A practical starting point for thinking ahead.

With careful planning and the right advice, you can reduce the amount of tax you pay and, in some cases, pay none at all.

During your working life, you may have built up savings in different places, including pensions, ISAs, general investments and cash.

As you approach retirement, it’s important to think about how best to use these to generate income in a way that keeps your tax bill as low as possible.

This information is based on our current understanding of HMRC tax rules in the UK. Tax treatment depends on your individual circumstances which could change in the future.

Quick read: 6 ways to reduce tax in retirement.

Only have a minute? Here are the key points from this guide:

01

Use both partners’ tax allowances.

Transferring assets between spouses or civil partners can help you make full use of your combined tax-free allowances.

02

Draw income from the most tax-efficient sources first.

ISAs, cash savings and investment accounts often offer more flexibility than pensions and can sometimes be used without triggering tax.

03

Understand when and how your State Pension affects you.

The full State Pension is £11,973 a year, which uses up most of your personal allowance once it starts.

04

Think carefully about how you access your pension.

You can take up to 25% of your pension tax-free (subject to a limit). Spreading withdrawals over time could help reduce your overall tax bill.

05

Consider other tax-efficient investments.

Products like investment bonds and Venture Capital Trusts (VCTs) can help generate tax-deferred or tax-free income in the right circumstances.

06

Blend your income sources with a clear plan.

As a couple, with the right structure, it’s possible to take over £50,000 a year tax efficiently, using a mix of savings, pensions, ISAs and other assets.

01

Use both partners’ tax allowances

Make the most of allowances across both partners.

If you’re married or in a civil partnership, you can both make use of tax allowances. You can also transfer assets between you tax-free, which can be helpful if one of you pays tax at a higher rate or isn’t using their full allowance.

By balancing ownership of your savings, you can make better use of your combined tax-free allowances and stay in lower tax brackets where possible.

02

Draw income from the most tax-efficient sources first

Use your tax-free savings options first.

Even with today’s higher interest rates, some income from savings and investments can still be received without paying tax:

- A retiree who has no other income is able to receive up to £18,570 of savings interest tax-free every year. This £18,570 figure is made up of your personal allowance (£12,570), savings rate band (£5,000) and a personal savings allowance (£1,000).

- Withdrawals from ISAs are always tax-free, whether they come from interest, dividends or selling investments.

- General investment accounts can also generate tax-free income, as long as you stay within your savings, dividend and capital gains allowances.

Source: DWP, Benefit and Pension Rates 2025 to 2026

03

Understand when and how your State Pension affects you

Remember the impact of the State Pension.

The full UK State Pension is now £11,973 per year (2025/2026). This typically uses up most or all of your personal income tax allowance.

That said, if you retire before your State Pension starts, you may have a few years where you can draw income from other sources, such as pensions or investments, without paying tax. Planning how and when to draw income can make a big difference.

04

Think carefully about how you access your pension

Combine pensions with other tax-free sources.

From age 55 (increasing to 57 from April 2028), you can normally take 25% of your pension as tax-free cash up to a maximum of £268,275. Rather than taking it all at once, many people choose to phase it over time, especially if they’re using it to top up other income.

Some also delay using their pension and draw income from other savings first. This approach can help you make better use of your allowances and may reduce inheritance tax, depending on your goals.

05

Consider other tax-efficient investments

Could other types of investments help?

Some less familiar options can also play a role in a tax-efficient income plan:

- Investment bonds let you withdraw up to 5% of your original investment each year for 20 years without paying tax straight away. This tax is deferred, not avoided, so advice is essential.

- Venture Capital Trusts (VCTs) are higher-risk investments that pay tax-free dividends. These won’t suit everyone but can be useful in the right situation.

The value of investments and the income from them can go down as well as up and you could get back less than you invested.

06

Blend your income sources with a clear plan

Structure your income carefully.

How and when you draw money from your savings makes a big difference. A financial planner can help you create an income plan that blends different sources, such as pensions, ISAs, savings and investments, in a way that keeps your overall tax bill down.

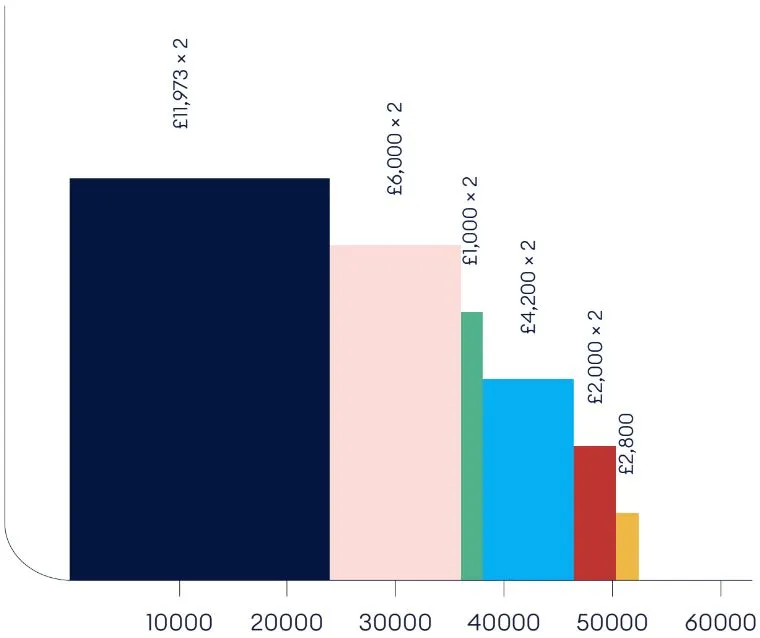

Here’s one example of how a couple might structure their savings and investments to create a tax-efficient income of over £50,000 a year:

Tax-efficient retirement income breakdown (couple)

This is just one approach. The best strategy for you will depend on your savings, tax status and financial goals.

| State pension | |

| ISA income | |

| Savings interest | |

| Interest dividends | |

| Pension income | |

| VCT dividends |

Total: £52,498 (after tax)

Plan ahead and review regularly

The more time you give yourself to plan, the more flexibility you’ll have. Using your tax-free allowances each year can make a big difference, not just now, but in the long term too.

A good retirement income strategy evolves over time. Whether you want to draw a regular income, preserve your capital or pass on wealth, your plan should reflect your personal priorities, and adapt as life changes.

Explore the full retirement planning series

This guide is one of six in our series designed to help you make informed, confident choices about life after work.

Worried about your retirement income?

Steps to help you stay in control and reduce the risk of running out.

Keep your retirement on track by avoiding these common mistakes

What we see most often and how to avoid it.

Will your retirement savings last if you live to 100?

Why it pays to plan for longer and how to make your money go the distance.