Investment Insights Q4 2023: Caution needed

<h2>Reasons to remain cautious about the investment outlook<br> </h2>

<p>We acknowledged we might be wrong, and inflation might fall without growth also tumbling in the wake of aggressive interest rate increases. But it wasn’t our base case. We believed inflation would return to the normal range by the end of 2023 — which does seem to be happening outside of the UK — but that a mild recession was a likely corollary. Yet no recession has arrived. An explanation is in order, and we want to address head on why we haven’t changed our outlook.<br></p>

Article last updated 22 July 2025.

Reasons to remain cautious about the investment outlook

We acknowledged we might be wrong, and inflation might fall without growth also tumbling in the wake of aggressive interest rate increases. But it wasn’t our base case. We believed inflation would return to the normal range by the end of 2023 — which does seem to be happening outside of the UK — but that a mild recession was a likely corollary. Yet no recession has arrived. An explanation is in order, and we want to address head on why we haven’t changed our outlook.

The signals we look at to help us forecast whether we are likely to enter recession or not operate with long and variable lags. While it may seem like we’ve been talking about this recession for a long time, there are no recession signals that are yet past their “sell-by” dates, past which we could say for sure that “it’s different this time”. Instead, we are well within the past windows between a warning signal and the start of a recession, whether those signals are coming from bond yields, money supply, bank lending standards, home affordability and other housing related indicators or the strength of company profits.

Strengths and weaknesses

To help explain what’s kept the global economy relatively resilient for longer than we expected and to summarise where we might go from here, it’s helpful to identify the economic strengths and weaknesses and the opportunities and threats stemming from that (a ‘SWOT’ analysis).

The first strength is the excess savings accumulated during the pandemic, which are still supporting consumption as real income growth (growth minus inflation) turned negative with high inflation. There are still some excess savings left to spend, but in real terms — what people can buy with them — excess savings are largely gone in the UK, Europe and the US. So those excess savings (or lack of them) could now be seen as a weakness and a threat.

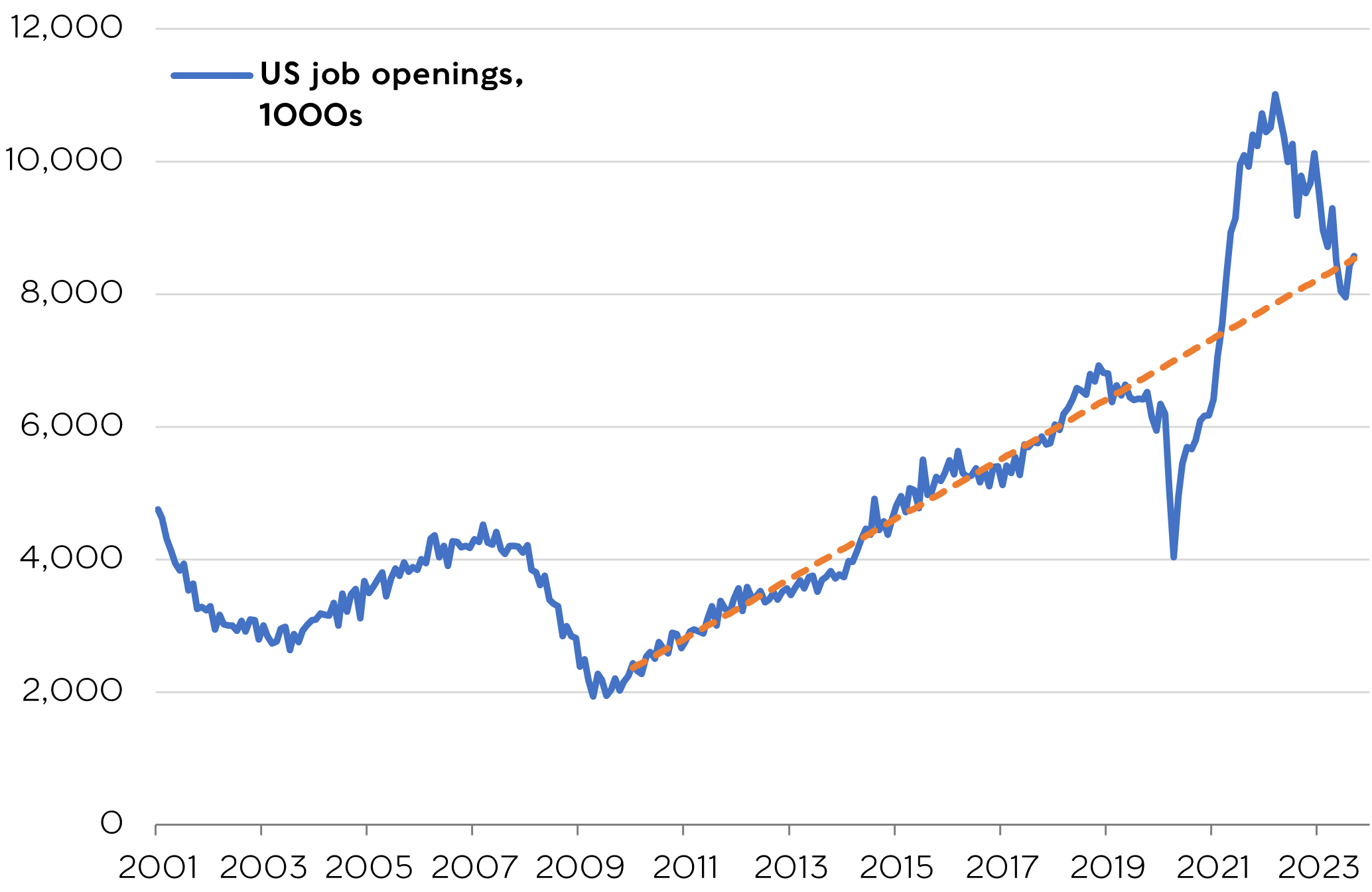

Another strength has been the resilient service sector and a resilient jobs market. These always vie with each other as the final shoe to drop. If the recession is expected to be mild, it is possible firms may not lay off staff if they perceive a possible future shortage of skills, and this may in turn avert that very recession. But this would be novel — and perhaps unlikely given job openings have fallen back a long way.

US job openings

The number of vacancies has fallen back a long way over the past year.

Source: Refinitiv, Rathbones.

The greatest reason for optimism is fading inflation, which could boost household spending as wages rise in real terms. But most of the real wage gains are likely to get eaten up by higher debt servicing and reduced government transfers, and could be needed to rebuild savings levels in real terms. We think consumer spending is only going one way from here.

In our view, the key source of weakness is the huge central bank and government belt tightening we’ve seen (increases in interest rates and decreases in government spending), which is still to be felt. This has been the most aggressive central bank tightening cycle since the early 1980s in most advanced economies. The effects of rate increases can take one to two years to feed through to the economy — it takes time for households and businesses to roll onto higher rates.

Up and down

Yet equity markets are up even as expectations for the next 12 months’ profits have been revised down continuously. While markets can look beyond the next 12 months’ earnings, they are also sensitive to the discount rate at which you turn tomorrow’s earnings into today’s prices (i.e. prevailing interest rates).

Investors also seem very complacent about the risks. The VIX — a measure of volatility known as the ‘fear gauge’ — is subdued. In 30 years, it has never been this low when leading economic indicators have deteriorated. So we are continuing to invest defensively, favouring quality companies less sensitive to the business cycle. There are some great companies we still think will generate great long-term returns.