Filters

A Gordian knot

Last Updated: September 30, 2025

Markets took a dive in December, but we think panicked investors may have got ahead of themselves. Chief investment officer Julian Chillingworth explains why things are relatively ok for global growth, but perhaps not so much for the UK

Great timing

Last Updated: September 30, 2025

US nonfarm payrolls smashed expectations once again, posting 304,000 new jobs in January instead of the 165,000 forecast. Last month’s number was revised down from exceptionally high to very high. The ISM manufacturing survey rose to 56.6, higher than expected, showing that US producers are busy and confident. Consumer sentiment was soggier, however, dropping to the weakest level of Donald Trump’s presidency. It was likely dragged down by the record 35-day government shutdown, yet it held up significantly better than economists had expected.

Year in Review Masterclass | December 2018

Last Updated: September 30, 2025

sc = 'ms4ffab0ec027af'; containerID = 'player'; videoID = '105776'; playerHeight = 481; playerWidth = 677;

The next recession

Last Updated: September 30, 2025

It’s that time in the ebb and flow of global commerce that investors cast around for the next big threat to the economy, the unforeseen wave that will upend everything.

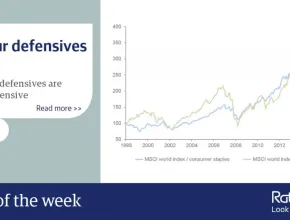

Chart of the week: Are your defensives safe?

Last Updated: September 30, 2025

Traditional defensives have kept pace with economically sensitive sectors through the long and fitful post-crisis recovery. Some ‘defensives’ are decidedly expensive, and investors may need to broaden their search for safe havens.

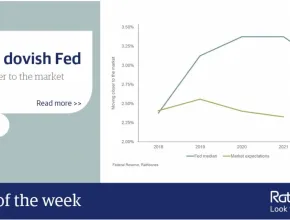

Chart of the week: A more dovish Fed

Last Updated: September 30, 2025

Markets have stabilised after the ‘Santa slump’ experienced into the year end, helped by comments from US Federal Reserve (Fed) officials suggesting they are moving towards more dovish market expectations.

Investment Update Q1 2019

Last Updated: September 30, 2025

From greed to fear – where next?

Is income-only or total return investment best for your charity?

Last Updated: September 30, 2025

When did you last review your investment mandate? Are you taking unappreciated risks in following an income-only approach? Andy Pitt, Head of charities at Rathbones, assesses what to consider when answering these questions.

Green Christmas

Last Updated: September 30, 2025

As far as the environment is concerned, Christmas is the least wonderful time of the year, as the highest heights of consumption are scaled through miles of wrapping paper, mountains of turkey, and rivers of petrol. But fear not! There are ways to keep Scrooge from darkening your door while making your Christmas more environmentally friendly too.

Rathbones Review Winter 2018

Last Updated: September 30, 2025

In this edition of Rathbones Review we take a closer look at India’s ongoing transformation and the radical reforms that are fuelling change.

Diversifying assets are important but don’t necessarily look for a big payoff

Last Updated: September 30, 2025

At Rathbones, we take a multi-asset approach to investing, which provides us with the flexibility to meet individual needs. In order to construct portfolios effectively and manage risk, we divide assets into three building blocks, which play different roles – liquidity (mostly safe-haven government bonds and cash), equity-type (such as shares, corporate bonds and emerging market debt) and diversifiers.

The housing shortfall

Last Updated: September 30, 2025

If housing wealth were used to provide an income in retirement, researchers calculate that the savings gaps, discussed in our previous article, could be halved. But few retirees draw on property wealth today, while home ownership rates are falling.