What to do when markets and data seem full of conflicting messages

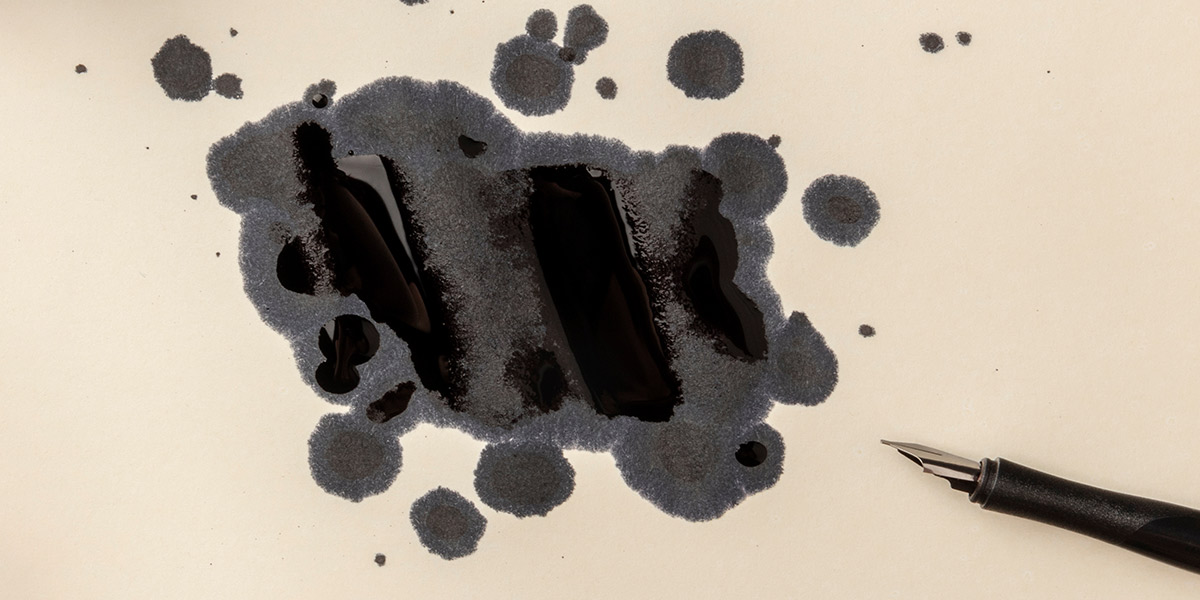

Quarterly Investment Update: A Rorschach test for investors

Article last updated 27 September 2023.

Market performance and the incoming economic data have both been full of mixed messages over the past quarter, providing a veritable Rorschach test for investors. In markets, for example, a handful of the largest US tech stocks have driven the S&P 500 higher – yet the rest of the index has been in the doldrums. Profits in aggregate have been falling since late last year. Meanwhile, there are clear signs of weakness in a few areas of the global economy, especially manufacturing, even as resilience persists elsewhere, notably in services.

Faced with innumerable contradictory signals, it’s more important than ever to take a broad and systematic view of the evidence, focusing on the most forward-looking data to determine the big picture and resisting the temptation to put more weight on a few headline-grabbing developments. Doing so leads us to conclude that recessions (albeit mild ones by past standards) are still likely later this year in the largest advanced economies, and that our current cautious positioning remains appropriate. Our analysis has also helped us set out a path for changing that positioning in time, as well as highlighting a few overlooked opportunities we can capture today.

It’s more important than ever to take a broad and systematic view of the evidence, focusing on the most forward-looking data to determine the big picture.

Growth risks persist

While resilient in places, the global economy has already slowed considerably from the breakneck recovery in 2021. Indicators with the best record of leading the business cycle generally suggest more weakness to come. When combining these signals, the overall message is to be prepared for a further loss of momentum.

Revised figures released recently show that the Eurozone was already in recession over the winter. And the US may follow later this year, according to both our own statistical modelling and that of third parties like the Conference Board. Essentially, four factors combine to darken the outlook for the largest advanced economies.

First, interest rates have already risen sharply. This US hiking cycle, for example, is the most aggressive since the ‘Volcker shock’ of the early 1980s, with rates rising by five percentage points in little more than a year. The effects typically feed into the economy with a delay of a year or more. Therefore, more rate-induced weakness would be no surprise, given the central bank’s largest rate hikes only took place in the second half of last year. The same goes for UK and Eurozone rates.

One reason for this delayed effect is that loans aren’t all refinanced at once – instead, borrowers roll on to higher rates over time. Think of the 800,000 or so UK households that will need to refinance mortgages in the second half of 2023, followed by a further 1.6 million in 2024. One plausible estimate suggests that the average UK household refinancing in the next year will pay £2,900 more annually than before. And it will be a similar story across other types of consumer and business loans.

Second, banks are tightening their lending standards, becoming more cautious about extending credit whatever the interest rate. This process began last year across the largest advanced economies and has continued recently in the wake of the recent banking sector turmoil.

Fortunately, this isn’t a 2008-style credit crunch with large financial institutions hamstrung by concerns about their solvency. The biggest lenders today are far better capitalised than they were then, and financial plumbing continues to function smoothly despite the demise of some US regional banks (most notably, Silicon Valley Bank and First Republic). Yet even this much milder form of reduced lending will make a difference. The tightening of lending standards in the US so far is consistent with private investment in equipment shrinking by more than 10%. And net lending by banks in the Eurozone has all but dried up already, contributing to the weakness already evident in its economy.

Fortunately, this isn’t a 2008-style credit crunch with large financial institutions hamstrung by concerns about their solvency. The biggest lenders today are far better capitalised than they were then, and financial plumbing continues to function smoothly.

Third, the extra savings that many households accumulated during lockdowns, which arguably boosted spending through 2021 and 2022, now appear to be running low. These savings were largest in the US, where fiscal support for individuals during lockdowns was particularly generous. Yet even there, surveys of households’ financial wellbeing no longer show the marked improvement on pre-pandemic levels that they did in 2021. Meanwhile, loan delinquency rates are creeping up again, and households are now putting away a greater share of their disposable income than they did last year. This all suggests consumer are becoming less flush with cash.

Fourth, the post-lockdown recovery in China is already fizzling out, so seems unlikely to provide much support to the rest of the world. The Chinese authorities’ decision late last year to lift their strict ‘zero-COVID’ policy sparked hopes of a strong recovery in the economy. But momentum has clearly faded in the past few months. Growth in investment and retail sales has been far weaker than expected. And the deep downturn in China’s housing sector has resumed after a brief pause. Concerned about debt levels and reinflating a housing bubble, officials there remain wary of delivering much extra support. They aren’t willing to provide what they call ‘flood-like’ stimulus, the massive waves of infrastructure spending which fuelled the past couple of strong rebounds in China’s economy. Instead, their efforts so far have been small scale, mainly just concerned with putting a floor under the property sector and ensuring completion of existing projects. The recent cut in interest rates by just 0.1 percentage point epitomises this very tentative approach.

It’s important to keep things in perspective. The spectre of the very deep recession that followed the global financial crisis often looms large in investors’ minds. But milder recessions have been much more common, and that’s what we’re anticipating this time. We don’t currently see evidence of the typical precursors of very deep downturns – the build-up of large imbalances in the economy (such as years of above-trend credit growth) and too much leverage at the core of the global financial system. While we need to be realistic about the economic outlook and prepare accordingly (more on this in a moment), we should also remember that navigating economic downturns is a normal part of investing.

While we need to be realistic about the economic outlook and prepare accordingly, we should also remember that navigating economic downturns is a normal part of investing.

Inflation coming back to earth

More encouragingly, there are good reasons to expect inflation to fall much further over the rest of this year despite its stubbornness in the UK recently. The risks have by no means vanished, but on balance it’s reasonable to expect headline inflation to fall to the low single digits in the months ahead.

To understand why, it helps to start by identifying the individual factors responsible for inflation surging in the first place. The most important of these are: the surge in goods prices caused by pandemic-induced demand and disruption to supply chains; big increases in food and energy prices caused by the invasion of Ukraine; and strong rises in services prices linked to very tight labour markets and the strength of demand generally.

A host of measures indicate that the disruption to global goods markets is now all but over. Manufacturers around the world report that their delivery times and inventory levels are now back to normal. Delays at global shipping hubs have cleared, and the cost of shipping goods around the world has plummeted. US consumer goods inflation has fallen back to pre-pandemic levels. Progress in the UK has been slower, perhaps hampered by past weakness in sterling (increasing import prices) which is now unwinding. In any case, the global improvements described above should continue to feed through. And on that note, it’s encouraging that UK manufacturers have said output prices are hardly growing at all. We’d typically expect this to feed through to consumer prices in a few months.

Meanwhile, the shock to global energy and food markets caused by the invasion of Ukraine is now fading. Russia effectively cut gas supplies to Western Europe last year, but its ‘gas weapon’ has proved less powerful than feared. Remarkably, wholesale gas prices are now even lower than they were on the cusp of the invasion as efforts to save demand, and to source supply from elsewhere, have proved surprisingly successful. While the details of how this feeds through to consumer prices will vary from country to country, in general it means that the single largest contributor to inflation last year should continue to ease. In the UK, for example, energy bills for the typical household will fall by nearly 20% in July. Bills could go from adding more than three percentage points to overall inflation at their peak last year to subtracting more than one percentage point in late 2023.

In a similar vein, the initial post-invasion surge in global food prices has now unwound, as markets have adapted and some of Ukraine’s agricultural exports have continued. Wheat prices, for example, are much lower now than they were on the eve of the invasion. More generally, growth in UK food producers’ input prices has slowed significantly in the past few months, pointing to falling inflation on supermarket shelves later this year.

Services is the area where there’s been the least progress on inflation, and the risk of further persistence here shouldn’t be dismissed. In the UK, services inflation has continued to rise even as inflation overall has dropped back from its peak. Wage growth is an important driver here, and this increased again in the latest figures, from 6.1% to 6.5%.

Yet even in this area, there are tentative signs that pressures will soon ebb. The latest UK wage growth numbers were influenced by the 9.7% statutory increase in the National Living Wage in April, which won’t be repeated. Meanwhile, there is evidence that the labour market, though very tight, has begun to loosen. The unemployment rate has risen from last year’s multi-decade lows, while the rate of unfilled job vacancies has fallen. Surveys show that firms have reined in their hiring plans, even as it has become easier to find qualified candidates. The labour market is likely to loosen even further in time, with the massive pandemic-related government and central bank support now firmly in the rear-view mirror. This is likely to cause wage growth to fall. We’ve already seen this beginning to happen elsewhere, including in the US, even if it hasn’t taken place as quickly as central bankers would have liked.

Closer to the peak in interest rates

With inflation past its peak and on course to keep falling, the major central banks are probably nearing the end of their rate increases, even allowing for the Bank of England’s (BoE’s) larger-than-expected move at its last meeting. Central bankers aren’t quite done yet, as they were keen to stress at their annual get-together in Portugal recently, but they could be soon.

In the US and Eurozone, they have a somewhat easier job since inflation in those economies has already fallen much further than in the UK (to 4.0% in the US, for example). But even here, it’s possible that the BoE will stop after a couple more rate increases, given the likely trajectory of inflation over the rest of the year.

With inflation past its peak and on course to keep falling, the major central banks are probably nearing the end of their rate increases.

Gilts looking more polished

This is one of a few reasons why we think the outlook for UK government bonds, or gilts, has improved after what has been an awful two and a half years (you can read about why we’re turning positive on gilts in our next edition of InvestmentInsights, out in the first week of July).

Looking back through the history books, government bonds have nearly always performed well after the last interest rate hike in the cycle, a point that may only be a few months away now. And our analysis suggests that the risks of being a little early are generally smaller than those of being equally late. At the same time, gilt yields have become much more attractive.

Hype springs eternal for equities

One of the defining features of equity markets recently has been the strength of a few mega-cap US tech stocks, bolstered mainly by a burst of optimism about breakthroughs in AI technology following the popularity of OpenAI’s ChatGPT software. Since early February, for example, the seven largest stocks in the S&P 500 are collectively up by more than a quarter, helping to push the index higher.

Although AI may well prove to be an economically significant technology, we’re wary of chasing the recent rally (you can read why in our next InvestmentInsights). And it hasn’t changed some of the more fundamental reasons for caution when it comes to equity markets.

It’s worth reiterating that market leadership has fluctuated rapidly since the pandemic. In this more turbulent environment, US tech stocks have fared exceptionally well at times, and poorly at others (including most of last year). High quality tech stocks are still an important part of our portfolios, but we can’t rely on them to deliver the extraordinarily consistent outperformance they did during the second half of the 2010s, when virtually everything – policy, the economic environment and so on – lined up in their favour.

The recent AI-inspired strength of the US tech giants has helped to paper over weakness elsewhere. The S&P 500’s remaining 493 stocks are little changed so far this year, as are European indices. In the US, the profits underlying the equity market have been falling since the last quarter of 2022 Based on our economic outlook, we would expect those profits to keep declining. Even in mild recessions, profits typically fall by at least 10%, something which hasn’t happened yet, and which the consensus of equity analysts isn’t currently factoring in either.

Taking all this into account, we continue to be positioned cautiously. This doesn’t mean throwing the baby out with the bathwater, and we still think it makes sense to be invested in equity markets. Again, navigating mild economic downturns is a normal part of investing, and the difficulty of timing the equity market precisely makes wholesale entry and exit unwise. But in general, we’re tilting towards companies operating in sectors that are less sensitive to the economic cycle, and those that score highly on measures of quality. By quality, we mean strong returns on investment, high and stable profit margins, and the ability to easily service debts. We’re also investing more than usual in the corporate bonds of firms with high credit ratings, which look much more attractively valued now than they did at virtually any point in the 2010s (particularly relative to equities) with yields averaging well above 6% in the UK, while typically delivering lower volatility than stocks.

As we set out in our quarterly update at the turn of the year, we also maintain a checklist of events that would persuade us to change our generally cautious stance, and venture further into more cyclical parts of equity markets. Those triggers haven’t been met yet, but we hope that a couple of them – namely the end of the US Federal Reserve’s tightening cycle, and a sustainable trough in leading indicators of the global economy – may be at some point later this year.

Taking all this into account, we continue to be positioned cautiously. This doesn’t mean throwing the baby out with the bathwater, and we still think it makes sense to be invested in equity markets.

Eastern promise

To end on an upbeat note, it’s worth highlighting another part of global equity markets which has had a quiet renaissance recently – Japan. While the US tech giants have taken the lion’s share of media coverage, Japan’s market has been the top regional performer so far this year in local currency terms. We see several reasons to remain positive, which we will also highlight in our next InvestmentInsights coming in early July. Among them are improving corporate governance and exposure to Asia without the risks associated with China.

Japan’s economy also continues to grow, and unlike virtually every other advanced economy, doesn’t face the headwind of much tighter monetary policy. Headline inflation there has risen, but is still scarcely above 3%, while wages are growing at an annual rate of less than 1%, allowing the Bank of Japan’s new governor to sound much more relaxed than his counterparts in the US, UK and Eurozone.

With all of this in mind, we still favour Japan’s stock market, even allowing for our current caution about equities in generally.