The coronavirus pandemic

<p>Markets have reacted to the collapse in demand that will be wrought across many sectors by attempts to contain the coronavirus outbreak, as conferences, business travel and holidays are cancelled and consumers are encouraged to stay indoors.</p>

<p>The longer the crisis lasts, the greater the risk that companies will face severe cash flow problems. When the economic tide is turning, as it is now, any shortcomings of business models are left exposed. As Warren Buffett famously said: “It’s only when the tide goes out that you learn who’s been swimming naked.”</p>

Article last updated 22 July 2025.

Markets have reacted to the collapse in demand that will be wrought across many sectors by attempts to contain the coronavirus outbreak, as conferences, business travel and holidays are cancelled and consumers are encouraged to stay indoors.

The longer the crisis lasts, the greater the risk that companies will face severe cash flow problems. When the economic tide is turning, as it is now, any shortcomings of business models are left exposed. As Warren Buffett famously said: “It’s only when the tide goes out that you learn who’s been swimming naked.”

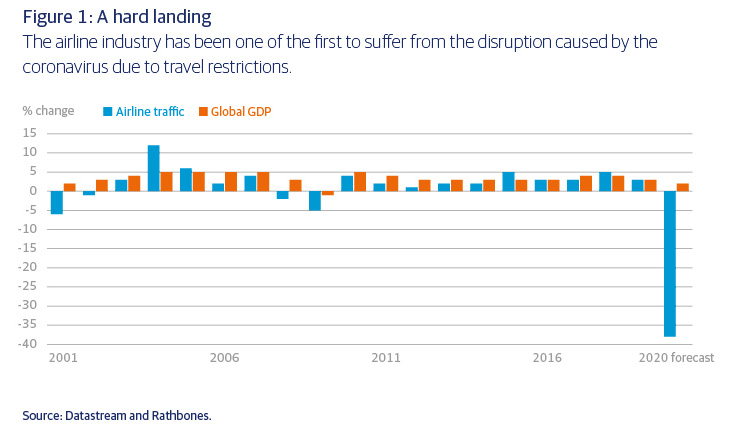

Draconian measures across the world, such as European nations quarantining entire populations, are ‘black swan’ events that no one could foresee. Events, tourism and aviation stocks will be especially hard hit in this slowdown due to restrictions on travel and gatherings (figure 1), showing that no two downturns are exactly alike. But there are certain precautions an investor can take to inoculate their equity portfolios against these 'unknown unknowns'.

Determining a company’s defensiveness

The main aspects to focus on when assessing the defensiveness of a business are the balance sheet, the cost base and the business model.

The key measure from the balance sheet is net debt, usually defined as total debt less cash. The more indebted a business, the higher the risk that in a slump it will be unable to pay interest or refinance debt. To know whether the level of debt is appropriate, it is necessary to look at the borrowings in relation to a company’s ability to pay off those debts.

A popular ratio is net debt to earnings before interest, taxes, depreciation and amortisation (EBITDA). Depreciation and amortisation are non-cash costs, so EBITDA is a reasonably good proxy for operating cash flow — but it’s not perfect, as it ignores cash required for the replacement of equipment. Another commonly used yardstick is operating profit divided by interest expense, which measures how far profits would need to fall before a company defaults on its interest payments. One problem with this measure is that when interest rates are very low, even the balance sheets of highly indebted businesses can look strong. Yet any increase in rates could cause financial difficulties. That appears to be happening as coronavirus fears push corporate bond yields higher, which means companies have to pay more to borrow.

Some companies can live with higher financial gearing ratios than others. Those with reliable levels of consumption, like a water utility, can tolerate net debt of up to six times EBITDA, whereas the average for the FTSE 100 is 1.4 times. Businesses that are much more sensitive to economic ups and downs, like UK housebuilders, tend to operate with net cash. Whatever the business, investors should be aware of its debt obligations and the potential for insolvency if demand weakens.

Debt is often referred to as financial ‘leverage’, and it is just one of two types of leverage investors need to consider. The other is known as operational leverage — how sensitive profits are to a decline in revenues. An example of a highly leveraged business from an operational point of view is package tour operators. They pre-purchase hotel rooms up to a year in advance, and resell them at a thin mark-up, usually six to eight weeks before the date of travel, leaving them with a precarious combination of rigid costs and poor sales visibility.

By contrast, online travel agents boast beefy operating margins, take no inventory risk and have mostly variable costs, which are measured per online click. Whereas a 5% drop in revenues for a tour operator can vaporise profits, for an online agent it would barely register.

Energy and resource stocks have fixed costs of extraction that make their earnings acutely sensitive to fluctuations in commodity prices. After Saudi Arabia’s recent decision to launch an oil price war, exploration stocks in the UK and US fell up to 50%. Therefore, it’s important to stress-test natural resource companies to ensure that they can endure depressed commodity prices.

What’s your business?

Business models are also important. For example, how easily can a company’s customers cut back on its products and services? People can stop going to the cinema, put off renovating their kitchens or buying a new car, but they do need to eat, take medication, fill out their tax returns, renew their car insurance, use their debit cards, satisfy their nicotine cravings, and pay their phone subscriptions. As a result, food and beverage companies, tobacco stocks, telecommunications, accountancy, payment processors and healthcare have long been considered classic defensives.

Technology stocks are increasingly falling into the defensive bucket. Notably, the tech-heavy Nasdaq Index has outperformed the S&P 500 during the initial phase of the coronavirus. Internet platforms are hardwired into consumers’ daily habits and services like social media and video on demand are either free or low cost, so their usage is relatively unaffected by a fall in spending power. Meanwhile, enterprise software vendors have shifted their business models from upfront licence sales, which can be volatile, to recurring subscription contracts.

There are also businesses that display counter-cyclical characteristics that thrive during downturns. During the current crisis, companies selling detergents, video conferencing, corporate messaging and home entertainment services like Netflix have benefited.

Unforeseen circumstances

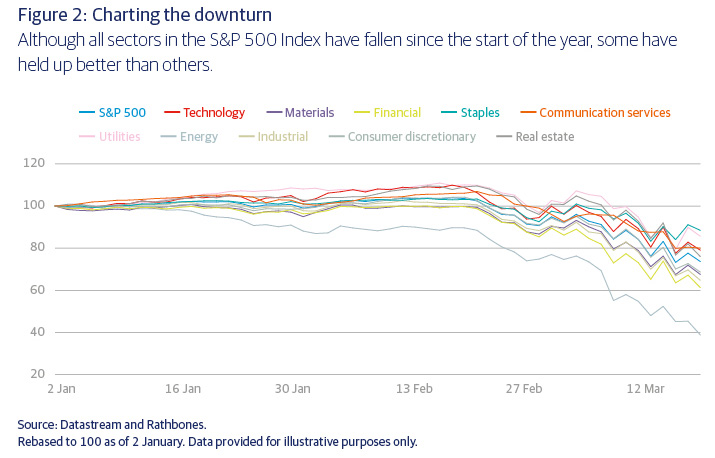

Ideally, investors would only hold purely defensive sectors such as utilities, healthcare, telecoms and consumer staples into a recession (figure 2) and the more cyclical, or economically sensitive, ones like financials, industrials and materials into the recovery. But investors who have demonstrated such prescient timing probably owe it more to luck than skill — market bottoms and tops are notoriously difficult to predict. The father of value investing, Benjamin Graham, explained this concept by saying that in the short run, the market is like a voting machine — tallying up the preferences of market participants who are not always rational. But in the long run, the market is like a weighing machine — measuring the intrinsic worth of businesses.

Equally, a strategy of just holding defensive sectors has its drawbacks. Every business comes with its own risks. By avoiding companies with even moderate economic sensitivity, investors would miss out on those that can outgrow their more defensive peers over the long run, have a more sustainable competitive advantage and trade on more attractive valuations.

It’s also important to note that recessions are infrequent and that the income lost during these periods is modest in the context of the long-term cash flow generation of a business, which is ultimately what determines intrinsic value.

Cyclicality is acceptable, providing investors don’t overpay for it, there is minimal risk of breaching covenants and the company can keep generating cash even if sales drop sharply. As investors discover during every downturn, when they hold businesses with the opposite characteristics — high leverage, high fixed costs, and discretionary services — they suffer steep falls in the value of their holdings that can quickly obliterate years of previous gains.

By scrutinising the balance sheet, the cost base and the nature of the business, investors can tilt their portfolios towards stocks with less earnings variability than the broader market. Such stocks can be held through thick and thin, weathering economic storms and benefiting from the upswing when it arrives. The next 12 months will be a real test of which companies are swimming naked.