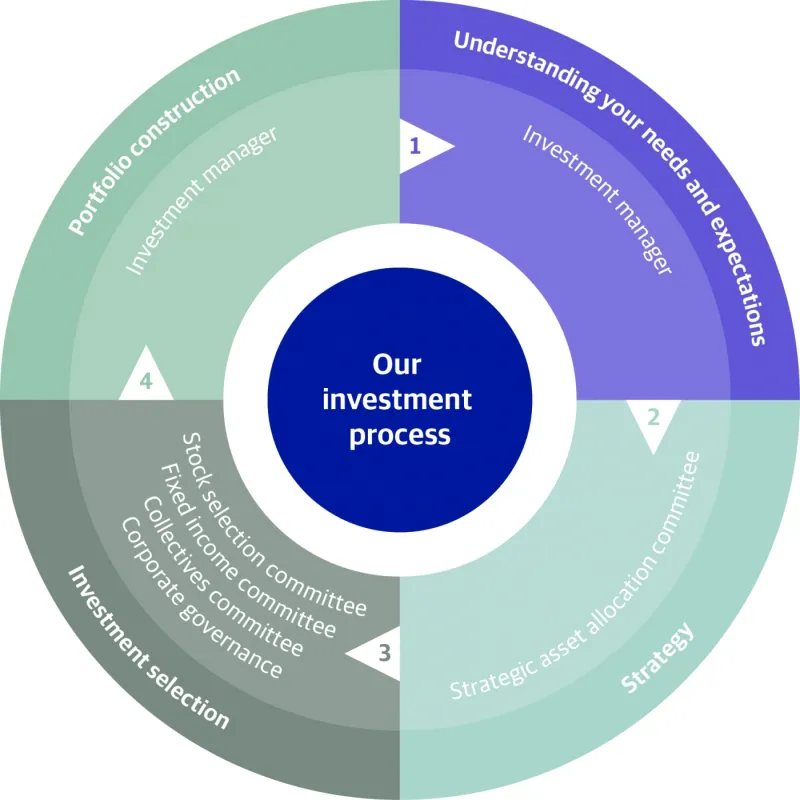

Our investment process

Your investment manager draws on the output from a series of committees covering strategic asset allocation; investment selection such as equities, bonds and third-party funds; and corporate governance. These teams of experienced professionals meet regularly to discuss the investment environment and any opportunities and risks they have identified.

Investment managers participate in our investment process, from company visits and internal discussions to analysing external broker research and assessing investment themes. The process informs their decisions but your individual requirements remain paramount.

We have structured our investment process to deliver clear guidance and genuine flexibility. It allows us to design tailored strategies to match your individual financial circumstances, investment objectives and risk appetite.

Asset allocation

Your portfolio will usually be based on our multi-asset approach to investing, which provides us with the flexibility to meet your individual needs over the long term. The starting point for designing your portfolio is to determine the right combination of assets for your investment targets and appetite for risk.

Our asset allocation framework is forward looking. It is dynamic and not based solely on backward-looking statistics. In order to construct portfolios effectively and manage risk, we divide assets into three building blocks, which play complementary roles:

- Liquidity

Assets that are likely to remain easy to buy and sell during periods of market distress or dislocation, sometimes referred to as “liquid investments”. They include government bonds, high-quality corporate bonds and cash.

- Equity-type risk

Assets that drive growth in your portfolio including equities (also called “stocks and shares”) and other securities with a high correlation to equity markets. However, they can lose value or become illiquid during periods of market stress. As well as equities, this category includes riskier corporate bonds, private equity funds, industrial commodities and some hedge funds.

- Diversifiers

Assets that have the ability to reduce or offset equity risk during periods of market stress. Potential investments must pass a range of tests before we can claim to feel confident in their diversifying characteristics across a range of market environments. They include precious metals, unleveraged commercial property funds and some hedge funds.

Investment selection

We have an experienced and well-resourced research team, which operates alongside our investment managers. To generate investment ideas we start by exploring the main forces driving the global economy and their implications for the future.

We have the particular expertise required to invest directly in individual equities and bonds. This approach gives us more freedom to implement our investment ideas efficiently and cost-effectively, while retaining full control over the process.

We can also select third-party funds when we consider it best to outsource the implementation of an investment idea to an external team with the specialist experience and skills required. These teams have local knowledge of a market or a particular investment edge. Our size and associated buying power help us gain access to such opportunities.

Stewardship

We prefer to invest in companies with high standards of corporate governance as they prioritise the interests of shareholders and other stakeholders rather than those of management. We monitor the actions, policies and decisions of the boards of companies we invest in and participate in voting at shareholder meetings. This helps to ensure that your interests as a shareholder are protected.

Robust oversight

While our investment managers enjoy flexibility and discretion to deliver our service to you, it is important to have a formal oversight framework to support the investment process. Our investment executive committee is responsible for this.

It makes sure we are managing all portfolios to the same high standards while being able to adapt to changing regulatory requirements and market conditions. It promotes best practice and oversees all aspects of the process from portfolio construction and investment selection to implementation.

This framework, supported by risk management systems, due diligence procedures and regular reviews, makes sure your portfolio remains in line with your investment objectives.