Growth vs value?

<p>Global equity markets have been on an upward path more or less since their precipitous drop in March 2020, when the world first went into lockdown. Over the course of this nearly two-year advance, leadership has passed from one investment style to another. But rather than choosing broad styles like growth or value, we believe a more company-specific focus on the quality and durability of profits will continue to be the best guide for finding long-term returns as the world moves on towards a post-COVID normality.</p>

Article last updated 22 July 2025.

Global equity markets have been on an upward path more or less since their precipitous drop in March 2020, when the world first went into lockdown. Over the course of this nearly two-year advance, leadership has passed from one investment style to another. But rather than choosing broad styles like growth or value, we believe a more company-specific focus on the quality and durability of profits will continue to be the best guide for finding long-term returns as the world moves on towards a post-COVID normality.

The market’s recovery was initially driven by the swift reaction of Western governments to lockdowns, limiting the potential for them to cause permanent structural increases in unemployment and losses to economic productivity.

"We believe a more company-specific focus on the quality and durability of profits will continue to be the best guide for finding long-term returns as the world moves on towards a post-COVID normality."

The investment styles of ‘defensive growth’ and ‘quality’ initially led the recovery in 2020 as investors shifted towards beneficiaries of COVID-driven changes. They include consumer staples that were favourably exposed to increased consumption as people spent more time at home (such as packaged food and dishwasher tablets) and technology companies which facilitated and benefited from an acceleration in e-commerce and in remote working and networking (defensive growth). Companies with recurring and predictable revenue streams (quality), affording them earnings resilience, were favoured over so-called cyclical companies whose demand was more sensitive to economic conditions.

The unique conditions of the COVID downturn, in which lockdowns restricted mobility and caused entire purchasing channels such as restaurants and high street stores to be shut down for extended periods of time, led to weakness in businesses reliant on footfall, which would have held up much better in more conventional downturns. Conversely, some sectors that tend to be cyclical in more ‘normal’ circumstances, such as semiconductors, proved to be far more resilient as they benefited from a surge in investment in the computers and remote hosting of cloud software applications that facilitated remote working.

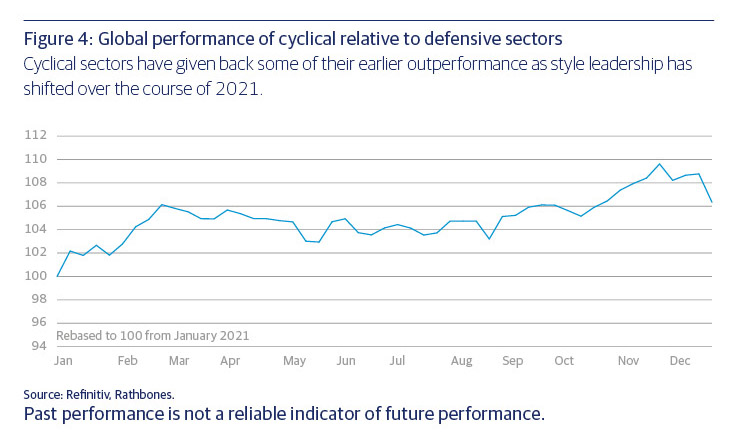

Following the November 2020 announcement of effective vaccines, market leadership shifted to the sectors and stocks that had underperformed through the initial pandemic crisis and would benefit from a normalisation of economic activity (figure 4). Companies that become known as ‘recovery’ stocks were found in both traditional value areas (which typically trade at lower valuations), such as energy and banks and so called ‘cyclical’ companies that are more geared to economic recovery, such as travel and leisure, which had suffered from COVID-related closures and weakened demand.

Persistent performance

The outperformance of these recovery stocks persisted until February 2021 and the emergence of the Delta variant, when concerns about the pace of recovery temporarily reasserted themselves. Since March 2021, there has been relatively little differentiation between value and growth investment styles, or between cyclicality and defensiveness. Earnings momentum and revisions to earnings forecasts have been the key determinant of stock performance. This is not surprising, as it is what tends to happen in the middle of an economic cycle, after the initial spurt of growth at the start of the recovery.

The rebound in economic activity has been so robust that it has created bottlenecks in the supply of various economic inputs, from labour to commodities and freight services, which since the second quarter of the year have caused heightened inflation concerns for business owners and policy makers alike. This has created a volatile and uncertain environment for profit margins and corporate earnings, which has only been exacerbated by the emergence of the Omicron variant.

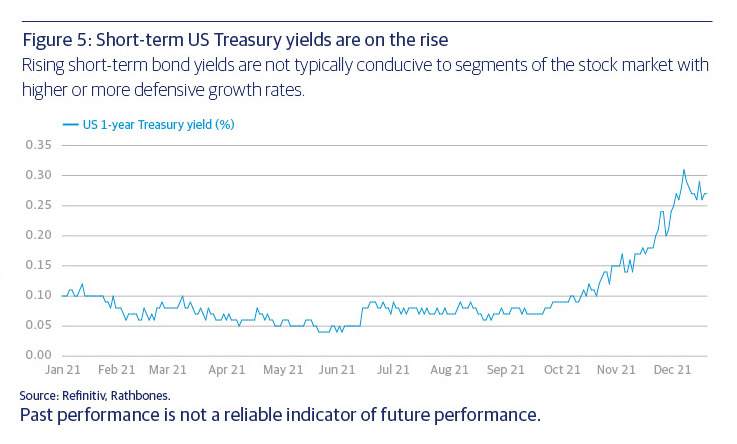

Further uncertainty surrounds the pace and timing of monetary tightening as authorities respond to inflationary pressures proving less transitory than had been initially expected. Rising short-term bond yields (figure 5) are typically not conducive to segments of the market with higher or more defensive growth rates. As more of their price today is determined by future earnings (compared with the average company), they are more sensitive to these short-term yields, which provide the discount rate that is used to translate tomorrow’s earnings into today’s money. Yet some of the leaders in these sectors have thrived and indeed re-rated in what is turning out to be a productive environment for stock selection.

One example is software giant Microsoft, which reported 22% sales growth in the third quarter of 2021 driven in particular by Azure and cloud services as well as the ongoing rollout of subscription services such as Office 365 and Dynamics 365. Another is spirits company Diageo, which was initially hit by the COVID-driven closure of bars, but swiftly used its market leading data analytics and agile business model to pivot its marketing and distribution towards at-home drinking occasions. Of course, this past outperformance may not be repeated as the recovery moves into its next phase and beyond, but it highlights the need to look to company specifics rather simply focus on particular styles.

Recovery from the lows

Many ‘COVID victims’ have enjoyed a recovery from depressed levels of profitability and share price, but others such as travel-related stocks have continued to languish as full reopening and normalisation have been delayed. The value sector of mining has also seen more muted performance because of its reliance on demand for iron ore from Chinese construction and infrastructure development. After surging in 2020, the curtailment of these activities and the travails of the Chinese property development sector have led to a collapse in iron ore prices in recent months.

Many of the stocks that enjoyed outperformance in 2021 benefit from structural tailwinds which have persisted throughout the last two years almost irrespective of COVID (and often accelerated by it). These include the increased penetration of cloud-based software and services, the inexorable rise of e-commerce (along with digital media, online gaming, online food delivery and other aspects of online consumption), growing automation and digitalisation of industry and increasing electrification of energy systems and transport.

Electrification is part of a wider structural trend of investment in sustainability and transition towards a more renewable-energy-based system. The ever-increasing importance of this transition to ‘net zero’ carbon emissions was evidenced by government and corporate commitments around November’s COP26 climate change conference in Glasgow. (You can read about the investment implications of COP26 in our post-COP InvestmentUpdate and about the global economic impact in our article ‘Will the green transition help or hinder economic expansion?’)

A key factor for success in 2021, given the sharp rise of inflationary pressures, has been inflation sensitivity (how flexible companies can be in finding lower cost inputs, and/or how well they can pass on higher costs to customers), which is generally a function of strong competitive advantage and differentiation, high switching costs and relatively sticky customer demand.

"The low-hanging fruit of recovery has been reaped and performance will likely continue to be driven less by any particular investment style than by picking the stocks with the best earnings momentum."

The low-hanging fruit of recovery has been reaped and performance will likely continue to be driven less by any particular investment style than by picking the stocks with the best earnings momentum — underpinned by structural growth drivers and a strong business model that is resilient to inflation. As the initial recovery comes off the boil and enters its next phase of normalisation, a balanced approach seems warranted, including exposure to companies in both the growth and value camps (you can read more about our views on the economic outlook in our lead article on page 3). Whatever the style, emphasising these company-specific qualities seems to us to be the best method for generating future returns.

This article has been taken from, 'Q1 2022 Investment Insights', read the full publication.