Mark Sait, CEO of SaveMoneyCutCarbon (SMCC), a leading UK-based money-saving and sustainability platform, tells us about some of the ways charities can cut their surging energy bills and boost their ESG credentials into the bargain.

Countering rising costs by using less energy – and cutting carbon emissions

Article last updated 20 January 2023.

Charities have been under increasing pressure from donors, partners, staff and other stakeholders to improve sustainability performance and reduce their carbon footprints as the UK seeks to achieve its net zero target by 2050.

"Charities have been under increasing pressure from donors, partners, staff and other stakeholders to improve sustainability performance and reduce their carbon footprints as the UK seeks to achieve its net zero target by 2050."

With the cost of living crisis now hitting charities’ incomes and making them more expensive to run, being ‘greener’ also has the potential to reduce the financial impact of steeply rising utility bills as well as helping to meet the ‘E’ of the ESG agenda.

With discounts from energy providers seemingly a thing of the past in the current market, realistically, the only way to slash bills is to use less gas, electricity and metred water, and that requires organisations to proactively reduce consumption.

The built environment is recognised as being one of the greatest carbon generators globally and with buildings in the UK responsible for 59% of electricity consumption, the single biggest challenge for reducing energy consumption tends to centre on an organisation’s offices, shops, storage and drop-off facilities. Improving their energy efficiency will significantly contribute to reducing bills and carbon emissions.

Quick wins

SMCC’s advice to charities is always to start small, act fast and go for the quick wins straightaway. CEO Mark Sait says this can include, for example switching from tungsten, fluorescent or older LED lighting to more efficient modern LED lighting that, even today, is still probably one of the most impactful changes an organisation can easily make. As Mark explains, swapping an old 60 watt bulb for an equivalent four watt LED bulb reduces energy consumption by a whopping 90%.

Improved technology makes it relatively easy to install lights that switch off or dim when no one is present or to use timers. Mark says it’s important to remember this includes not just more obvious interior lighting but also that in storage areas and external and security lighting for fire escapes, car parks and loading bays, which often get forgotten.

Water usage can be reduced by installing eco-WCs, and sink taps that switch off automatically through automatic sensors. It’s simple to fit aerators to taps to reduce water consumption without any perceivable reduction in pressure, or there are easily fitted flow restrictors that can slash usage by up to 60%.

Where changing facilities are provided for staff who cycle to work, for example, it may be worth installing a whole new smart washroom with eco showers.

Mark urges charities to be particularly carefully about heating for buildings and water. Taking action as basic as re-setting heating systems to only come on when really needed or lowering thermostats and boiler temperatures by a degree or two really makes a difference.

You could fit thermostatic valves (TRVs) to radiators and, where appropriate, consider using modern infrared heating panels in place of radiators. These work by heating the overall surfaces in a room which is more efficient than only heating the air in the room like conventional radiators and can be retrospectively fitted in most buildings.

Mark points out that many of these moves seem obvious, and are often the sort of thing we do at home, yet SMCC finds many organisations are not effectively managing their energy control settings, are unaware of the energy consumption of their buildings and not utilising the affordable tech that’s available to them.

Getting help

While going for the low hanging fruit, organisations also need to consider implementing more sophisticated, long-term solutions for managing and controlling heating, ventilation and cooling systems in their buildings.

And they should consider replacing any vans or cars they own with electric vehicles. Despite the initial investment outlay SMCC calculates that the lifetime cost of electric vehicle ownership is actually cheaper than polluting petrol and diesel cars, with lower maintenance costs.

So it’s vital to establish a framework for implementing longer-term and more complex sustainability solutions and to be able to measure both financial savings and your performance against specific KPIs connected with ESG objectives.

However, many smaller charities simply don’t have adequate resources to do this and may need to consider outsourcing to specialists like SMCC.

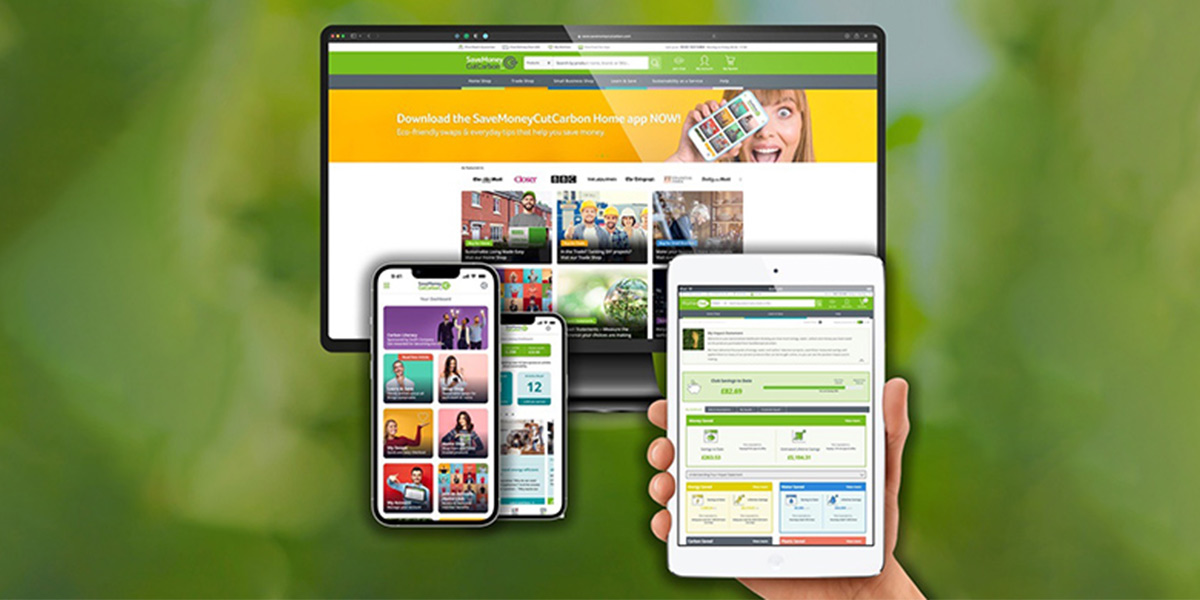

As Mark says, “When organisations come to us, their starting point is our online platform. This gives them access to a huge knowledge-sharing database of energy-saving advice and tips, and they can book a free 30-minute video consultation with one of our expert carbon mentors to establish their broad sustainability and cost-saving ambitions.”

“If they wish, they can then work with us online to draw up a carbon roadmap defining specific behavioural changes, targets, potential cost savings and specific projects to be pursued and measured, with options for on-site energy and water efficiency audits, and progress-monitoring reports.”

The bigger picture

Of course, implementing cost-saving sustainability solutions usually requires some sort of initial investment but if properly planned it should more than pay for itself over time.

To make larger and more expensive energy-saving projects viable, SMCC can arrange flexible financing that can be spread over an extended period, with the aim of making projects self-funding in the longer term.

"Looking at the bigger picture, supporting sustainability extends beyond a charity’s own immediate operating environment and the buildings it occupies."

Looking at the bigger picture, supporting sustainability extends beyond a charity’s own immediate operating environment and the buildings it occupies.

It’s important to help staff, volunteers and beneficiaries to save money on their own energy and water bills and reduce their carbon footprints, by providing them with the support and assistance they need to improve their ‘carbon literacy’, as SMCC calls it. This is particularly relevant given the increased levels of home working and the cost of living crisis – and taking action this way also helps the charity address its wider ESG considerations.

Bearing that in mind, Mark says his organisation is keen to work with charities to help them find ways not only to save money on their own energy bills, but to use its platform to enable their people and beneficiaries to do that as well.

SMCC has even seen interest in using its platform as a value-added benefit to wider charity stakeholders, like members and those that donate, in return for a new unrestricted income stream. It’s also possible to incorporate employees’ energy-saving activities into a charity’s wider ESG reporting.

If you would like to find out more about energy saving opportunities or SMCC, please contact Mark’s PA at jess.courdelle@savemoneycutcarbon.com