or civil partner conditions), allowing couples to shelter up to £5m at 100% relief. If the first death was before 6 April 2026, it’s assumed the full £2.5m allowance is available to transfer to the survivor.

- Where a client’s qualifying (non-AIM) business/agricultural property is within £2.5m per estate, the cap may not change the tax outcome – but the planning pressure increases sharply above that level.

Trusts

A £2.5m allowance will also apply to the combined value of relievable agricultural and business property in trusts, with detailed rules on how it applies across trusts and settlements (including transitional rules).

Pensions

Neither BPR nor APR (at any level) is available for otherwise qualifying investments held inside pension funds.

Index linking: the £2.5m limit is planned to remain fixed until 5 April 2031, with CPI index-linking proposed from 6 April 2031 (subject to confirmation).

Instalments

IHT on qualifying assets can still be paid in ten annual instalments; the first falls due by month six after death. Interest free treatment continues only while the asset retains qualifying status. It has been clarified that the instalment facility applies regardless of whether the asset qualifies for 100% relief (up to £2.5m cap) or 50% relief on all value.

![A graphic explaining how different assets qualify for different levels of IHT relief (using a ladder metaphor) and shows that IHT payments begin six months after death and can continue interest‑free for nine more years.]()

Who it affects – and why it matters

1) Owners and investors with >£2.5m of qualifying business and/or agricultural property

Part of the value that previously expected 100% relief may now sit at 50% relief (effective 20% IHT on that slice). Valuation principles, including control discounts, are unchanged - but funding becomes the new pressure point.

2) Couples with unequal ownership or out-of-date wills or succession paperwork

Transferability helps, but misalignment can still lead to under-use of the combined £5m 100% relief and create avoidable liquidity issues on the second death.

3) AIM / “not listed” strategies used for IHT planning

From April 2026 these holdings move to 50% relief. That can be fine, but it makes suitability, volatility and liquidity even more central, because a tax-driven strategy can still leave a real cash bill.

4) Trustees and executors

Where 100% relief is capped, trustees must factor the cap into exit-charge calculations and executors must plan for a month-six payment, or instalments, where 50% relief leaves tax to fund.

How we can help – practical planning actions

Allowance mapping (one page, joined up)

A simple grid across client/spouse/civil partner trusts showing: £2.5m @ 100% used, value at 50% relief, including AIM/not listed, and the resulting tax and liquidity requirement.

Ownership and documents alignment (so the plan works in real life)

Where appropriate, rebalance qualifying holdings so each spouse is positioned to use or transfer a full allowance, regardless of order of death. Refresh wills/letters of wishes and align shareholder/cross-option documents where business continuity matters.

AIM / “not listed” audit (risk, liquidity and timing – not just tax)

Quantify AIM exposure and the post-April 2026 IHT position. Where suitable, explore alternatives. Managing two-year qualification periods and the practical timing risks around reinvestment.

“Month-six liquidity” by design

Appropriate whole-of-life cover written in trust can create cash for the month-six deadline and/or fund instalments, reducing forced-sale risk. (Any insurance solution must be assessed for suitability and affordability.)

Trust readiness and record-keeping

Ensure trust records correctly track the settlor’s use of the £2.5m allowance, including seven-year tracking where relevant, and monitor qualifying conditions to protect relief and the interest-free instalment facility where qualifying assets are held in trust.

Let's talk

If you have a client where APR/BPR value may exceed £2.5m (or where AIM / “not listed” exposure is part of the plan), we can help with a short, no-obligation triage call to sense-check the position and identify the most useful next step.

Bring one anonymised fact pattern (asset mix, ownership, approximate values, and any trusts) and we’ll come back with a simple action outline: allowance use, month-six liquidity considerations, and where legal/tax documentation might need aligning - with your firm remaining central to the tax/legal advice.

Get in touch

Illustrative case (impact of the cap)

- Alex & Priya (married).

- Estate: £7m qualifying trading shares + £5m other assets, owned equally.

- First death: everything to survivor; survivor retains qualifying shares.

| |

Before April 2026

|

After April 2026

|

| Qualifying shares |

£7,000,000 fully relieved ⇒ £0 IHT |

£5,000,000 at 100% relief (2 × £2.5m) ⇒ £0 IHT; remaining £2,000,000 at 50% relief ⇒ £400,000 IHT |

| Other assets (RNRB not available: estate >£2m) |

(£5,000,000 – £650,000) × 40% = £1,740,000 |

£1,740,000 |

| Total IHT (second death) |

£1,740,000 |

£2,140,000 |

Planning takeaway

The relief still helps, but above the allowance, the important job becomes quantifying the exposed slice and designing month-six/instalments liquidity.

When to act – timelines & deadlines

Now to March 2026

- Map allowances and ownership, and capture any post October gifts of qualifying property.

- Model IHT for deaths after 5 April 2026.

- Identify liquidity gaps and obtain indicative cover terms where relevant.

By 6 April 2026

- Implement agreed ownership and any trust changes.

- Review and make any necessary changes to your will and shareholder/cross option agreements.

- Align trust records with the revised unrelieved value approach where qualifying assets are held in trust.

Beyond 2026

- Keep a clear record of allowance usage (important for index linking from 2031).

- Maintain AIM / “not listed” monitoring at 50% relief and review qualifying status and life cover as values change.

Key takeaways for you and your client

From 6 April 2026, 100% relief is capped at £2.5m per individual across APR/BPR, with 50% relief above that cap — and 50% relief on all AIM / “not listed” holdings.

For your affected clients, the practical priority is to:

- Quantify exposure

- Protect available allowances through ownership and document alignment

- Design “month‑six liquidity” (or instalments funding) so executors aren’t forced into rushed sales or disruptive decisions.

Where clients use (or are considering) BPR‑qualifying investments, suitability, investment risk and liquidity must remain central — and clients should take personal advice before acting.

Start the planning journey