You might have read or heard about it: ‘blockchain’ is the financial disruption buzzword of the moment.

Blockchain: Digitisation and the future of advice

Jakov Agbaba, Risk analyst, Rathbones

Intended initially as the platform for storing and transferring the Bitcoin cryptocurrency, blockchain has become the building template for what is referred to by some as the biggest change since the internet. Blockchain is promising to do for value what the internet has done for information: decentralise control, remove asymmetries, and change the way we transact and interact with everything.

From money transfers and asset trading, through healthcare provision and music downloading to collaborating and sharing of resources, blockchain promises to enable, empower and revolutionise. And disrupt.

In simple terms, blockchain is a shared digital ledger of all transactions that is stored across a network of computers. Think of it like pages in a book. A book is a chain of pages. Each page in this blockchain book is a mini-statement of transactions. The entire blockchain book represents all the transactions ever executed. Every time a block is filled and added to the chain, a new block is generated. Blocks are linked to each other in a clear linear and chronological order: an open book for all.

This allows a buyer and a seller to transact without the necessity of banks, clearing houses or other intermediaries. All you need is a computer and the internet. Transfers of cash – or information and other files – are recorded and verified by the database itself.

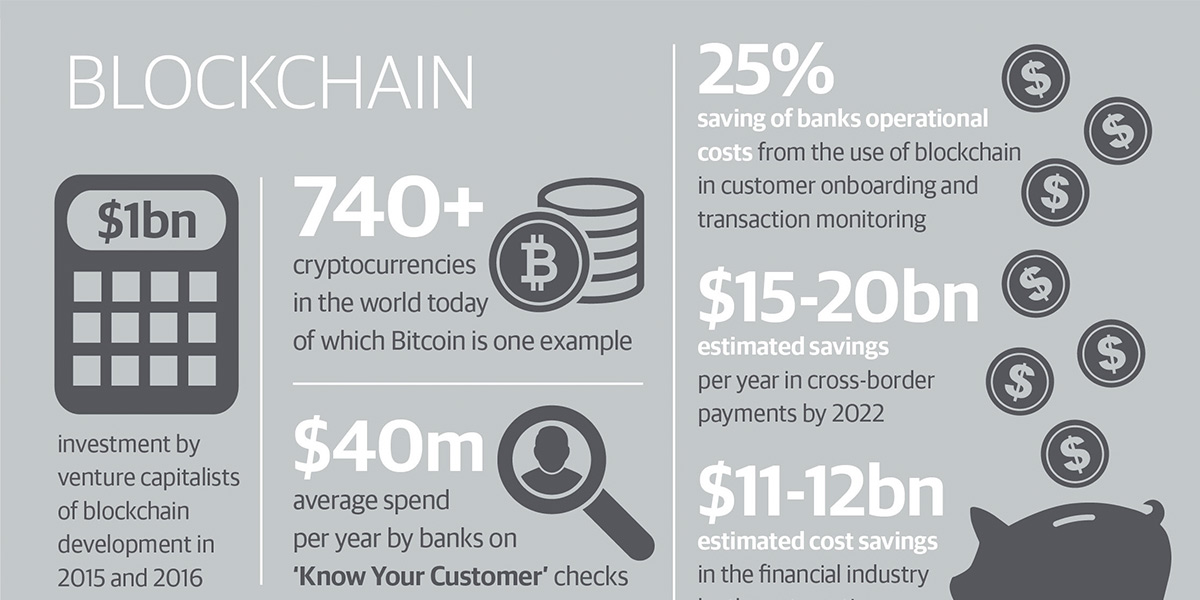

Know Your Customer

For independent financial advisers, blockchain could have the most impact in the time-consuming but highly important and sensitive area of ‘Know Your Customer’ (KYC). A 2016 global survey conducted by Thomson Reuters revealed that each bank spends on average $60m a year carrying out these checks. The largest lender can spend roughly half a billion dollars on due diligence, anti-money laundering and KYC. And as every adviser knows only too well, due diligence is not a one-off exercise either. Every time a client moves banks or approaches a new financial services provider, the whole process must be undertaken once again.

As alluded to earlier, blockchain can be used for more than money: it can be used to share information as well (money is simply a unit of information anyhow). It can also be encrypted so private parts of the blockchain record are only accessible to authorised parties.

Once a bank has carried out its KYC process with a customer, it could confirm this with a statement on the blockchain and a summary of the documentation that has been collected. This information could then be used by other banks, insurance companies and other financial actors — after all, much of the underlying information belongs to the customer, not the bank.

Being able to share client information in this way could revolutionise fact-finding and slash hundreds of millions of dollars of duplicated work. Not having to fill out pages of forms could also make it easier for clients to change providers, boosting competition and improving industry standards.

Why good advice will be more important than ever

Blockchain can be used to transfer everything from property rights to stocks, shares and currencies, without the transaction needing the intervention of a middle man. It has the potential to take away some the time-consuming and costly transactional processes associated with dealing with financial institutions.

What it can’t do, of course, is replace the human dimension of expert financial advice. Clients will continue to find making the right choice of investments a daunting prospect without professional input, and will continue to need guidance and support navigating their way through financial services.

Even if robo-advice were to become more widespread, it is only ever likely to work effectively for those with straightforward financial needs. Investors with complex financial planning issues will still require continuing professional input to ensure that, as their lives change and they face new financial challenges, their investments and plans continue to be relevant to their goals. While online platforms can do a great job in maintaining a client portfolio, they don’t offer the comfort and explanation that a human adviser can give. Therefore, in reality, these platforms represent only a small part of the overall client relationship.

All that is likely to change is that the resulting transactions will be dealt with faster and more efficiently, thanks to the application of blockchain technology.