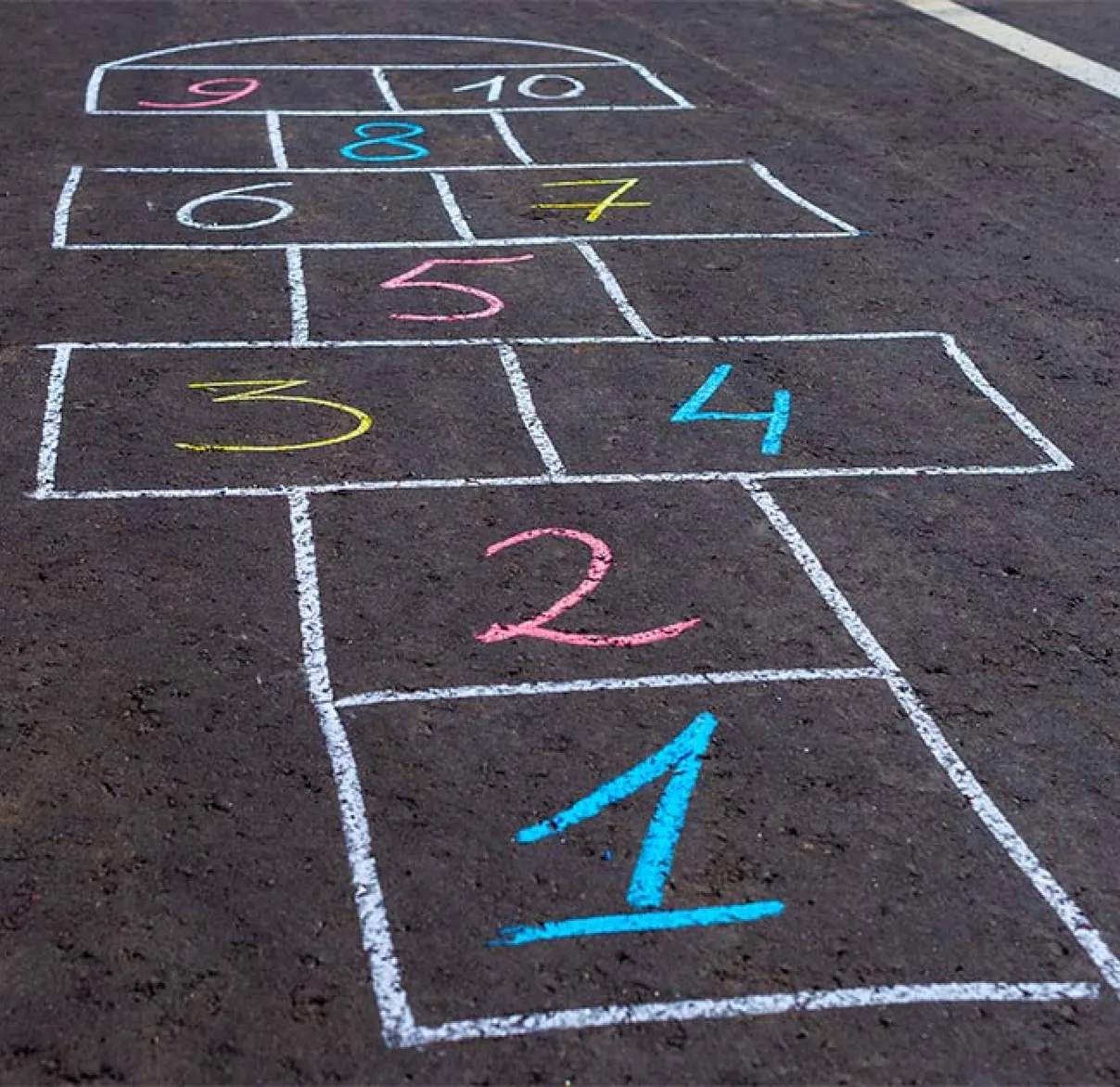

Review of the week: Skip, hop and jump?

All eyes are on the direction of central bank monetary policy. After expecting a policy pivot, investors now think the most likely outcome is a skip in tightening followed by a hop to pause mode before a jump to interest rate cuts.

Article last updated 30 September 2025.

|

Quick take - Will the Fed skip a rate hike this month? - And might it then hop towards a lengthy policy pause before a jump to rate cuts? - Expect a lot of political noise as former US President Donald Trump goes to court on federal criminal charges and we learn more about former Prime Minister Boris Johnson’s abrupt exit from Parliament. |

It’s a big week for some of the world’s biggest central banks. First up, we get the US Federal Reserve (Fed)’s latest interest rate decision on Wednesday, followed by the European Central Bank (ECB) on Thursday and the Bank of Japan (BoJ) on Friday.

Earlier this year investors were firmly focused on the idea of a Fed pivot away from its super-aggressive rate increases and towards significant rate cuts from mid-year. But over the last few months they’ve shifted away from expectations of a sharp pivot to rate cutting and have been pricing in a more gradual policy shift. They now seem to be endorsing the idea that the Fed’s next move is most likely to be a skip – a temporary pause in policy tightening that leaves the door open for more hikes if necessary.

Skipping this time around would give the Fed around six weeks before its July meeting to consider how the economy is holding up, with the next round of labour market and inflation data coming in the gap. A skip might also allow the Fed to get a sneak peek at US second-quarter GDP figures ahead of the July meeting.

Fed Governor and vice chair nominee Philip Jefferson and Philadelphia Fed President Patrick Harker recently suggested we might have to wait a bit longer for this cycle’s rates peak. Both these voting Fed-members stressed that a potential pause in June wouldn’t signal that the Fed’s tightening cycle had come to a definitive end.

Policy expectations have moved a lot since banking sector turmoil erupted in early March with the collapse of Silicon Valley Bank. Back then, most investors thought there’d be a sharp pivot to Fed cuts by the summer because they feared an imminent banking crisis. Those fears now seem to have been averted – and expectations of a pivot have been pushed out later and later into this year. In fact, bets on a pivot at all by year-end are now hanging by a thread.

For now, investors seem to be pricing only about a 30% chance of a Fed hike on Wednesday, though conviction in a skip was tested by surprise rate hikes from the central banks of both Canada and Australia last week. These seemed to counter hopes that most big central banks are on the verge of concluding their rate hikes, particularly since the Bank of Canada was one of the first formally to signal a likely pause in tightening back in January.

We should get a clearer sign on where the Fed is headed when the latest US inflation figures covering May are released on Tuesday. US consumer price inflation (CPI) is expected to have fallen from 4.9% in April to 4.1%, though core CPI excluding food and energy prices is likely to be stickier, down from 5.5% in April to a consensus estimate of 5.3%.

As long as the data don’t show a definitive reacceleration in the labour market and the pace of inflation, our view is that after a skip this week, the Fed will hike again once more and then hop towards a prolonged policy pause before finally cutting rates late this year or early in 2024.

For its part, the ECB is expected to raise rates by another quarter percentage point on Thursday even though the Eurozone’s official shift into recessionary territory (marked by two consecutive quarters of contracting GDP) was confirmed last week. And the BoJ is expected to stay on hold.

| Index | 1 week | 3 months | 6 months | 1 year |

| FTSE All-Share | -0.4% | -2.7% | 3.2% | 3.8% |

| FTSE 100 | -0.5% | -2.8% | 3.3% | 5.1% |

| FTSE 250 | -0.2% | -2.0% | 2.5% | -1.9% |

| FTSE SmallCap | 0.3% | -0.9% | 3.0% | -3.5% |

| S&P 500 | -0.4% | 4.3% | 7.7% | 8.5% |

| Euro Stoxx | -1.0% | -2.6% | 9.5% | 13.4% |

| Topix | 1.3% | 0.7% | 10.1% | 11.5% |

| Shanghai SE | -1.4% | -8.7% | -4.0% | -6.7% |

| FTSE Emerging | 1.0% | -2.6% | -0.2% | -3.5% |

Source: EIKON, data sterling total return to 9 Jun

| These figures refer to past performance, which isn’t a reliable indicator of future returns. The value of investments and the income from them may go down as well as up and you may not get back what you originally invested. |

Bad week for big political hitters

Meanwhile, it’s shaping up to be a tumultuous week in politics as big hitters both sides of the pond try to defend their reputations in the face of damning allegations. Former President Donald Trump is due in court on Tuesday to face 37 charges, most of them relating to claims he improperly held on to highly classified documents after leaving office. It’s the first time in US history that a former President who is also running against the sitting President has faced federal criminal charges. Unsurprisingly, he’s fighting back hard, claiming the charges represent “horrific abuses of power”.

Former Prime Minister Boris Johnson seems to be following Mr Trump’s lead and vociferously airing a litany of grievances as his fortunes turn. The Parliamentary investigation into claims he misled Parliament about breaches of COVID rules when in office is due to report its findings this week. After receiving a confidential copy of the report on Friday, Mr Johnson abruptly resigned from the House of Commons. The committee had the power to force Mr Johnson into a by-election to hold on to his constituency – a contest he might well have lost. He seems to have pre-empted that move by quitting on Friday, but has claimed the investigation was a “witch hunt” aimed at forcing him out of politics.

Mr Johnson clearly faces less immediate legal problems than Mr Trump. But his political fortunes may be less promising, at least in the short term. Mr Trump commands a healthy lead in the polls of Republican primary candidates and the latest historic legal actions against him could deliver a boost of energy, and potentially donations, to his presidential bid. It’s happened before.

If you would like to hear more about what’s going on in the global economy and how it affects the way we invest, please join us for our next Investment Insights webinar on Tuesday 11 July at 12.30pm. You can register here.

If you have any questions or comments, or if there’s anything you would like to see covered here, please get in touch by emailing review@rathbones.com. We’d love to hear from you.