Filters

Review of the week (wk ending 29 March)

Last Updated: September 30, 2025

The UK was the biggest loser in a tough quarter for global equity markets. Despite a wave of bad news for many of the US technology giants, the S&P 500 was the strongest major developed market in local currency terms over the past three months. Worries about rising inflation and faster interest rate hikes were compounded by America’s belligerent trade policy, causing sharp share price falls around the world.

Turning the clocks back on trade

Last Updated: September 30, 2025

Weathering the markets last week wasn’t too dissimilar to weathering the roads: challenging, and not necessarily good for morale. Markets closed down on Friday; the FTSE 100 had fallen -2.3% during the week and the S&P 500 -0.6%. February closed to the downside across major markets.

Too much of a good thing?

Last Updated: September 30, 2025

In the fullness of time, markets are a finely-tuned valuation machine. Risk and reward is weighed in countless transactions allocating capital to the places where it does the most good for society. But in the short-term it looks a bit like a dog’s breakfast.

Stocks up, government shutdown

Last Updated: September 30, 2025

American stocks have matched the longest run of unbroken calm in their history, fittingly at the same time as the US government shuts down due to political impasse.

What’s to come?

Last Updated: September 30, 2025

For those interested in stats, another record is about to be challenged: the longest-running period without a 5% fall for the S&P 500.

What a difference a year makes….

Last Updated: September 30, 2025

Rathbones’ Asset Allocation Strategist, Ed Smith, reflects on one year since the outcome of the Brexit referendum and assesses the impact of the decision to leave the European Union on the UK economy.

What giants?

Last Updated: September 30, 2025

The UK’s quixotic attitude to immigration has claimed another victim, a minister to go with scores of unfairly treated British citizens from the commonwealth. Home Secretary Amber Rudd resigned this morning for misleading the House by saying that her department had no deportation targets. The proof to refute Ms Rudd was summoned in less than a day.

Saving the planet from plastic

Last Updated: September 30, 2025

The environmental damage that plastic waste causes has become a global problem. Steps to address the issue are now being taken worldwide, with a reduction in non-biodegradable plastics a key goal. But how close is science to offering us viable solutions?

UK equities look attractive across various valuation measures

Last Updated: September 30, 2025

UK stocks have underperformed other major developed markets so far in 2018, extending a pattern that has been in place since the June 2016 vote to leave the EU. A longer-term analysis also suggests Brexit isn’t the only thing weighing on UK companies, so why should investors be interested in UK equities now? We think investors are pricing in a fairly negative Brexit scenario, and see UK shares as offering fundamental value and opportunity in differing economic outlooks.

US tariffs could end up biting the hand that feeds the consumer

Last Updated: September 30, 2025

Until recently, protectionism had gone quiet in the press. But Donald Trump has never stopped playing the pugnacious attack dog of the anti-trade movement.

Summer days

Last Updated: September 30, 2025

It’s been a hot and sleepy summer punctuated by a few small scares, notes chief investment officer Julian Chillingworth. With a bit of luck, the trade-related worries should fade away over the rest of the year.

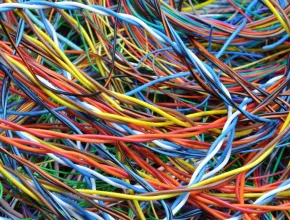

Tariff tangle

Last Updated: September 30, 2025

Trade threats and tech troubles have made investors nervous, but economies around the world remain healthy and relatively vibrant. Our chief investment officer, Julian Chillingworth, says markets are likely to remain rocky, but that should provide opportunities