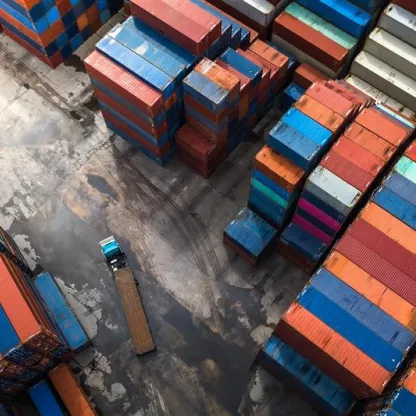

Quarterly Investment Update Q3 2025: After much sound and fury, stock markets are at record highs

Major equity indices hit bear market territory on twists and turns in US tariff policy, before responding to news of a partial climbdown. Meanwhile, the oil price rose and fell and the dollar weakened.

12 mins