Investment Insights Q4 2023: AI industrial revolution?

Major new technologies often result in investors over-extrapolating: think of radio stocks in the 1920s, or internet stocks in the late 90s. Or even the dominance of miners and oil producers in 2010 as globalisation — which is technological in a sense — was touted as never-ending. The history of artificial intelligence (AI) is filled with predictions that now seem absurd: pioneering computer scientist Herbert Simon said that by 1985 a computer would be as capable as the human brain.

Article last updated 25 November 2025.

Comparing AI with biological brains isn’t a bad way to think about it — after all both AI and brains are based on neural networks. Ajeya Cotra of Open Philanthropy wrote a well-respected paper in 2020 that found ChatGPT-2, the state-of-the-art generative AI at the time, was equivalent to a honey bee’s brain and it would take until 2050 before AI was as likely as not to be as powerful as a human’s. But progress has been rapid and GPT-4, which is part-owned by Microsoft, is now approximately as powerful as a squirrel’s brain and her estimate of likely human-brain equivalence has been updated to the late-2030s.

That may seem scary or it may seem tremendously exciting. Our advice: get to know it now. Play about with ChatGPT or Bard or Claude. Ask them to write an essay on a topic you know something about: you’ll probably give it a B — better than what most people could achieve, but many could do a lot better. Although not in just a few seconds, of course.

Productivity gains

Some scientists think the large language models on which these AIs are based are never going to threaten the capacity humans have for abstract reasoning — they’re essentially predictive text engines, after all. But perhaps that’s not necessary to unleash tremendous productivity gains. B-grade work delivered in a few seconds is good enough for many of the tasks many occupations require, freeing valuable labour time for activities with greater added value. Some studies have found significant productivity gains from generative AI in certain professions already (such as customer support centres and software coders), especially among less experienced staff. But to revolutionise economic growth wholesale it needs to be adopted and more universally adapted to. This is where there is considerable uncertainty.

The ‘great invention’ interpretation of economic history has lost academic currency since the millennium. Rather than single inventions, we should think of productivity cycles as being driven by clusters of complementary technologies and their ability to diffuse via many people across many industries, learning from each other and making incremental improvements. Because of the lags involved in adopting and adapting to new processes, it takes time before output growth accelerates.

The steam engine is a good example of how these things can take time. Newcomen’s Dudley Castle Machine of 1712 did nothing for industry. It took until James Watt’s 1774 invention of the separate condenser for that to change, but its take-up was slow outside of mining. The development of high-pressure steam engines in the first two decades of the 19th century did not expand steam use by much. Steam’s peak contribution to economic growth arrived with the further advances in high-pressure technology and with the arrival of compounding (extracting steam energy in multiple stages rather than just one) in the 1840s and 50s. Even then it needed to be combined with other important technological breakthroughs, such as the steel-hulled ship, to truly transform the world.

It took four decades from the opening of the first power station for electricity to have a significant effect on productivity. Its peak contribution to growth came when Dupont and other industrial innovators found ways to deliver electrical power to each workbench rather than the whole factory at once, enabling incredible efficiencies. The benefits came from the adaptation not the adoption. Computers did little to raise productivity growth in the decade before the internet came along, and even then the spike in productivity growth was disappointingly short-lived. It was over by the time most internet companies had figured out a way to really monetise the thing.

|

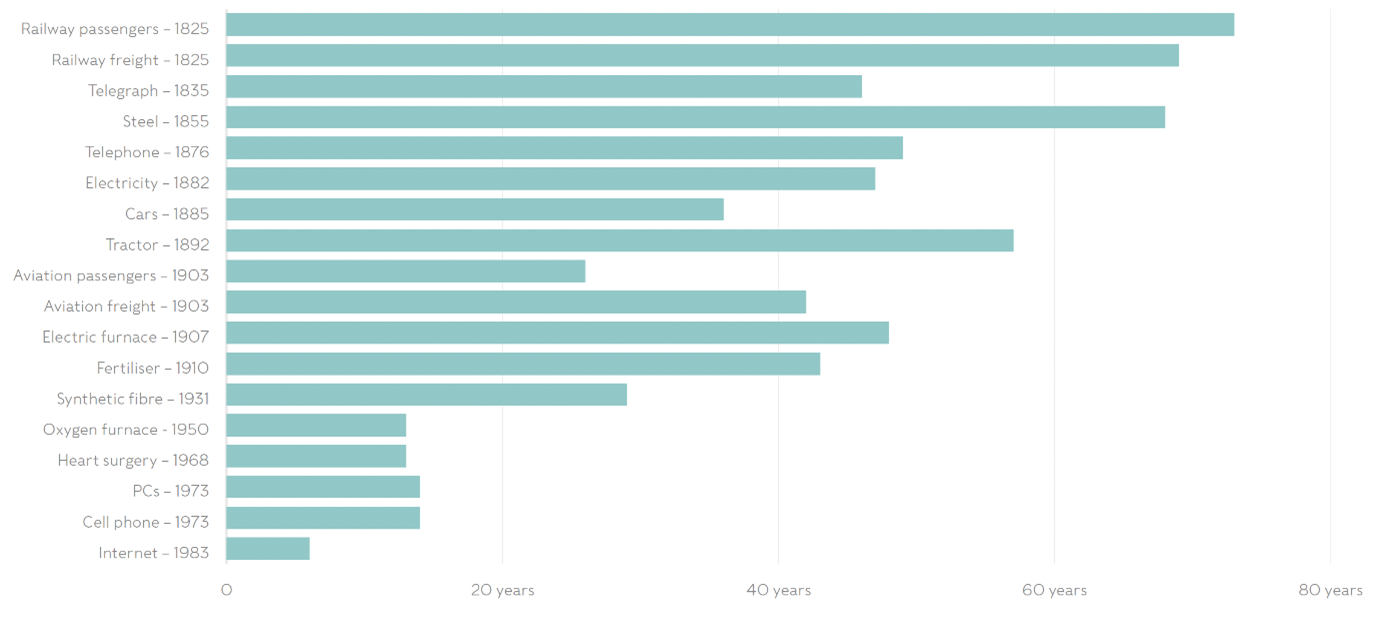

New technology timescales The adoption timescales for new technologies are getting shorter — but not necessarily the adaption times. Source: Diego Comin and Martí Mestieri (2018) “If Technology Has Arrived Everywhere, Why Has Income Diverged?” American Economic Journal.

|

The average time to widespread adoption of new technologies seems to be getting shorter. But are we getting better at adapting? This is less clear. Are ideas able to diffuse well? There’s good evidence they are not, which is a concern because there’s also evidence that if innovation is concentrated in too few firms or industries the economy is trapped in a low-growth scenario. Productivity booms tend to follow periods of supernormal investment spending. MIT scholars found that for each dollar of capital invested in computers, firms tend to make $10 of complementary investments to change business processes, repurpose roles, train staff and so on. But will today’s higher interest rates, high levels of indebtedness, and high uncertainty around inflation constrain the necessary investment spend? We’re optimistic, but there are arguments both ways.

In short, generative AI could conceivably boost GDP growth by 1-2% a year, but no one knows if that will begin next year, in 10 years, or further out. Economic history cautions us against assuming we can adopt and adapt immediately. Mark our words, this technology has got a better chance than anything we’ve seen in a long while, but investors need to keep a level head and diversify across the suppliers, adopters and adapters of generative AI at this relatively early stage.

Find out more about our views on the future of AI in our previous Insights publication or by speaking to your investment manager.

VIEW PDF VERSION