The Statement of Costs and Charges we send you each year is designed to show you the costs and charges that are deducted from your portfolio for management and administration of your investments.

Alongside Rathbones' charges, it includes charges levied by third parties you are invested in, such as unit trust managers.

It's important to note that where we facilitate a payment to a financial adviser on your behalf, or you pay for Rathbones services other than investment management, these amounts won't show on the statement and will instead appear separately in the cash statements.

Below we have explained some of the terms used in the statement.

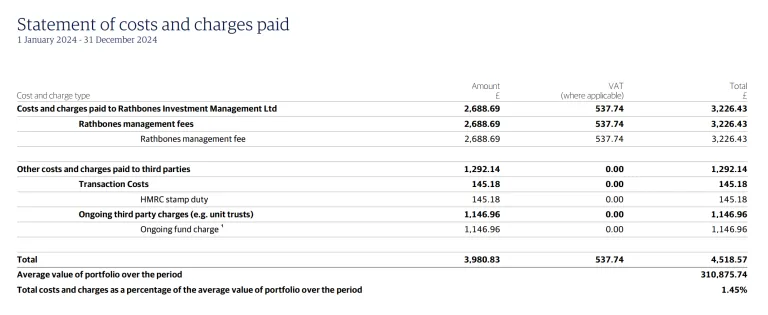

Statement of costs and charges paid

In the Statement of costs and charges paid, the "Average value of portfolio over the period" is calculated by reference to the gross portfolio value before any costs and charges.

Rathbones management fees are charged quarterly in arrears and are debited after the quarter end date. The calculation shown here is based only on the fees debited in the reporting period.

Where management fees or other charges are transferred to another fund to be paid, they will appear in the calculation for the paying fund rather than for the fund in which the charges were incurred.

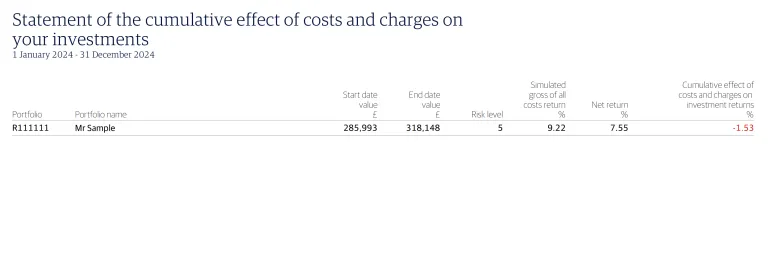

Statement of the cumulative effect of costs and charges on your investments

The Statement of the cumulative effect of costs and charges on your investments shows the annualised effect of costs and charges on the performance of the individual funds within your portfolio.

- "Simulated gross of all costs return" is the percentage return, before all costs and charges

- "Net return" is the percentage return after the deduction of Rathbones' costs and charges.