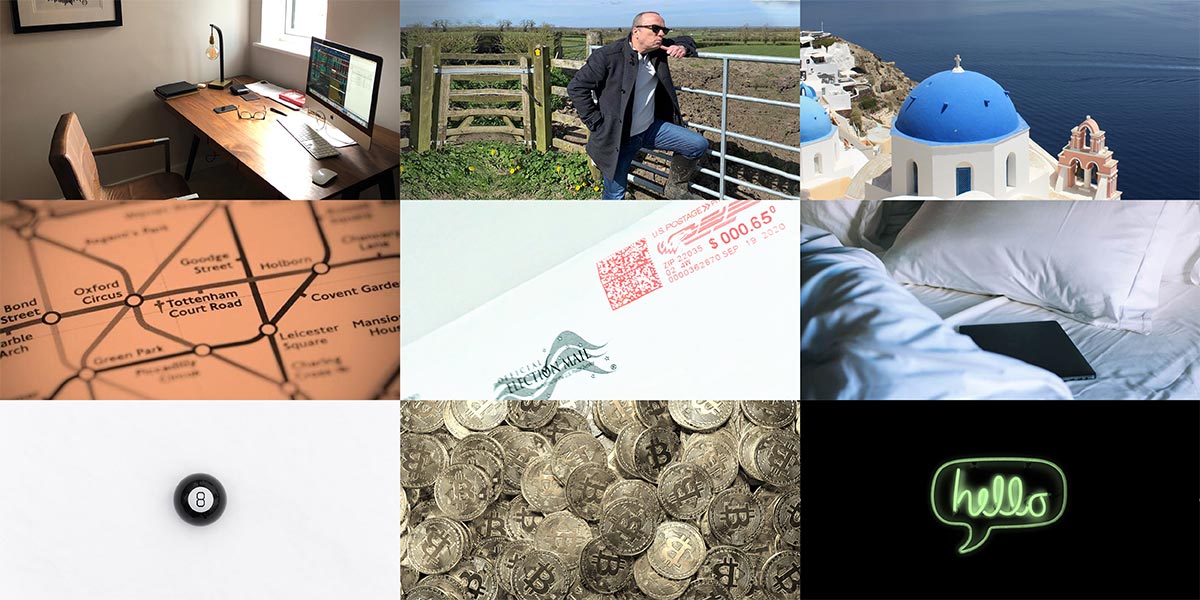

A year already? Our head of multi-asset investments David Coombs gives a flavour of his latter-day lockdown days and ponders an omnichannel working life.

A day in the life of a year at home

It’s been a year to the day since we were all sent home. I thought I would give you an insight into how we manage the funds while still in our PJs, and how we hope to work once the pandemic is behind us.

I leave my bedroom at 7.30am and start my commute: I stop off in the kitchen to make a cup of tea before arriving in the office about 7.33am.

Laptop and Mac fired up (now linked by cable to the hub, so instant access) and ready to read the morning notes on the action overnight. If necessary, I can comfortably deal in Asia before closing, something that was a stretch in the office-bound past. A big bonus of WFH. Onto the rest of the day:

8.00am — Rathbone Unit Trust Management (RUTM) exec committee meeting – a check in to ensure our business is working fine under current disaster recovery conditions. Early pandemic these meetings were daily, but now are down to three a week, often lasting only five minutes. A sign that this is now normal.

8.30am — Nip out to the kitchen for breakfast and a flat white from our new coffee machine (purchased with savings from daily Costa spending).

9.30am — Multi-asset team meeting. Half an hour catch-up on markets, along with what’s good to watch on Netflix or read. Or a mixture of the two: That Will Never Work by Marc Randolph (one of the founders of Netflix) is a recent favourite. This book should be on all GCSE curriculums, bumping Shakespeare and Austen. Far more likely to inspire our nation's youngsters.

12.30pm — Lunch. Time to get away from the office and into the garden (if the weather plays ball).

2.00pm — Investment meeting with our wider analyst team. Always informal but a chance to throw oddball ideas at the wall. Questions like what effect would it have if the EU manages to turn around its lagging vaccination programme?

4.30pm — Multi-asset wrap meeting – catch up on the day’s events, plan for tomorrow and gossip (important cathartic treatment towards better mental health).

5.00pm — Sometimes later – commute home.

5.05pm — Stop for a spin class on the Peloton in the garage – now up to top quartile having started lower third in December.

A change is as good as a holiday

This is my structured week, at any rate, interspersed by lots of other Zoom/Teams meetings with companies, brokers, clients, etc.

What can we take from this? My team’s productivity is much higher than pre-COVID. My energy levels are higher and stress lower – body fitter. Does that make for better decision-making? I spend less time bumping into colleagues not directly linked to the day job, which makes it easier to focus. What is the downside to this – personally and professionally?

Have we been less innovative? Well, we launched two new multi-asset portfolios in 2020 (Defensive Growth and Dynamic Growth), and we’re about to launch a sustainable range of multi-asset funds. So the answer feels like no.

Over the next six months, assuming we are near the end of the pandemic, many people will be asking the same questions. I suspect that, for many industries, the answers after the fatigue of 12 months may be different to the ones offered at the end of last spring when people thought WFH was the nirvana they were looking for.

Post-pandemic effects: big for some, small for many

We have always been cautious about some of the claims of the long-term impact of the virus on people’s behaviour and economic activity. At the end of last summer we began to rotate our portfolios away from some of the COVID winners towards the more economically cyclical companies in our portfolios. We are indeed very grateful at how the past few weeks have panned out. Our mantra throughout has been that the global trends in place before COVID haven’t really changed, just accelerated. The volatility in share prices over the past six months (notwithstanding distractions like GameStop) reflects how investors are struggling to value companies in the post-COVID world.

In our view, the long-term changes will have smaller economic impacts than some of the more excitable predictions of last summer. However, certain companies may see their business models become obsolete and it’s crucial that we avoid them.

Now is the time for calm reflection, and to remember the disruptions of ecommerce, artificial intelligence, rising computer power, ageing populations, poor health and populism were here well before a year ago. They will remain for many years to come.

What does the future look like for me specifically? I’m going hybrid – omnichannel, if you will – WFH and trips to the office and yes, face-to-face meetings with clients and managers because I still think up close and personal matters.

Also, I’m longing for my Moroccan meatballs from Leon.