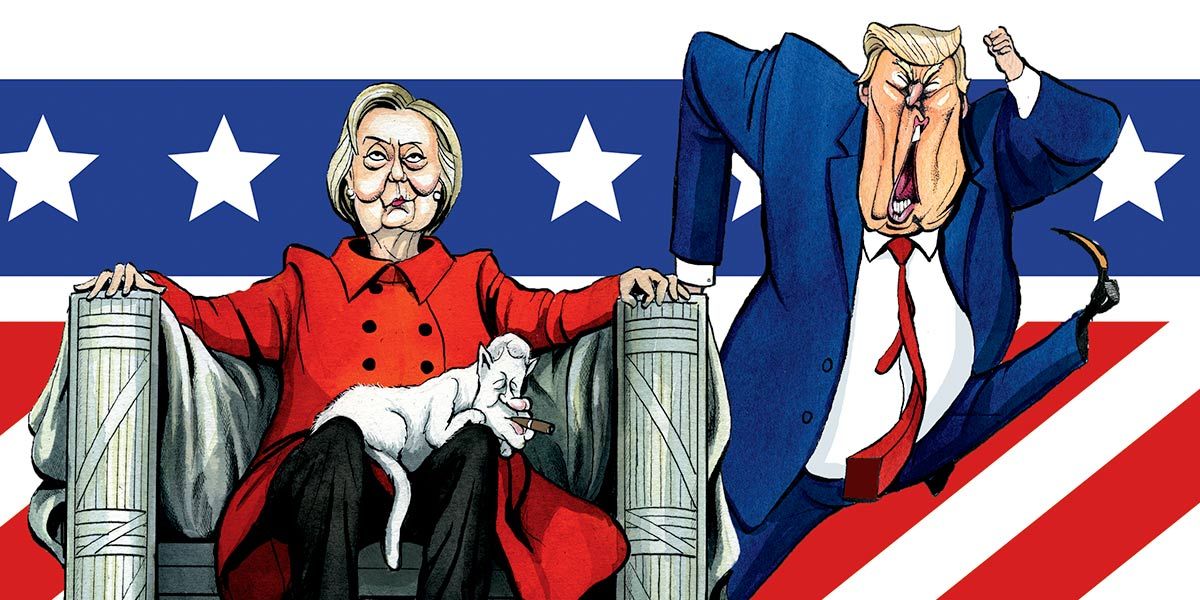

It’s the final showdown of the desperate duo. Hillary Clinton and Donald Trump are probably the most despised American presidential candidates ever presented. Trump is Marmite and Clinton is distrusted by many Democrats, let alone her opponents and the undecided. Both are desperate for votes.

From the sublime to the ridiculous

This seems almost definitely the dawn of a one-term presidency.

However, it’s all too easy for smug elites in Europe to look down on developments in the US and dismiss them as transitory and inconsequential. Similar forces are building on the Continent, which will have significant ramifications for the European project (more on that will be coming up in another blog). As very keen investors in US equities – it’s our preferred market – we have looked hard at the national mood in America and what it will mean for markets.

Given the difficulties (mostly self-inflicted) that Trump’s campaign has overcome, we have to assume that there’s a fair chance he could be the next president. That kind of shock would probably lead to a knee-jerk equity and currency sell-off, like the one we experienced after the Brexit result. A case could be made that protectionism would mean fewer US imports, therefore fewer dollars in global circulation, which would lead to a stronger dollar. However, you could just as easily see that offset by large liquidations of US treasuries by foreign nations (particularly the Chinese central bank).

On balance, we think a vote for Trump would probably be negative for the dollar in the short term. Trump is probably hated more by moderate Republicans than by Democrats, so his ability to influence domestic policy would be severely limited. Foreign policy is another matter, of course.

However, a Clinton presidency accompanied by a Democratic clean sweep of the House of Representatives and the Senate could have greater impact over a longer term. This is the greatest risk to US equities over the medium term, we believe.

At the moment, Republicans control both the Senate and the House of Representatives. While the latest legislative term has been marked by bitter partisanship and gridlock, it has also kept some of the more extreme branches of the Democrats from implementing anti-business policy. Lately, the Democrats have been increasingly under the sway of its left wing, as shown by the considerable support garnered by Senator Bernie Sanders.

As always, any investor in US equities should hope for a different party controlling Congress than the one that holds sway in the White House. That stops politicians from meddling – ultimately that’s a good thing.