A practical starting point for thinking ahead.

How much money will you need in retirement?

Many people underestimate how much money they will need in retirement or how long they will need it to last. Others avoid making a plan altogether. With people living longer, working differently and spending more actively in later life, retirement has become far more personal. That makes preparation essential.

This guide explores some of the most common mistakes we see and how to avoid them.

Quick read: 7 things to think about

Only have a minute? Here are the key points from this guide:

01

Know what you want.

Get clear on how you’d like to spend your time and who else you might support.

02

Plan for a long retirement.

You may live longer than expected, so your money needs to go further.

03

Be realistic about income.

Many people underestimate how much they’ll need, especially for a comfortable lifestyle.

04

Don’t forget inflation.

Rising prices can seriously affect your spending power over time.

05

Use cashflow modelling.

A financial planner can help you test whether your money is likely to last and what to do if it isn’t.

06

Think about where your income comes from.

The order in which you draw your savings and pensions can make a big difference.

07

Start sooner, not later.

The earlier you plan, the more flexibility and confidence you’ll have.

01

Know what you want

Mistake 1: Drifting into retirement without clear goals or priorities.

In the past, retirement typically began at a fixed age and came with a fixed income. Today, many people take a more flexible approach. Some reduce their hours gradually or explore new opportunities, while others continue working well into their seventies.

The challenge is that flexibility needs funding. A clear picture of the life you want is the foundation of a good retirement plan, whether that includes travel, time with family or supporting children financially.

Susan, a 58-year-old marketing executive, always assumed she would retire at 60. When she sat down with a planner, she realised her savings might not support her travel plans unless she delayed them or made some adjustments. With the right strategy, she is now preparing for a phased retirement that suits her lifestyle and goals.

02

Plan for a long retirement

Mistake 2: Underestimating how long your money needs to last.

Many people plan for an average retirement length. That might not be enough.

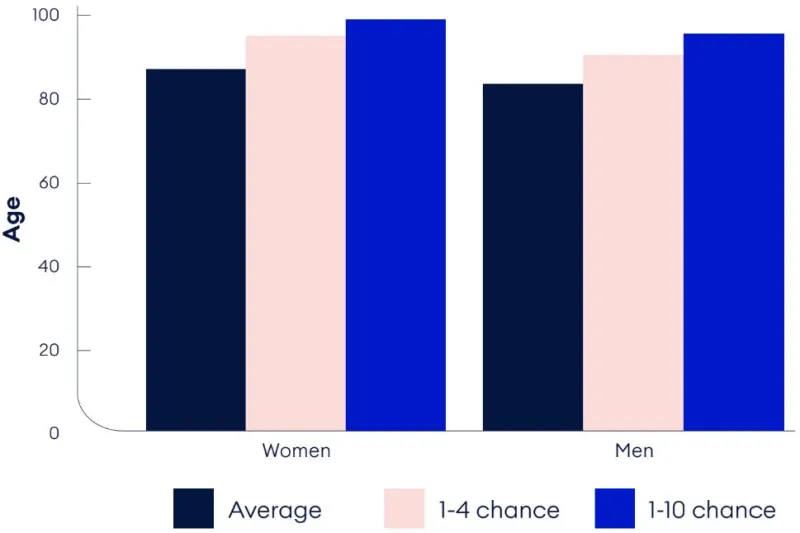

According to the UK’s Office for National Statistics (2025), a woman aged 60 today can expect to live to 87. One in four will reach 95 and one in ten will live to 99. A man of the same age is likely to live to 84, with one in four reaching 92 and one in 10 living to 96.

If you are in good health, your retirement could last well over 30 years. Planning only to the average could leave you with difficult choices later in life.

Life expectancy at age 60

This chart visually compares average, 1-in-4, and 1-in-10 life expectancies

for men and women aged 60.

03

Be realistic about income

Mistake 3: Assuming your expenses will drop more than they actually might.

According to the Retirement Living Standards, a single person needs to spend more than £43,900 a year for a comfortable retirement. For a couple, it’s £60,600. This assumes you have no mortgage and covers a lifestyle with occasional holidays, meals out and a car.

The savings required to generate enough post-tax income to pay for this depend on your investments, retirement age and other sources of income.

Without a clear plan for how to use your assets, it’s easy to underestimate what you will need or to draw income in a way that limits your long-term options. Taking time to plan how you’ll generate a reliable income is one of the most important steps in building financial security for later life.

04

Don’t forget inflation

Mistake 4: Overlooking how rising prices can erode your spending power over time.

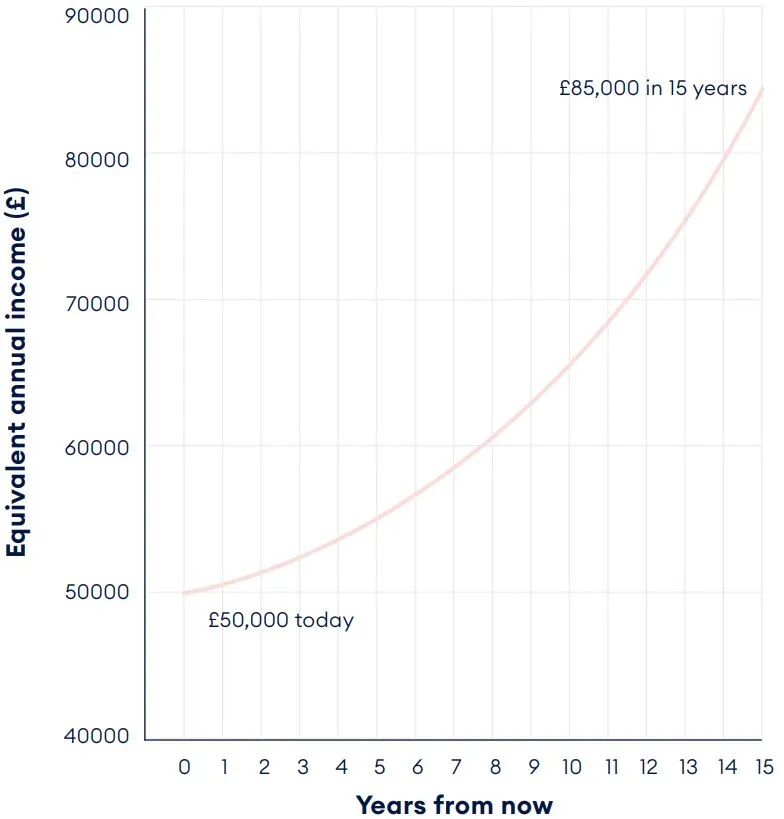

Even modest inflation reduces the value of your income over time. According to the UK’s Office for National Statistics (2024), prices have increased by an average of 3.60% a year based on the Retail Prices Index. At that rate, if you want £50,000 a year today, you’d need £85,000 in 15 years to maintain the same standard of living.

We all feel inflation differently. If your spending is weighted towards essentials like food, fuel or care, rising prices may affect you more than someone with more fixed costs.

A retirement plan should include realistic assumptions about how inflation might change your needs.

How inflation could affect the income you may need

Source: ONS, Retail Prices Index, July 2025

05

Use cashflow modelling

Mistake 5: Missing out on valuable insights by not projecting your future finances.

Many people avoid forecasting their finances because it feels too uncertain. Yet modelling your expected income and spending over time is one of the best ways to see whether your money is likely to last.

A financial planner can run scenarios based on your goals, current savings and investment returns. The aim is not to predict the future but to test how different decisions could affect your financial position, such as retiring earlier, helping children or selling a property.

David and Anika, both in their early sixties, weren’t sure whether they could afford to retire at the same time. A cashflow model showed that with some small adjustments, they could retire on a timeline that worked for both of them. They now feel more confident about their financial future.

Cashflow models are based on certain assumptions and it’s important to remember that these may turn out differently and to regularly review your circumstances.

06

Think about where your income comes from

Mistake 6: Withdrawing money in a way that could increase your tax bill or reduce growth.

Your pension may be the largest source of retirement income, but it may not be the best place to draw from first. ISAs, general investments and other savings all have different tax implications. The order in which you access these can significantly affect how much tax you pay and how long your money lasts.

The most effective income strategy looks at all your assets together and helps you withdraw in a way that protects your income and supports your goals. This approach is especially important if you want to reduce Inheritance Tax or support loved ones during your lifetime.

The most effective income strategy looks at all your assets together and helps you withdraw in a way that protects your income.

07

Start sooner, not later

Mistake 7: Delaying advice.

Some people put off planning because they are not sure where to begin. Others feel they should wait until they are closer to retirement. In reality, the earlier you start, the more options you are likely to have, and the easier it becomes to adjust if your plans change.

Whether you are in your forties and thinking ahead or already approaching retirement, speaking to an adviser can bring clarity and help you avoid costly mistakes.

Explore the full retirement planning series

This guide is one of six in our series designed to help you make informed, confident choices about life after work.

Worried about your retirement income?

Steps to help you stay in control and reduce the risk of running out.

Keep more of your money in retirement

How to draw an income tax-efficiently and help your savings go further.

Will your retirement savings last if you live to 100?

Why it pays to plan for longer and how to make your money go the distance.