The world has fundamentally changed, argues Rathbone Income Fund co-manager Carl Stick. Higher interest rates and higher inflation mean that cash earned today rather than tomorrow has become much more valuable.

How many possible futures are you prepared for?

Ari Wallach is an American ‘futurist’, founder of an enterprise called Longpath, and currently doing the podcast circuit, unsurprisingly promoting a book.

With Longpath, Wallach is waging war on the short-term thinking that has accelerated in the social media age. He argues that, to tackle the pressing issues of the day, we must have a much longer view of time when considering our behaviour. We must be informed by the past and think way beyond the present when making decisions. For example, how different would politics be if the protagonists and voters were motivated beyond the next election cycle? How different would commerce be if CEOs were not distracted by the next quarter’s numbers, and really focused on long-term strategy, impervious to short-term market reaction? Wallach argues for the understanding of considerations with ramifications tens, hundreds, even thousands of years down the road.

At heart, his message is one of compounding returns – something we can identify with! The actions you take today influence what happens tomorrow, and the next day, and the next. It’s a bit like chaos theory – or put it another way, a smile and a good morning can have a domino effect through the day, and who knows what good that does at the end of its tangled consequences.

Wallach’s message is also one of humility: while striving to do the best for the long term, you also have to accept that the future cannot be known ahead of time. Flexibility is key – you must account for the chance of unforeseen consequences and events scuppering best-laid plans. Trillions of daily interactions and decisions, all compounding on each other, create an infinity of possible futures. Rather than accepting this, however, we all have a tendency to try to predict the future, even if all we can really do is have the softest of hands on the tiller. As investors we read research reports entitled ‘the future of energy’, ‘the future of agriculture’, ‘the future of tech’, etc, etc, as if we can predict the future of anything. Rather, the future is just one outcome of an infinite number.

Valuation matters

When it comes to investing, I think Wallach’s arguments reinforce the importance of paying a reasonable price for an asset and the crucial nature of diversification.

At the moment, we are challenged by an unusual paradox: rising interest rates have punished highly valued, longer-duration stocks (promises of earnings in the future, not today), while recession fears have hit more economically sensitive stocks. In the first eight months of 2022, UK ‘value’ stocks were up over 10%, while their ‘growth’ counterparts are down 6%; defensive sectors are up 13.5%, ‘cyclicals’ down 5%. Great uncertainties still prevail, but our focus remains on valuation, as we note in our recent ‘In conversation’ video update.

What is priced into the stocks we’re buying and holding? What if the gloomiest prognosis does not come to pass? And what if it does? The areas that deem worthy of our attention right now seem to be split into two categories: cheap ‘growth’ and cheap ‘cyclicals’.

Cheap cyclicality offers up an intriguing opportunity set. We want great businesses that – while exposed to economic cycles – are important and differentiated enough to give us comfort as the strains begin to show in global economies. There are two potential drivers of outperformance, the first linked to predictions so bearish that any incremental good news, however small, is a major positive; the second is economic recovery, which will come eventually, however dark the current mood. The point is, valuation matters, and cyclicals have rarely been this cheap.

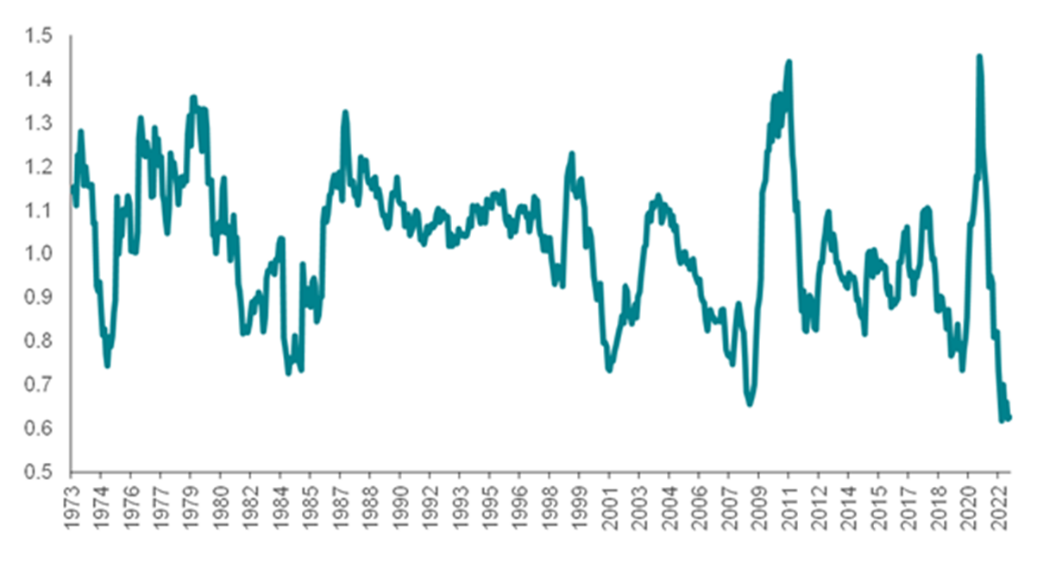

European cyclicals versus defensives trailing PE

Source: BNP Paribas Exane, Factset, MSCI

Again, humility in the face of the unknown future is the reason why valuation matters so much. The more expensive the price of a share, the more weight you are placing on a limited number of very specific futures. Couched behind arguments like, ‘it’s only revenue growth that matters,’ or, ‘that’s the growth algorithm,’ is a reliance on many things going right over many years.

But what if the world contrives against this future? What if we don’t know what lurks around the corner? COVID-19? War? A vaccine? A price cap on energy? Regulation, or a helping hand? Mini-budgets? The lower the price risk you take at the outset, the cheaper the stock in relation to the quality of the business, the greater the number of possible futures that may benefit your investment. This is a way of understanding what a margin of safety means, and we believe it always needs to be at the core of any investment strategy, irrespective of style or asset class. Valuation matters.