The Magnificent Seven

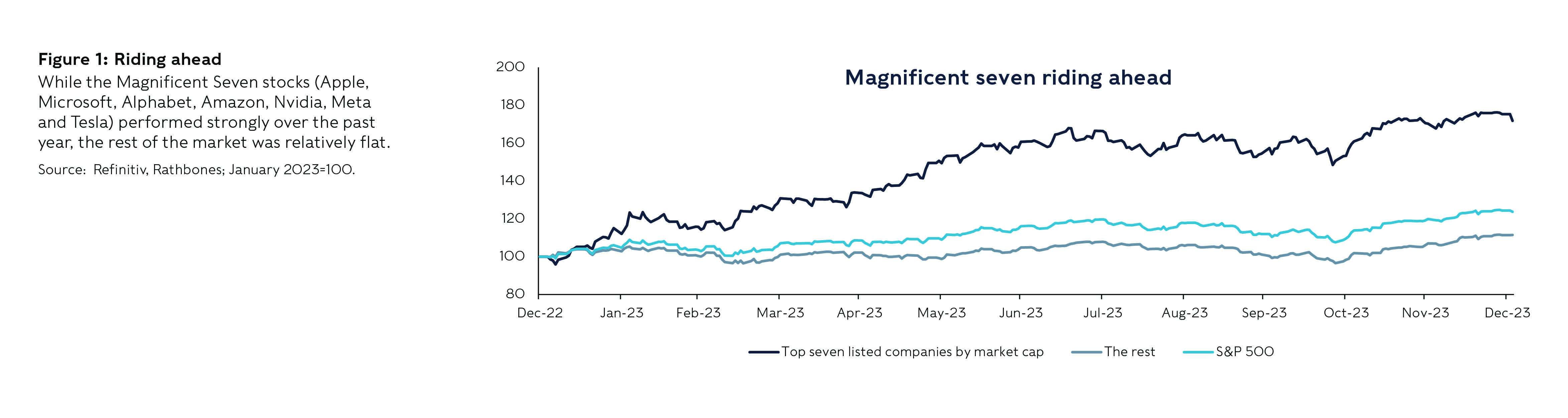

“Dashing superheroes rescue distressed equity investors from the perils of rising interest rates” could be the headline for last year’s lopsided stock market action. Dubbed the Magnificent Seven, a small group of companies — comprising Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla —contributed more than half of the gain in the S&P 500 in 2023.

Article last updated 25 November 2025.

“Dashing superheroes rescue distressed equity investors from the perils of rising interest rates” could be the headline for last year’s lopsided stock market action. Dubbed the Magnificent Seven, a small group of companies — comprising Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla —contributed more than half of the gain in the S&P 500 in 2023.

|

At the end of the year, their market capitalisation (the combined value of their outstanding shares) commanded 29% of the US market. Excluding these tech giants, the remaining S&P 493 was up a more modest 9%, proving more sensitive to sharp interest rate rises, cost inflation and weakening economies. Will the Magnificent Seven be able to maintain their superhero status and global domination through this year? With all but Nvidia having reported their latest quarterly earnings in recent weeks, some divergence has emerged among them, with Nvidia up over 40% in the first month and a bit of 2024, while Tesla has slumped nearly 30%.

This elite group shares a common thread — they embody the seemingly unstoppable rise of the technology sector, although a less charitable view might put Tesla with the traditional carmakers rather than whizzy software developers. Terms like FAANG (Facebook, Amazon, Apple, Nvidia and Google), Fang+, MAFANG, and MAMAAs have been coined over the past few years to encapsulate the influence these tech titans have on stock market returns.

Performance in context

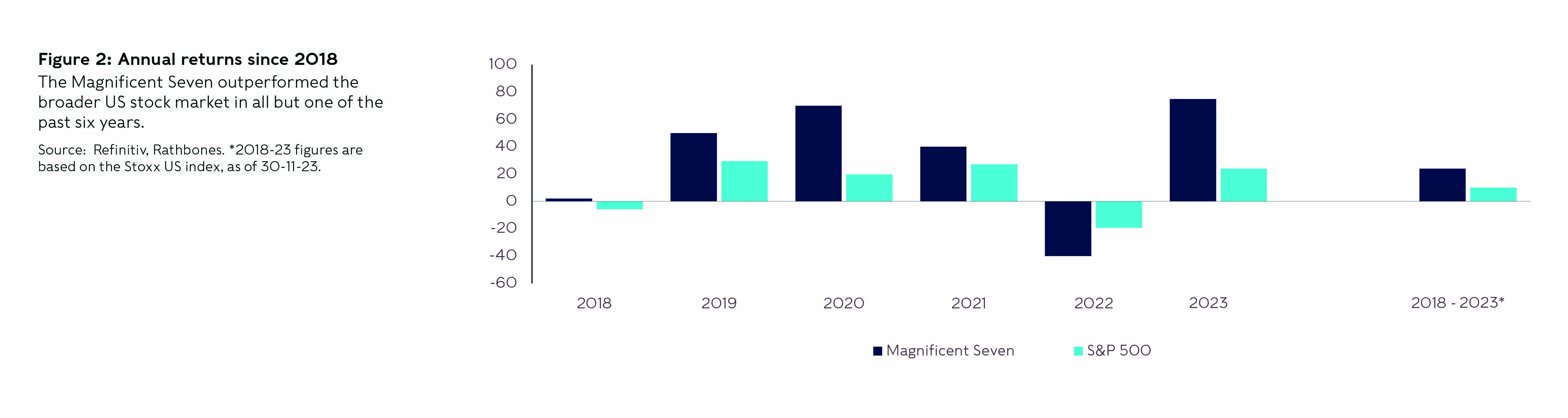

Although this concentration was extreme in 2023, it needs to be viewed in context. In many ways, the Magnificent Seven’s stellar performance is a rebound from the precipitous declines of 2022, when they were collectively down 40%. They accounted for almost as much of the S&P 500’s decline that year as they did the gains in 2023.

|

The Magnificent Seven weren’t the only protagonists in the tech sector’s success story last year. Oracle, Adobe, Booking Holdings, and even UK-listed Sage have also delivered impressive returns, symbolising the broader ascendancy of the sector. While tech stocks commanded 40% of the US market and 27% of world indices as 2023 came to an end, the pivotal question for investors is not what is driving the Magnificent Seven, but what explains the success of the tech sector in general?

No doubt some of the gains last year have were fuelled by hype around the potential for generative AI (exemplified by ChatGPT and other so-called large language models) to transform businesses and create lucrative new revenue streams.* We think the more important driver has been the recovery from oversold conditions in 2022. These outperforming tech companies, to varying degrees, have been able to continue growing while the wider market stutters — and the case for them to drive superior earnings growth long into the future remains compelling.

However, the sheer size of the Magnificent Seven demands special consideration. Apple and Microsoft boast market valuations greater than the entire UK stock market, making a view on these companies unavoidable for investors. To evaluate the sustainability of their performance, investors should eschew reliance on charts of share price performance and focus instead on business fundamentals and current valuations — the most reliable predictors of long-term equity returns in our view. Let’s delve into each member of the Magnificent Seven.

Take a bite

Apple’s revenues and operating profits both fell by around 1% in 2023 as demand was pulled forward during the pandemic when consumers in lockdown used excess savings to upgrade their iPhones. Given such soggy sales growth, it seems surprising that the shares rose by over 50% over the year and are currently priced at 28 times expected 2024 earnings per share. That’s a 25% premium to their five-year average. Apple remains dominant in high-end smartphones and is benefiting from a shift towards services, which offers a more profitable and recurring source of revenue than hardware. If Apple can return to the 5-10% annual profit growth the market predicts for this year, the valuation, while looking somewhat full, is justifiable. But even at these rates, it’s worth noting that Apple would be growing much more slowly than the expected pace of Meta and Alphabet, despite trading on a significant premium.

Microsoft, up nearly 10% in the year to date at the time of writing, boasts an even higher valuation than Apple on 33 times expected 2024 earnings, which is towards the higher end of its past range. Its partnership with OpenAI positions it as a frontrunner in the race to develop generative AI services. One area we have a keen eye on is its cash generation, which is deteriorating across all the cloud providers. Yet with operating profits expected to grow 17% a year between 2024 and 2027, the shares still look attractive compared to other software stocks.

Meta trades on 23 times next year’s forecasted earnings. This is a modest premium to the overall S&P 500 index, which has a price-to-earnings multiple (PE) of 20. Given Meta remains the preeminent force in social media, and its profit growth is expected to significantly outpace the market average, we feel it should be able to continue delivering market-beating returns; Meta is up by more than 30% so far in 2024.

Navigating new challenges

Google parent Alphabet trades on a similarly pedestrian PE multiple of 23, reflecting concerns about its maturing advertising business and potential disruption to its search business by ChatGPT. However, Alphabet is up a modest 4% so far this year, and we think it has sufficiently deep pockets and expertise to navigate through whatever challenges and opportunities AI presents. We view the valuation as low for a business that controls the gateway to the internet.

Ecommerce giant Amazon is trading on a much richer multiple of 38, and has continued to make strong gains, up about 14% so far in 2024. While cheap compared with where it’s traded in the past, it looks expensive against its tech brethren. Investors are betting on significant expansion of profit margins in its ecommerce business, which is expected to drive 30% annual profit growth in the years ahead. The prevailing view is also one of a decade of robust revenue growth ahead for its data centre division, AWS, as enterprise IT spend shifts into the cloud. This one admittedly requires more of a longer-term horizon from investors to justify the valuation.

With Nvidia’s shares, so far this year, having added over 40% to last year’s 240% gain, its forward PE has jumped to 34 from a mere 25 at the end of 2023. Sales of the firm’s GPU chips to data centres for AI applications have so far blown away analyst forecasts, and it appears to have a lock on the chips AI applications need. However, the company is not without risks. Major customers like Amazon and Alphabet are developing their own chips and demand for AI chips could drop just as quickly as it climbed if large commercial applications for generative AI fail to materialise. For now, given Nvidia’s quasi-monopoly and enviable profit margins, we will be paying close attention to its results, with the next set of quarterly figures due out on 21 February.

Tesla is the most expensively valued of the Magnificent Seven, trading at 60 times 2024 profit estimates, though down from 67 at the end of last year after reporting disappointing quarterly results. The carmaker faces challenges with falling profits and ambitious growth expectations. Its valuation hinges on realising autonomous driving software’s potential and achieving substantial scale. Scepticism is warranted, but its colourful CEO Elon Musk has proven doubters wrong many times in the past.

A regulatory caution

One note of caution is that big tech is in the cross-hairs of regulators — Nvidia in the form of chip export bans to China, Apple for the fees it charges on the app store, Alphabet for paying to be the default search option on the iPhone and Meta for its acquisition of Instagram in 2012. Negative developments on these fronts could erode the value of these businesses.

While four of the Magnificent Seven face regulatory risks, investors can still harbour a healthy appetite for these stocks. The broader question, however, extends beyond this group to whether the wider tech sector, with its colossal weight in indices, can continue outperforming. We believe conditions favouring technology companies will persist, including high returns on capital and structurally advantageous business models, and they will remain an important driver of equity returns. It doesn’t have to be limited to the Magnificent Seven, but we expect more sequels from this band of superheroes.

* This article originally appeared in our latest quarterly Investment Insights publication. You can read more about generative AI in the previous two issues of Investment Insights, which are available online at www.rathbones.com/insight/investment-insights.