Filters

A new chapter

Last Updated: July 22, 2025

Here’s how our financial planning and investment management teams worked with a client to give her the confidence to retire through a financial plan that balanced financial security with the freedom to enjoy her life.

How to boost your retirement income

Last Updated: July 22, 2025

If you’ve not yet started to draw your State Pension, you may find that buying extra National Insurance years can boost your income.

Investment Insights Q3 2019

Last Updated: July 22, 2025

While the Brexit deadline draws closer, the route to a deal between the UK and the European Union (EU) shows no signs of materialising.

Quarterly Investment Update Q4 2023: Entering the midnight zone

Last Updated: July 22, 2025

The darkest hour for economic indicators is still approaching; then comes the dawn.

Review of the week: France cuts spending, ECB to cut rates?

Last Updated: July 24, 2025

The twin engines of the European economy, Germany and France, are sputtering. With inflation falling and France turning to austerity, will the central bank come to the rescue?

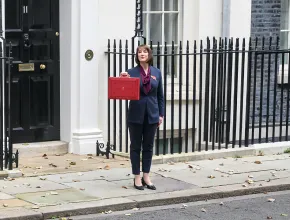

Autumn budget: Labour hits reset

Last Updated: September 15, 2025

Big changes to taxes, spending and the fiscal rules. Rachel Reeves used her long-awaited first Budget to hit reset, with big increases in tax and spending alongside a major change to the fiscal rules. While there are significant implications for individuals’ financial planning as capital gains and inheritance tax change, this article focuses on the potential effects on the UK economy and financial markets.

Review of the Week: Bonds vs Fed

Last Updated: July 22, 2025

Signs of economic weakness in America have bond investors hoping the US central bank will soon let up on its path of higher interest rates. But they might be a little early.

A spring statement on fiscal discipline

Last Updated: July 24, 2025

Chancellor Rachel Reeves today prioritised fiscal discipline, leaving intact the near-term outlook for positive, though weak, growth.

Review of the week: Gloves off?

Last Updated: July 24, 2025

US stocks held up well during a wild week of White House adjustments to its tariff policies. US government bonds and the dollar were less fortunate.

Review of the week: One year on

Last Updated: July 22, 2025

The war in Ukraine has caused misery in Eastern Europe, upended global trade and sharpened world politics. An era of cheap hydrocarbons is now behind us, and further energy shocks could be on the horizon.

Staying invested during volatile markets

Last Updated: July 22, 2025

The S&P 500, an index comprised of the 500 largest companies in the US, is down -20% from its value at the start of the year. Even UK government bonds, considered to be one of the safest and least volatile asset classes, are down by double digits. Bond prices move inversely to interest rates, and so this year’s rising interest rates have adversely impacted prices, ending what had previously been a 10-year bond market rally supported by a steady decline in interest rates.

It's good to talk

Last Updated: July 22, 2025

If approached in the right way, family get-togethers can present a great opportunity to discuss your financial plans.