Review of the week: The money eraser

Inflation can often seem an abstract concept. Not lately, though: everyone is keenly aware of soaring prices. Is inflation finally starting to drop?

Article last updated 30 September 2025.

It’s a big week for UK inflation, but you’ll be forgiven for feeling like it hasn’t turned a corner just yet.

The Office for National Statistics reveals the inflation figure for April on Wednesday. The Bank of England’s (BoE) analysts have forecast a large drop of 1.7 percentage points, which would take the rate from 10.1% to 8.4%. Investors seem hopeful yet cagey. The price of UK 10-year government bonds is heavily influenced by expectations of inflation and prevailing interest rates. If inflation doesn’t fall as much as expected, more BoE interest rate hikes could be coming, which would push bond prices lower and yields higher. Equally, if inflation falls by more than forecast it would push bond prices higher and yields lower. Last week, the 10-year gilt yield was up and down like a yo-yo, ending above 4.0% and at its highest level since the mini-budget and 2010 before that. Plenty of sadness priced in then.

In a speech to a business conference last week, BoE Governor Andrew Bailey admitted he was still concerned about the potential for knock-on, ‘second round’ effects of earlier inflation to keep price pressures strong for longer. However, he also said that he thinks this is about to fall away. Food prices are still running hot, while consumer confidence and the central bank’s economic outlook have both brightened recently. In its most recent report, the BoE said it now believes the UK should narrowly avoid recession this year (the IMF still forecasts a mild recession).

Much of this won’t help bring down inflation, so why is everyone expecting a sizeable drop in the numbers? Energy prices will be doing most of the heavy lifting and it’s mostly maths, so don’t worry, you won’t be alone in struggling to reconcile your power company direct debit with reported improvements in energy inflation.

Stick with us here, because it gets wonkish: April will be a year on from the first huge hike in power bills in 2022. This means that the retail price of electricity and gas has gone up by only 40% over the past year, compared with the roughly 100% annual increases of previous months, as that first hike drops out of the annual comparison. Result! To mere mortals, a 40% increase in a price is a travesty; however, to inflation calculations, it’s the deceleration that’s most important. That slowdown from 100% to 40% should help drag the overall inflation rate much lower because inflation measures change (i.e. a slowdown in the rate of change results in a lower inflation figure.

Energy bills could fall later this year. But it may be years before they’re back to their usual pre-invasion levels, despite wholesale gas prices now even lower than they were on the eve of the war in Ukraine. The UK’s power market is a spiderweb of caps, guarantees and long-term contracts to supply energy at the extremely high prices of months past. This, combined with much higher mortgage and rental costs, should reduce Brits’ spending money, which would dampen demand for goods and services, and thereby reduce inflation.

We should peek at the CPI index itself from time to time – that’s the level, not the percentage increase that’s reported each month. It can be helpful to put these monthly inflation rate fluctuations into context. At 128.9 in March, that level is almost 20% higher than in March 2020. Has your income gone up that much in the past three years? On the flipside, your debts (including mortgages) have devalued by roughly a fifth too.

Over many years, stock markets are typically a helpful place to store wealth. It’s risky – there’s a chance that you will lose more than you invested – but as long as you can ride out both bad years and good, well-diversified investments tend to grow faster than inflation. Over the past three years to 31 March, the FTSE World stock market index outpaced UK inflation three-fold. There were more than a few scares hidden by that, of course: the index dropped roughly 15% several times over those three short years.

Inflation is just the movement of prices for goods and services, and businesses are in the market of selling goods and services. That means inflation should broadly flow through company accounts. Some businesses may suffer higher expenses in costs that they can’t pass on through higher prices, while others will benefit from being able to charge customers more (which may push inflation higher itself). Our task as investors is to spot which companies should benefit from certain scenarios and which will suffer, to deliver steady returns over time.

| Index |

1 week |

3 months |

6 months |

1 year |

| FTSE All-Share |

0.3% |

-1.8% |

6.3% |

8.6% |

| FTSE 100 |

0.2% |

-1.5% |

7.2% |

10.3% |

| FTSE 250 |

0.6% |

-3.0% |

1.7% |

1.1% |

| FTSE SmallCap |

0.2% |

-3.7% |

3.6% |

-1.3% |

| S&P 500 |

2.0% |

-0.4% |

2.3% |

9.8% |

| Euro Stoxx |

1.0% |

0.1% |

12.1% |

19.7% |

| Topix |

1.0% |

2.8% |

8.0% |

10.4% |

| Shanghai SE |

-0.4% |

-3.7% |

3.2% |

2.6% |

| FTSE Emerging |

0.2% |

-5.5% |

-0.1% |

0.3% |

Source: EIKON, data sterling total return to 19 May

| These figures refer to past performance, which isn’t a reliable indicator of future returns. The value of investments and the income from them may go down as well as up and you may not get back what you originally invested. |

A few swamp the rest

Many stock markets have done well so far this year, but their performance has been driven by only a few, big companies. Is that a warning sign for investors to heed or is it simply a curiosity?

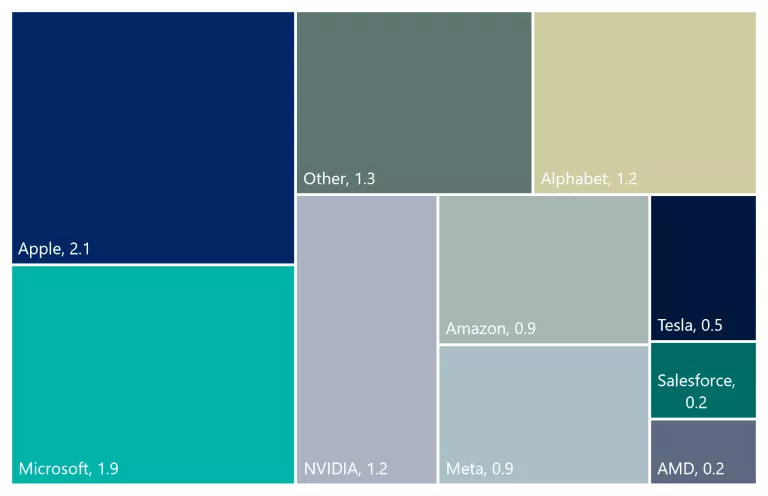

The chart below shows how, in the US, a familiar handful of tech stocks have contributed much more to index returns than the rest of the market (‘Other’) put together. Without them, the S&P 500 would hardly have risen at all in 2023.

The usual suspects drive US equities in 2023

Source: Refinitiv, Rathbones; contributions to S&P 500 returns (percentage points), 31 Dec 2022 to 19 May 2023

There are other ways to measure how ‘narrow’ index performance has been. You can compare the wider index, like the S&P 500 or the FTSE All-Share, against a basket of the largest 50 or 100 stocks. If the larger-company basket is doing much better, you know the index performance is pretty narrow.

Another way is to compare the wider index against an equal-weighted index, where every stock makes up the same proportion of the index, i.e. 1/100th of the FTSE 100, rather than the typical market-cap-weighting that gives large companies a correspondingly bigger proportion of the portfolio. If the equal-weighted index is less than the market-cap-weighted, again, you’ve got narrow performance.

Whichever way you slice it, market returns have certainly narrowed in recent months, particularly in the US. In fact, the S&P 500 has only narrowed like this a few times going back to 1986. There’s a popular theory that a narrowing market is a warning sign – evidence that a market lacks underlying momentum, and that broad indices will soon fall. We delved into history to test that theory. A lot of concern about narrow markets probably stems from the final days of the dotcom bubble at the turn of the century. As the S&P 500 rose to dizzying heights in early 2000, it narrowed by even more than it has done recently, with a handful of big stocks more than offsetting weakness elsewhere. Disaster soon followed, with the index plunging as the tech bubble finally burst.

Beyond this example, though, it’s hard to detect a consistent relationship between narrowing rallies in the stock market and subsequent poor performance. Even during the dotcom era, the stock market had begun to narrow years before the bubble burst – from as early as 1993, and decisively from 1998 – as the index climbed. In other words, the combination of a rising but narrowing market can persist for years and isn’t a clear signal that trouble is imminent. Selling just because the market was narrowing would have meant getting out far too early. Meanwhile, there have been other times when a narrowing rally didn’t seem to cause any problems at all. The market narrowed significantly from late 2011 to September 2012 as the index rose, for example, but just continued to climb thereafter with the rally eventually broadening out.

With that in mind, the narrowness of the stock market alone is probably not a major reason to be concerned. But it’s important to consider the bigger picture. We currently see other, more compelling, reasons to be positioned defensively. Interest rates around the world have increased extremely rapidly and the full impacts are yet to be felt – despite the failure of several banks. Global economic activity has dipped recently and we expect that to continue, with a mild recession likely in America (and therefore the rest of the world) before the year is out.

If you have any questions or comments, or if there’s anything you would like to see covered here, please get in touch by emailing review@rathbones.com. We’d love to hear from you.

View the PDF version of Review of the week here.

Bonds

UK 10-Year yield @ 3.99%

US 10-Year yield @ 3.68%

Germany 10-Year yield @ 2.43%

Italy 10-Year yield @ 4.26%

Spain 10-Year yield @ 3.47%

Central bank interest rates

UK: 4.50%

US: 5.00-5.25%

Europe: 3.75%

Japan: -0.10%

| Economic data and companies reporting for week commencing 22 May |

|

Mon 22 May EU: Consumer Confidence, Manufacturing PMI, Services PMI Full-year results: Kainos Group, Big Yellow |

|

Tue 23 May UK: Public Sector Net Borrowing, Manufacturing PMI, Services PMI Full-year results: Cranswick, Rs Group, Bytes Technology, Helical Bar, FD Technologies, Engage Xr Holdings, Calinex Solutions, Assura, Eneraqua Technologies, |

|

Wed 24 May UK: Core Inflation Rate, Inflation Rate Full-year results: Severn Trent, Great Portland Estates, Marks & Spencer, SSE, C&C Group, Ondine Biomedical |

|

Thu 25 May US: GDP Growth Rate, Chicago Fed National Activity Index, Continuing Jobless Claims, Initial Jobless Claims, Corporate Profits, GDP Price Index, Pending Home Sales Full-year results: Intermediate Capital, Qinetiq, Pets at Home, Workspace, United Utilities, Renewi, Griffin Mining, Reneuron |

|

Fri 26 May UK: Retail Sales, Retail Sales ex-Fuel Full-year results: Volvere |