The Value of ESG

How mainstream has the adoption of ESG into adviser investment practices become? And in what ways is the growth of ESG impacting businesses and client relationships?

Most importantly, what value is adoption bringing to advisers? We have commissioned a piece of independent research to explore these questions and much more…

MiFID II and the implications for ESG investing

In June 2020, rating agency Morningstar reported that global investments in environmental, social and governance (ESG) funds had reached a record high of $1.06 trillion, with capital inflows into sustainable funds up 72% in the second quarter alone.

4 mins

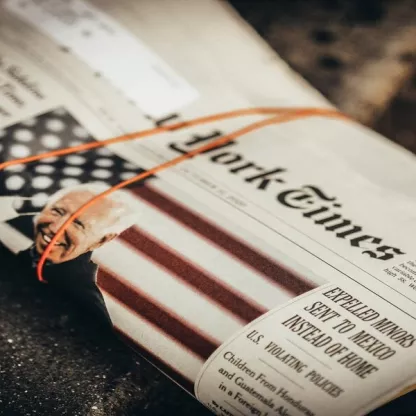

Rathbone Global Sustainability Fund: US Election — November 2020

The new tenant of the White House plans to make some major changes to green infrastructure and climate change policies. With America’s sustainability agenda set to head in a new direction, fund manager David Harrison muses about the knock on impact of US President-Elect Joe Biden’s policies on the Rathbone Global Sustainability Fund.

2 mins

The changing face of consumer ethics and behaviours

Global consumer values, behaviours and spending habits are changing.

4 mins

The changing face of ESG for advisers

In the face of hard science and changing consumer behaviours, the investment world is transforming to meet growing demand for values-driven investment strategies.

4 mins

Where the wind blows

Rathbone Global Sustainability Fund manager David Harrison discusses the rise of renewable energy and how it is making a more sustainable world.

3 mins

Responsible Capitalism in the US - the complete report

During David’s trip to the US, he found a country where responsible capitalism has truly taken off, where people are much more aware of the social and environmental costs of doing business. Much like other parts of the world, investing along environmental, social and governance (ESG) principles is clearly ascendant in the US.

1 min

Uncharted territory

During times of crisis, the way companies respond can have a major impact on society as a whole, not just their balance sheets. Rathbone Global Sustainability Fund manager David Harrison discusses why he believes companies with strong sustainability principles have a greater potential to weather the pandemic.

3 mins

A sustainable stimulus

As Vladimir Lenin said, “There are decades where nothing happens; and there are weeks where decades happen”. Our stewardship director Matt Crossman tries to grasp what the current pandemic means for the planet and our plans to save it.

3 mins

Responsible capitalism Q&A with Matt Crossman, Stewardship Director at Rathbones

At the centre of our responsible capitalism report our stewardship director Matt Crossman and governance and voting analyst Archie Pearson highlight our efforts to put this into practice over the past decade. They highlight the tangible benefits not just to our clients, and not just in financial terms, but to our wider society. Matt Crossman discusses some of the points he makes in the report in the short Q&A videos below.

1 min

Responsible capitalism: benefiting society and investment returns

Since pulling out of the global financial crisis, markets have been on one of the longest bull runs in history. Yet as wages stagnate, productivity slumps and living standards drop, large swathes of people in Western democracies feel left behind. Many of them are losing trust in capitalism itself.

2 mins