Filters

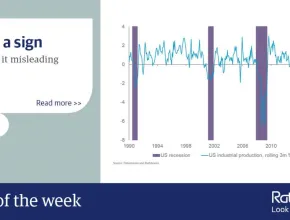

Chart of the week: Give us a sign

Last Updated: September 30, 2025

We have more reasons than at any time over the past decade to be worried about the global economic outlook over the next 12 months. Notably, US industrial production is contracting quarter- on-quarter. But we don’t think it’s time yet to cash in your chips. A mild contraction in many of these indicators is not actually unusual. Quarterly US industrial production growth has been negative five times now since the recovery began in 2009, sometimes for prolonged periods. Taken together, the indicators are not yet signalling more than a typical mid-cycle slowdown.

Rathbones Look forward podcast

Last Updated: September 30, 2025

Download the podcast of the series here. The future of happiness - Richard Layard

Rathbones’ Ed Smith comments ahead of the US Federal Reserve interest rate decision

Last Updated: September 30, 2025

Now that the latest round of China/US trade talks have come to an uninspiring end, attention will shift to this evening’s announcement from the US Federal Reserve and the expected 0.25% rate reduction in the real interest rate. Markets will also be searching for clues as to whether there will be any further rate cuts this year, or whether this is a one off insurance cut.

Rathbone Global Opportunities Fund

Last Updated: September 30, 2025

James will discuss his best (and worst) performers this year, the reason why he is fully invested and his significant exposure to the US, technology and other growth stocks.

Foxes and hedgehogs

Last Updated: September 30, 2025

They strive each day (and most nights) to completely understand their discipline, so why does their labour only make expert forecasters more inaccurate? Rathbones Income Fund manager Carl Stick looks at why specialists fail at the future.

Communication breakdown

Last Updated: September 30, 2025

The US central bank changed tack so fast in 2019 that you could hear the thunderclap. Rathbone Global Opportunities Fund manager James Thomson warns that investors shouldn’t follow suit.

The origins of capitalism: a privilege with a purpose

Last Updated: September 30, 2025

Stewardship director Matt Crossman explains how the idea of a responsible capitalism — where firms exist for the wider benefit of society — is nothing new.

A decade of investing responsibly

Last Updated: September 30, 2025

Our stewardship director Matt Crossman and governance and voting analyst Archie Pearson tell us about putting responsible investing into practice over 10 years under the UN-endorsed Principles for Responsible Investment and where we go from here.

A parable of responsible capitalism

Last Updated: September 30, 2025

It’s the middle of the 18th century and you are standing in a forest in what we now call Germany. There are elm and beech and alder and spruce and a cornucopia of mosses, lichens, shrubs, flowers and ferns.

Responsible capitalism: benefiting society and investment returns

Last Updated: September 30, 2025

Capitalism today is delivering returns for shareholders, but not in a sustainable way if the other stakeholders — employees, customers and the wider world — aren’t sharing in the benefits or, worse, if they’re paying a cost for delivering those returns. Using a parable of Prussian forests, our head of asset allocation research Edward Smith addresses this myopic focus on short-term measures of profit growth in a surprisingly relevant way.

Rathbone Greenbank Review Spring 2019

Last Updated: September 30, 2025

Collins Dictionary’s word of 2018 was ‘single-use’, an unsurprising choice for a year during which public awareness of global plastic waste increased significantly.

Time to buckle up

Last Updated: September 30, 2025

New threats require new defences. Our head of multi-asset investments David Coombs explains how he’s filling the sandbags to protect his funds against a populist storm.