Filters

Amusing ourselves to death

Last Updated: September 30, 2025

Quite possibly the worst bounty delivered by the 21st century is the 24-hour news cycle.

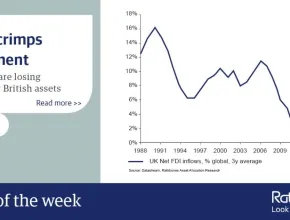

Chart of the week: Brexit crimps investment

Last Updated: September 30, 2025

Foreign companies and governments are simply not investing in British assets as they used to. This is worrying because modern economic growth relies on technological transfer, or learning from others and improving on it. The benefits of this transfer are clear from the productivity data - firms with inward investment from overseas are almost twice as productive as firms without any link to foreign investment. So, a slowdown in this area means a slowdown in productivity; a big worry.

Investment conference 2019

Last Updated: September 30, 2025

Britain’s future in the world Andrew Marr opened the evening with an insightful summary of Britain’s current political position in Europe, where we may go next, and why.

Inflation anyone?

Last Updated: September 30, 2025

US corporate earnings hit a crescendo this week, yet most people are focused on the Federal Reserve and the fluid trade policies of the American President.

Rathbone Multi-Asset Portfolio Funds: Pound of Flesh

Last Updated: September 30, 2025

Equity and credit markets exacted their pound of flesh from investors in the last quarter of 2018, as concerns over global growth mounted in the face of tariff wars and rising interest rates. Assistant fund manager Will McIntosh-Whyte discusses the outlook for 2019 and the risks that sterling might pose for investors as Brexit unfolds.

Rathbone Multi-Asset Portfolio Funds: A year of Snakes and Ladders

Last Updated: September 30, 2025

Investors have done a lot of clambering up ladders only to slide down more than a few snakes this year. Assistant fund manager Will McIntosh-Whyte discusses how the US Federal Reserve and G-20 leaders have been playing the game recently and how the dice may land in 2019.

Rathbone Multi-Asset Portfolios: A close shave with Occam’s razor

Last Updated: September 30, 2025

The simplest solution tends to be the most likely answer. Following early October’s tumble, many different theories for the equity market fall have been thrown around. Join assistant fund manager Will McIntosh-Whyte as he argues you can follow a logical path back to a hefty jump in US Treasury yields stemming from the Federal Reserve’s declaration that interest rates are “a long way from neutral”, and discusses how the multi-asset portfolios have behaved through the recent market volatility

Rathbone Multi-Asset Portfolios update: An A for effort? Trump at the mid-terms

Last Updated: September 30, 2025

The US President has spent most of the year sending ill-advised tweets from the back of the classroom, but his boisterous optimism and background deregulation has pushed the US market to new highs. His politics may be questionable, but it’s businesses we focus on. Join assistant fund manager Will McIntosh-Whyte as he assesses the economic prospects as the mid-term elections approach, and runs through a report card of what has worked for the funds and what hasn’t.

Rathbone Multi-Asset Portfolios: Bored of Brexit

Last Updated: September 30, 2025

Assistant fund manager Will McIntosh-Whyte discusses how the multi-asset team remain vigilant in positioning the funds in the face of the ongoing saga that is Brexit

Rathbone Multi-Asset Portfolios: Italy - a 'new wind' or a worrying whiff?

Last Updated: September 30, 2025

Will looks at the implications of recent developments in Italian politics, and discusses how the multi-asset funds are positioned.

Multi-Asset update - exploring the China OBORtunity

Last Updated: September 30, 2025

Will looks at China’s One Belt One Road initiative. Is this is Chinese solution to global economic blues? Hear how the multi-asset strategies are allocating to the region.

Are we seeing the start of a technology backlash?

Last Updated: September 30, 2025

If you believe everything you read, Amazon pays no taxes, YouTube advertises terrorism, Facebook hands out our data to the highest bidder and Apple is tracking our every move. Will considers the folly of investing in acronyms and whether this is the start of a technology backlash. Take this opportunity to hear how the strategies are positioned as developments unfold.