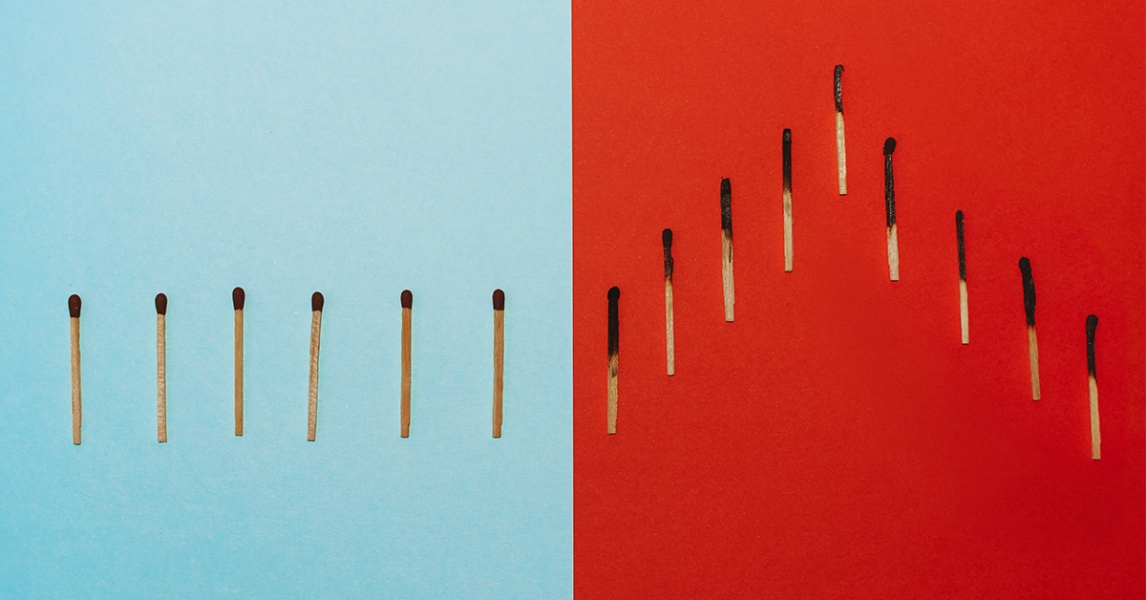

A flattening COVID-19 infection curve is steepening bond yield curves. Head of fixed income Bryn Jones wrestles with the outlook for inflation and the chances of another flare-up of COVID-19.

Curve goes down, curve goes up

As the global fight to flatten the COVID-19 infection curve enjoys more success, it is steepening a different curve.

Government bond yield curves – the difference in yields offered for bonds of different maturities, from a month or three to 10 and 30 years – have changed dramatically in the past month. These curves have ‘steepened’, meaning that the yields of bonds with maturities further in the future have increased significantly compared with the yields for bonds that are shorter-dated.

Simply put, these steepenings are the result of investors selling longer-term debt and buying either shorter-term government bonds or moving into something more risky, like corporate bonds or shares. As the infection rate in advanced economies has dropped, allowing lockdowns to be eased, investors are becoming more confident about the prospect of an economic revival. If the cautious reopening doesn’t elicit a second spike in infections, a recovery in economic activity would bring with it greater inflationary pressure and better returns for riskier investments.

UK M4 money supply – which covers virtually all the cash-like assets in our economy, including all company bonds maturing in five years or less – hit its second highest on record. In the US, aggregate household income jumped 10% to $20.7 trillion in April, higher than the total before the pandemic hit. The US Department of Commerce reported that $6.1trn was saved in April, compared with the roughly $1.3trn saved each month in the Before Times. That’s a lot of pent-up demand on main street. All the monetarists out there are murmuring about a mass of inflation, as the pile of cash for spending increases relative to the amount of stuff you can buy with it. Yet the deflationary forces in the world – demographics, technology and increased debt – remain likely to stick around for decades to come.

I feel that inflation might be coming down the pipe later, but it’s also very likely that central banks are trying to manipulate the yield curve using their massive bond-buying programmes. The jury is still out on whether inflation or deflation will prevail, and for how long.

The steepening of the curves is helped by the fact that government debt is starting from mind-bogglingly low yields. With yields on many government bonds negative after inflation – and negative before inflation in some cases – many investors may be thinking, “There’s no safety in safety, so why not pile into risk.”

This week has had some of the strongest days of the rally so far in corporate bonds. Investment grade spreads (the extra return above government bonds that you get for taking on the risk of default) sunk rapidly as bond prices rose, following an already strong previous week. Riskier financial debt spreads plummeted roughly 4 percentage points, a phenomenal move. Brokers I spoke to were reporting eight buyers to every seller. The path of least resistance continues.

Taking a look at an index of high yield corporate credit spreads, it has recovered from a high of 7.5% above government bond yields during the height of the sell-off to roughly 3.7% today. Putting the extremes in context, the index’s 12-month average is 3.07%.

It feels like we are in for the summer of love with risk markets a one way street. Yet all this is in spite of a pandemic which is still highly prevalent and spreading rapidly through the emerging world (more on this next week) and an extremely volatile US situation – both because of the protests against racism and police brutality and the escalating tensions with China. America matters for the global economy because it is such a huge part of the market. When it sneezes, the world catches a cold, as the hackneyed saying goes.

For me, the chance of a second wave of COVID-19 is key for the economic recovery and therefore for sustaining the recovery in corporate bond markets. I keep in touch with my alma mater Birmingham University, and have been very interested in the COVID-19 research its School of Biosciences has been doing. It has had its biggest success in trialling existing drugs to stop infected people ending up in intensive care where the chances of survival are literally 50/50. I will be trying my best to get as much information from them and others about the chances of a dreaded second wave.

Hopefully, the developed world has the virus on the retreat now. Then we can lend a hand to our friends in the emerging markets.